Using consumer surveys and data from the Office of National Statistics, Barclaycard and Development Economics say resale and renting, or what they call the recommerce economy, has become more popular in the last 12 months.

UK consumers now spend around £5.92bn on second hand products and £1.07bn on renting items.

The report says that Gen Z consumers are driving the trend, with two thirds of consumers in this age bracket preferring second hand to new items. Younger Millennials, aged 25-34, are the next largest Recommerce consumers, spending an estimated £1.95bn on second hand items in the last 12 months.

Overall, 44% of consumers say they are buying more second hand items than they did a year ago.

“Recommerce” includes products bought or rented that have previously been owned. The most popular items to buy and sell in this way include clothing, particularly designer goods, homeware and children’s toys.

Clothing and accessories accounts for 17.3% of the recommerce economy – an estimated £1.22bn – and second only to cars and vehicles.

UK consumers are making an average of £25 a month by selling unwanted items though online marketplaces or in-person such as at garage sales or boot sales.

The cost of living is a driving factor for the change, with 62% of UK consumers saying that this is making them think more carefully about purchases. 44% say that concerns about sustainability are what made them switch, while 22% say that buying second hand allows them to access designer items that would otherwise be out of reach.

In 2022, a GlobalData report showed that the resale apparel market had "soared" between 2016 and 2021.

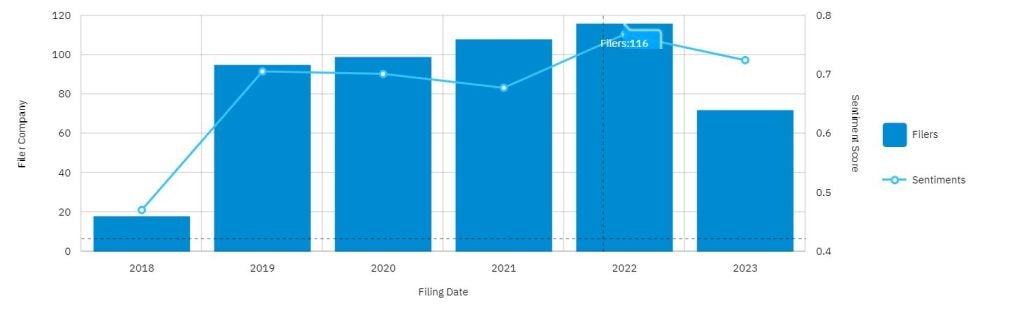

Despite this, GlobalData’s filings data shows that the word “resale” has not been mentioned as frequently in apparel company filings so far this year. This comes after steady growth in mentions of the term since 2019.

Mentions of ‘resale’ in apparel company filings 2018-2023

In 2018, the term was mentioned in just 18 apparel company filings but this massively increased to 95 times in 2019. In the following years the number of mentions increased steadily, until “resale” was mentioned in 116 apparel company reports in 2022.

So far in 2023, “resale” has only been mentioned in 72 apparel company filings.

In September, GlobalData figures showed that “circular economy” mentions in apparel company filings increased from 1,048 in 2018 to 2,040 in 2022.

Linda Weston, managing director at Barclaycard Payments, says: “The rising cost-of-living and a shift towards more sustainable habits are changing the way Brits shop. Our data shows we’re increasingly opting to shop second hand, or rent items for a short period of time, rather than buying outright. The trend is permeating a range of sectors, from childcare to pet care and from fashion to fitness.”

“This demonstrates an exciting opportunity for the UK economy, as well as retailers, with more than a third of Brits saying they plan to embrace more sustainable shopping practices in the years ahead. In order to capitalise on this trend, businesses should think about how they adapt to provide consumers with a range of more sustainable and affordable ways to shop in the future.”

Steve Lucas, economic development manager at Development Economics, adds: “UK consumers are increasingly recognising the value-for-money and sustainability benefits of renting or buying the items they need second hand. The Recommerce Economy is therefore already creating important economic influences across the UK, and these effects will continue to grow as more consumers recognise the benefits and extend their use of renting and second hand to a wider set of products.”

“The market is supporting a significant number of retail sector jobs across the UK, and this proportion is set to show strong growth over the next few years.”

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.