Data analysis company GlobalData said the upcoming US Job Openings and Labour Turnover Survey (JOLTS) report for November 2023, which is due to be released later today (3 January 2024), is expected to print between 8.3 to 8.5 million job openings.

However, it believes this forecast is below the consensus expectation of 8.75 million and is also lower than the October 2023 figure of 8.73 million.

If realised, GlobalData explained this would mark the lowest recorded value since April 2021, driven by tighter monetary policies and companies using AI to improve productivity.

GlobalData pointed out the key dynamic resulting in the rapid decline in job openings is the rate of job closures is surpassing the creation of new job postings across various sectors.

GlobalData's US Active Jobs index, which is derived from a high frequency company job postings dataset shows there is a 5.2% month-on-month decline in November 2023. This dataset is said to have over an 90% correlation to JOLTS data and is available in near real-time.

GlobalData's director of financial markets Adarsh Jain noted: "Exceptional monetary and fiscal policy support during the Covid pandemic (April 2020 to February 2022) supported exceptional job openings, averaging over 8.8 million each month. This figure significantly exceeds the average monthly job openings of 7.2 million recorded in the pre-pandemic period from January 2019 to January 2020, a phase that aligned with the previous peak in the Federal Funds rate.

"However, since March 2022, persistent weakness in GlobalData’s US Active Jobs index mirrors the rise in US Fed Funds rate, which has helped cool the labour market. GlobalData believes, even with the current pause in Fed Funds rate and likely cuts in 2024, job openings will continue to normalise towards pre-pandemic levels, similar to 2007-2009, when job openings continued to fall despite the onset of Fed’s rate cutting cycle."

US apparel industry jobs dwindling

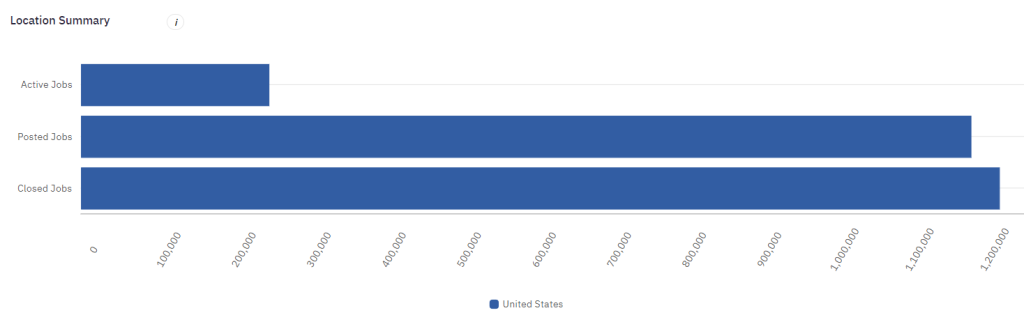

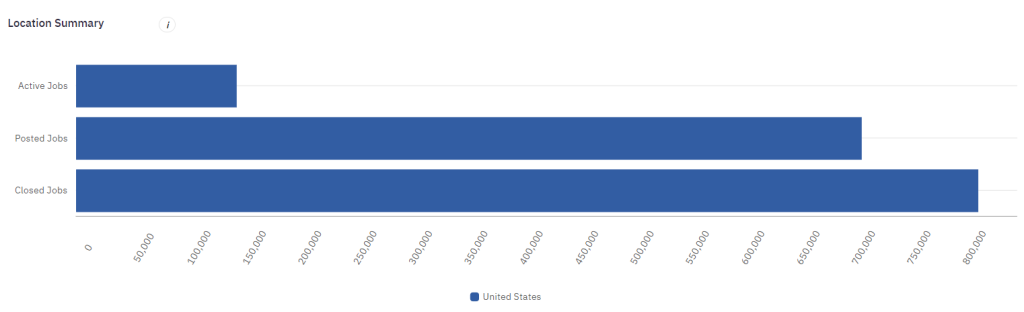

According to US apparel job filings data shared by GlobalData, a comparison between jobs postings from January to December 2022 and January to December 2023 revealed a decline in the number of 'jobs posted', with 'jobs closed' exceeding this figure during the period.

Between January and December 2022, jobs postings totalled 1,185,394 with 1,223,239 jobs closed. In contrast, the period from January to December 2023 witnessed 708,938 jobs posted and over 814,190 jobs closed.

Notably, active jobs in the US apparel market experienced a substantial decline, decreasing from 250,251 in January-December 2022 to 144,589 in the corresponding period of 2023.

In line with the data, Jain concluded GlobalData anticipates a subdued trend in new job postings moving forward.

He said: "This expectation is influenced not only by the tightening of monetary policy but also by the recent advancements in AI, particularly in generative AI. These are being implemented in innovative ways to enhance productivity, enabling more to be achieved with fewer resources. In fact, companies hiring across sectors with generative AI skillsets has accelerated over the last six months, as per GlobalData’s Jobs dataset. Job opening numbers are expected to revert to pre-pandemic levels of around 7.5 million per month over the course of the first half of 2024, with risks to the downside as companies deploy generative AI across business operations to improve productivity."

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.