Recycled fabrics – has the trend peaked?

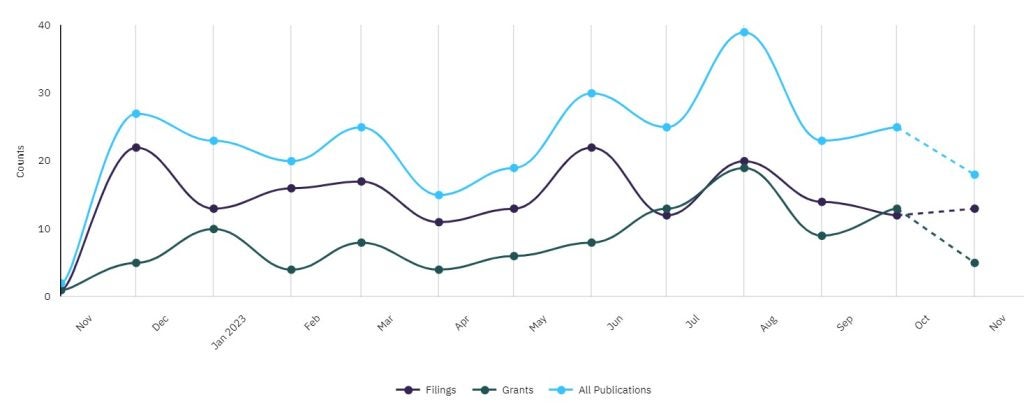

2023 may have been the year that the apparel sector’s focus on recycled materials finally waned. According to GlobalData’s patents data, the number of patents mentioning “recycled” filed by apparel companies hit a peak in August 2023.

Since then, the number of apparel companies filing patents in this area seems to have trailed off slightly. With consumers becoming increasingly aware of sustainability issues – and legislation on ‘greenwashing’ claims pending – interest in recycled fibres appears to be dwindling.

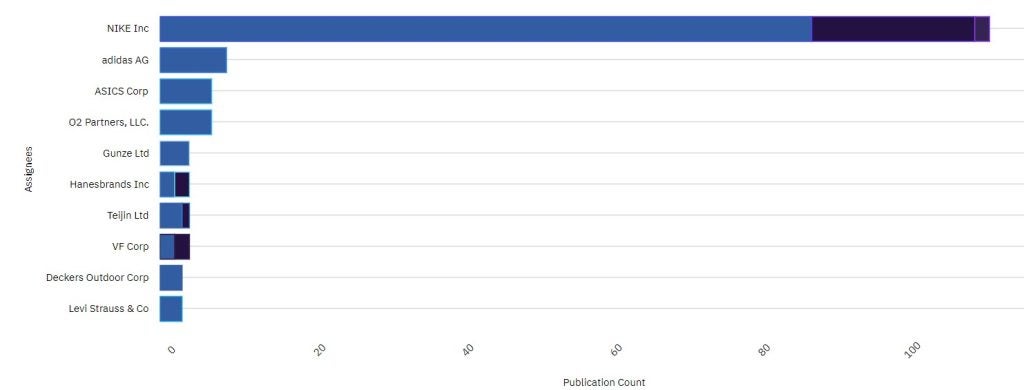

The top apparel companies filing recycling-related patents in the past year include Nike, which is leading the way by a considerable margin with 122 patents filed on the topic. The next closest competitors in this field include Adidas with a total of nine recycling-related patents and Asics, with a total of seven recycling-related patents.

In April, Adidas announced that it now uses 96% recycled polyester in its products. The sports brand aims to replace virgin polyester with recycled wherever possible by the end of 2024.

In December, German sports brand Puma launched a "one-off" capsule collection made entirely from its recycled polyester RE:FIBRE fabric.

AI - apparel companies hire AI experts in 2023

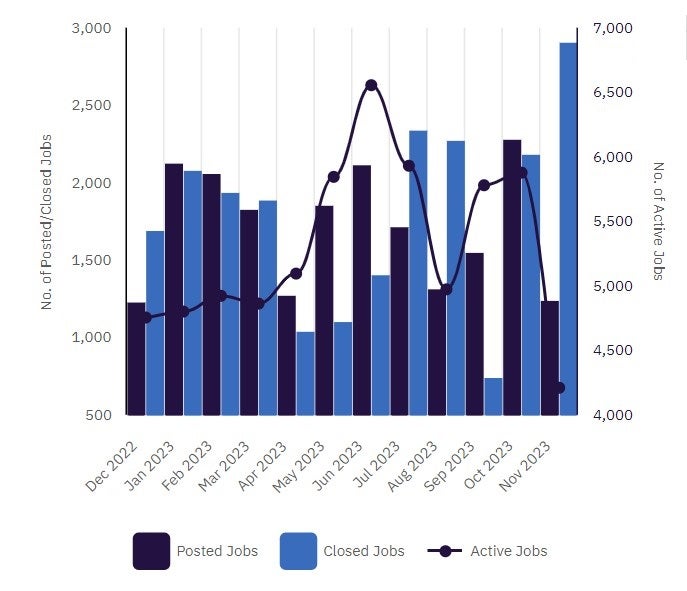

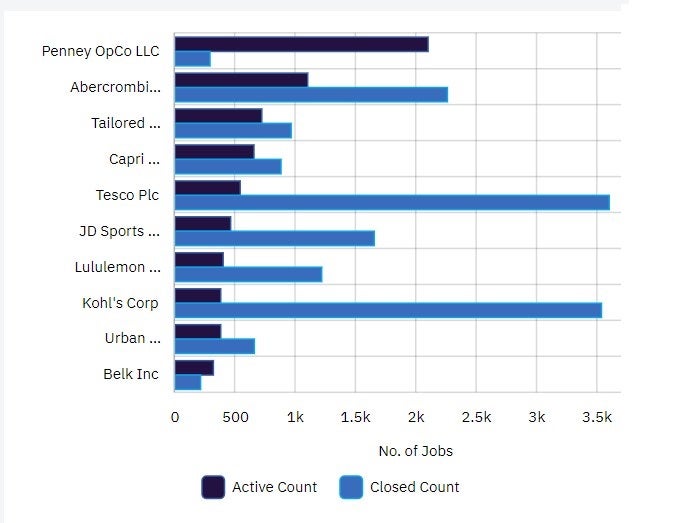

The number of AI-related jobs in the apparel sector seems to have peaked in November 2023, according to GlobalData’s jobs data, with 2,898 jobs closing last month, up from just 1,683 jobs closing in December 2022.

The top recruiters for AI jobs in the apparel sector this year include Amazon, Walmart and JD Sports.

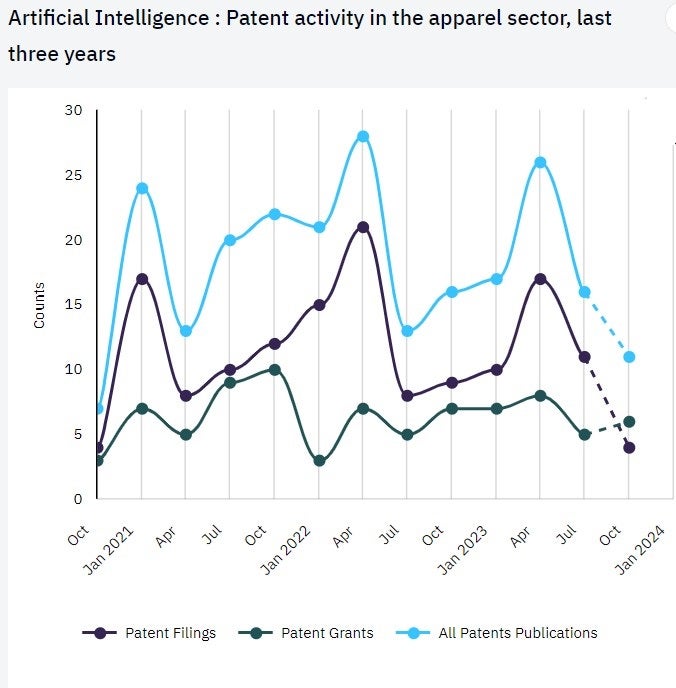

GlobalData’s patents data suggests that interest in AI may also be past its peak, with the number of patents filed by apparel companies falling slightly in 2023 compared to 2022.

In August, Just Style reported that the number of designers employed in the apparel sector has more than doubled in the past year, despite growing concerns over AI's impact on creatives working in the sector.

However, according to McKinsey & Co’s latest report, the overall financial impact of gen AI on the fashion industry is significant, with as much as a quarter of the value expected to be driven by use cases at the design and product development stage of the value chain in 2024.

Omnichannel – a key focus for apparel retailers

Omnichannel has been another key theme for apparel in the past 12 months. According to GlobalData’s jobs data, the number of closed jobs peaked in November 2023, with a total of 12,216 omnichannel jobs closing at apparel companies that month. This is up from just 4,371 omnichannel job closings in January 2023.

The top hiring companies for omnichannel jobs include Penney OpCo, Abercrombie & Fitch and Tailored Brands Inc.

In July, UK activewear brand Sweaty Betty adopted NewStore’s mobile point-of-sale system to provide a “seamless and scalable omnichannel experience” in its 73 stores.

Personalisation – an untapped trend?

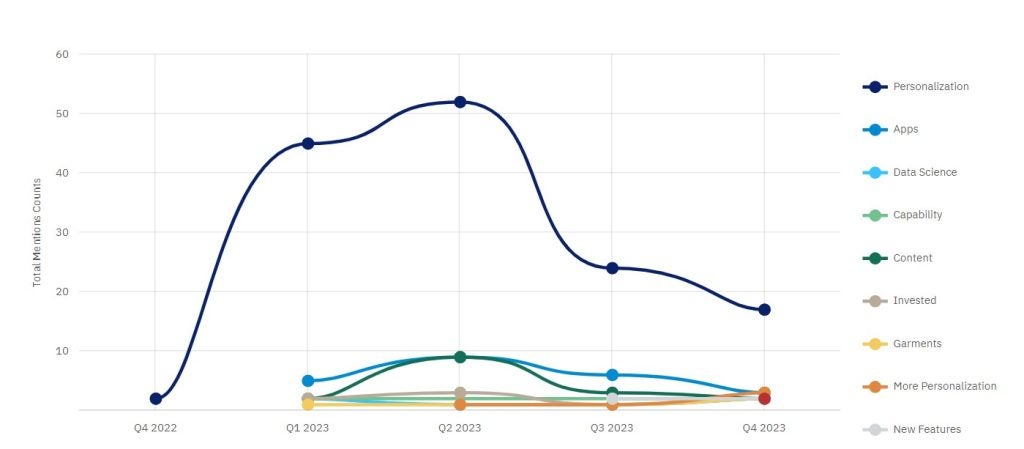

According to GlobalData’s patents data, the number of apparel companies mentioning “personalisation” in their financial filings peaked in Q2 2023, with the theme mentioned 52 times that quarter. In Q4, the trend is mentioned just 17 times so far.

Looking deeper into the data, the word “personalisation” was mentioned just twice in Q4 2022, showing how much this trend has come into focus in 2023.

While mentions of “personalisation” in apparel company financial reports had trailed off slightly by the end of this year, with just 17 mentions in Q4 2023 so far, Q4 has also seen three companies mention “more personalisation”, which suggests that this is a growing trend for apparel companies.

According to GlobalData’s filings data, top apparel companies mentioning personalisation in their financial reports include e-commerce giant Asos, US-based retailer Dick’s Sporting Goods and British supermarket Tesco.

A report in September found that a business model based on mass customisation of clothes can help address the issue of overconsumption and reduce the fashion industry's environmental impact.

A new focus on resale and rental

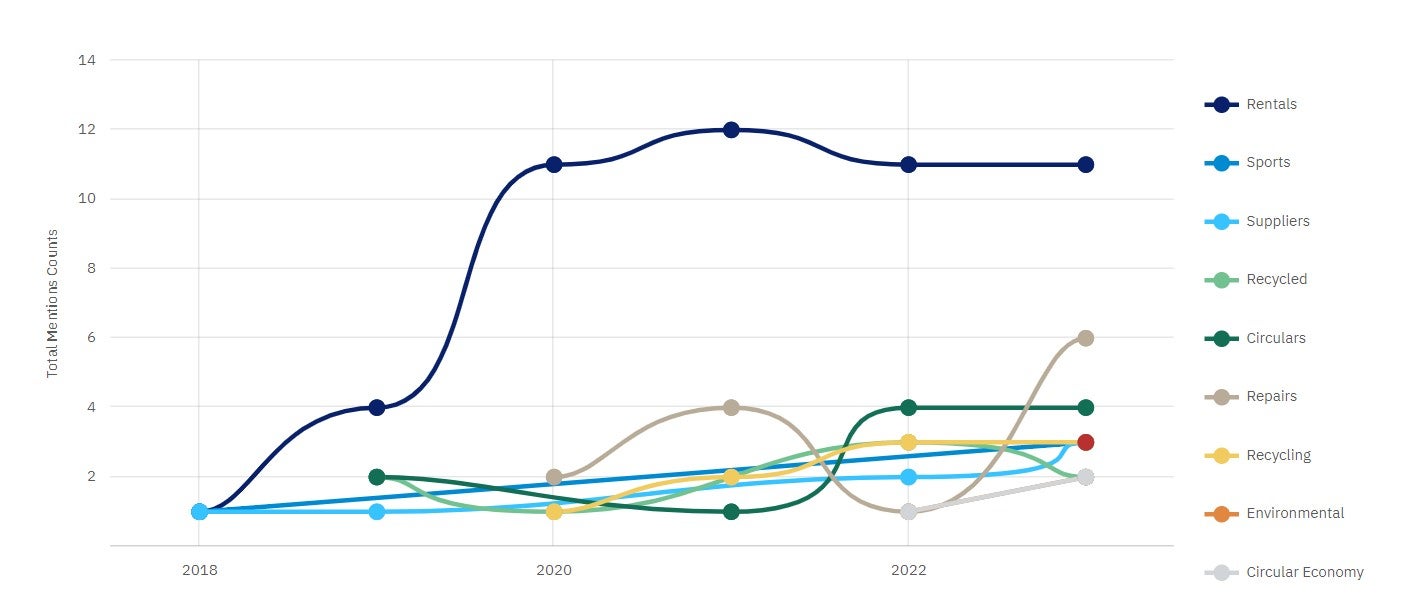

The trend towards a circular economy continued in 2023, with a growing number of companies launching resale and rental platforms as part of their offering.

According to GlobalData's filings analytics, the number of apparel companies mentioning "rentals" in financial filings has been steadily growing since 2018. This year, the term was mentioned 11 times in financial filings so far.

"Repairs" were mentioned six times in apparel company filings in 2023, up from just two mentions in 2020. The term "circular economy" has also appeared in apparel company searches this year, with two mentions in 2023.

The companies most frequently mentioning resale, rental and connected terms include US-based retail Group Urban Outfitters, British department store John Lewis and fast fashion giant H&M.

In September, Just Style reported apparel companies’ interest in the circular economy and resale market has been steadily growing over the past few years, with mentions of the “circular economy” in company filings having nearly quadrupled since 2017.

In October, a report from resale platform provider Trove and software provider Worldly found that fashion brands can maximise the environmental benefits of their resale platform by increasing the value of their products in their secondary markets. Product durability and timeless styles are key here, as well as low rejection rates.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.