New analysis shows that mass-market brands, including Lululemon, Puma and Adidas, are making better progress on human rights than some of their luxury counterparts.

In the KnowTheChain report, 65 of the largest apparel and footwear companies are benchmarked on their efforts to protect workers in their supply chain from forced labour.

The average score for fashion brands featured was just 21 out of 100, with more than 20% of companies scoring five out of 100 or less.

KnowTheChain has been ranking businesses across three high-risk sectors since 2016. Companies that had been benchmarked since the first report in 2016 performed better on average than those who were assessed for the first time this year.

Only 8% of companies disclosed details on forced labour risks identified across supply chain tiers, despite 77% of those listed sourcing from at least one high-risk country (including Argentina, Bangladesh, Brazil, China, Ethiopia, India, Malaysia, Nepal, North Korea, Thailand and Vietnam).

Just 22% of companies featured in the report said they engage with local or global unions to improve freedom of association in their supply chains.

Despite almost half of the benchmarked companies identifying allegations of forced labour in their supply chains, only 22% disclosed examples of remedy outcomes for workers.

Just three companies – Lululemon, Puma and Adidas – scored more than 50 out of 100. The highest performer was Lululemon, thanks to due diligence efforts.

Áine Clarke, head of KnowTheChain and investor strategy at the Business and Human Rights Resource Centre, commented that, while the largest fashion brands have returned to profit since the Covid-19 pandemic, workers in the sector’s supply chain continue to face tough conditions.

Clarke said: “The largest apparel companies have experienced a combined growth of $42bn since 2022, yet an estimated $71m is still owed to workers because of wage and severance theft committed during the pandemic."

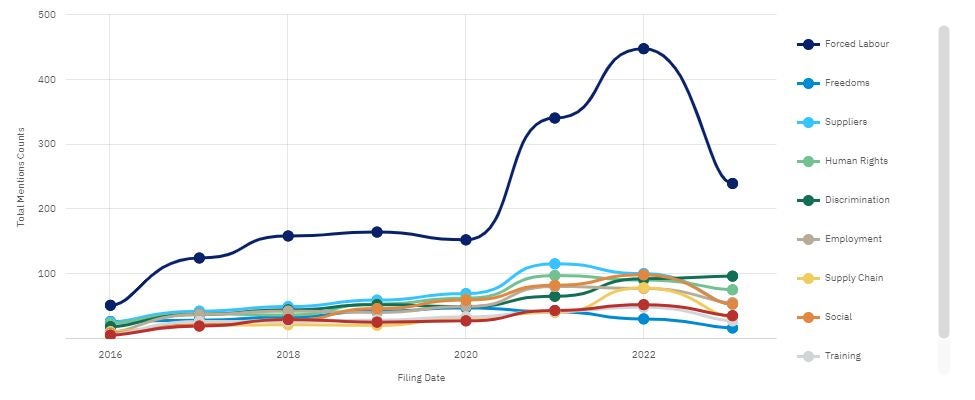

Mentions of 'forced labour' in apparel company filings

Analysis of apparel company financial filings using GlobalData's signals data, shows that mentions of the term 'forced labour' seemed to peak in 2022, before tailing off in 2023.

In 2022, the words 'forced labour' were mentioned 448 times in apparel company filings - up from just 52 mentions in 2016. However, while there seemed to be some real focus on addressing these issues between 2020 and 2023, the number of mentions of the term fell in 2023, with just 240 mentions.

Could this mean the sector has put these concerns on the back burner in recent months? KnowTheChain's Clarke said that while the fashion industry often been in the media spotlight for its human rights risks and labour abuse scandals - recent examples include a Chinese prison ID being found inside a Regatta coat, and the Canadian watchdog investigating Zara over links to forced labour - the sector has not adapted to the scale of the challenge.

"Exacerbated by multiple crises in 2023 – including climate breakdown, international conflict and post-pandemic realignment – alongside an increase in strategic litigation, legislation and associated operational, reputational and financial risks, makes this ‘business-as-usual’ approach by so many brands short-sighted and misguided," Clarke explained.

With new legislation on forced labour pending, Clarke says the report serves as a reminder to the sector of the importance of due diligence. She said: “With the recent political deal on the EU’s Corporate Sustainability Due Diligence Directive, this year’s benchmark findings should serve as an especially timely call to action for companies and their investors to look again at business models that perpetuate abuse and create shared prosperity for CEOs, shareholders and, crucially, workers alike.”

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.