As customers seek more affordable options, the Global Apparel Resale Market to 2027 report revealed an increase in the importance of online platforms such as Vinted and Vestiaire Collective, which have also helped raise consumer awareness about the practice of secondhand online shopping from the perspective of both buyers and sellers.

According to the report, while inflation is expected to return to "reasonable levels" later in 2024, consumer confidence will take time to rebuild with shoppers continuing to appreciate the affordability offered by resale options.

The report further indicated that concerns regarding the fashion industry’s impact on the planet will also continue to grow, especially as Gen Z ages and has more of an influence on the consumer market.

Resale apparel market growth to soften post-2024

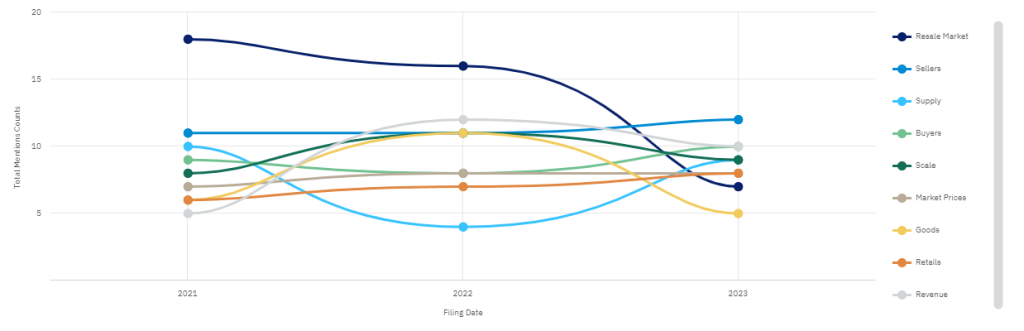

The apparel company filings data shared by GlobalData reveals that the keyword "resale market" was the most-used from January 2021 to 2022, 18 and 16 times respectively. From January 2022 to 2023, it slumped to almost half the usage at 7.

The report projects a 16.3% growth in the apparel resale market in 2024, with growth gently softening in the following years as the sector becomes more established. Between 2023 and 2027, the market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 12.9%, reaching $314.7bn.

The researchers modelled five apparel brand archetypes and calculated the carbon footprint of 38 products, concluding that by 2040, resale initiatives have the potential to lower annual carbon emissions for these brands by 15-16%.

While more recently, the UK-based fashion brand HERA announced the launch of an integrated platform for secondhand clothing resale, as part of its wider plan to provide customers with a complete circularity journey.

Examples like these indicate that the apparel industry is becoming more environmentally conscious, taking strides to enhance circularity. This also underscores the growing awareness among shoppers who, faced with limited discretionary income, are increasingly relying on alternative shopping options

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.