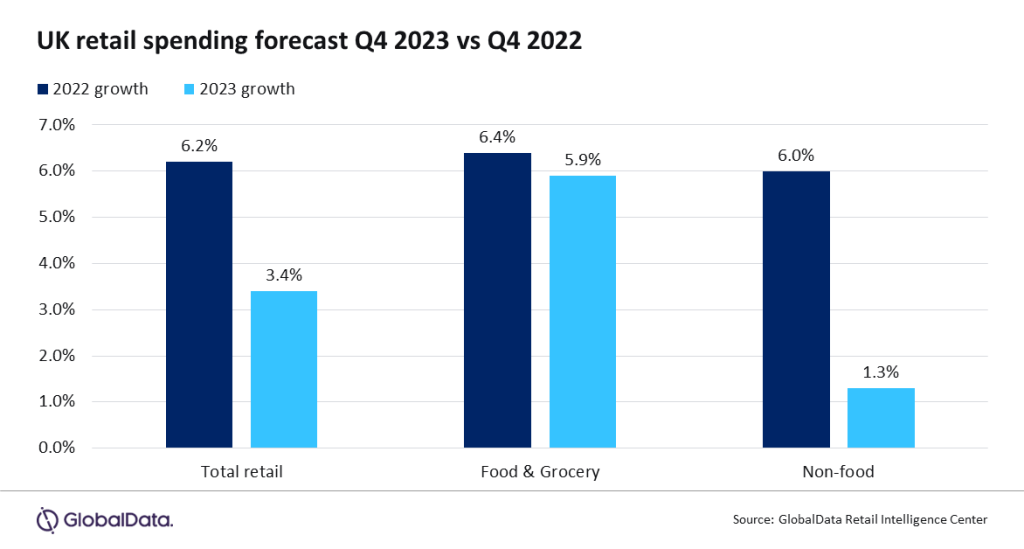

Consumer spending in the build-up to Christmas will increase spend by 3.4% in the UK, according to new figures from data analytics company GlobalData.

Despite a 9.3% increase in retail prices GlobalData anticipates shoppers making savvier choices to avoid high prices.

This also marks a second quarter of slowing growth in 2023, down from a peak of 5.2% in Q2.

This means that UK retailers will see barely half of the 6.2% increase in spend seen in last year’s Christmas build-up. Christmas 2022 was the first Christmas without restrictions since before the pandemic, which helped contribute to the 6.2% increase in UK consumer spending.

UK retail spending forecast Q4 2023 vs Q4 2022

Clothing and footwear are expected to grow the fastest out of all non-food sectors in the UK. This is despite last year seeing strong growth as consumers purchased new outfits for 2022’s party season after several years of cancelled events.

GlobalData says the fashion sector is “proving resilient” to the cost-of-living crisis with younger consumers enjoying the chance to dress up again after the pandemic.

The sector has also seen a growing trend for “capsule wardrobes”, which see consumers collect a small number of items that can be worn together in different ways, often including premium pieces. GlobalData suggests these more expensive items are well-suited to gifting.

GlobalData’s lead retail analyst Nick Gladding explains: “This year’s growth in retail sales is driven by inflation, which GlobalData expects to reach 9.3% for the year as a whole. Sharply higher prices mean shoppers will spend less in real terms than last year, choosing either to trade down or trim the number of presents they buy. Last year sales growth was supported by shoppers spending savings built up during the lockdown. But with those savings now depleted by cost-of-living increases and mortgage rate hikes, consumers are likely to shop more cautiously and more savvily.”

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.