Baozun, the Chinese brand e-commerce service, recently entered a partnership with Authentic Brands Group (Authentic), the company behind Reebok and Ted Baker brands, to acquire a 51% equity interest in Hunter's intellectual property in Greater China and Southeast Asia.

As part of this exclusive, long-term license agreement forged through a newly formed Authentic subsidiary, ABG Hunter LLC, Baozun and Authentic's joint venture enables Baozun to design, manufacture, market and distribute Hunter brand products in Greater China.

Inside the deal

The license agreement will be assigned by ABG Hunter LLC to Hunter IP Holdco as the licensor across the region.

Jamie Salter, founder, chairman and CEO of Authentic, calls this partnership a "strategic move" which is in line with its strategy to "think global and act local".

Salter continues: "We are thrilled to partner with Baozun to grow Hunter in this important region. By partnering with Baozun, a leader in digital and e-commerce experiences in China and Southeast Asia, we are able to combine our expertise in brand management with their deep understanding of the local market nuances and cultural trends."

Here's why the deal matters

Earlier in March, Authentic expressed interest in a deal with footwear firm Hunter when an auction of the business was understood to be taking place after it secured a multimillion-pound funding lifeline, with existing shareholders injecting £5m ($6.3m) into the business and lenders contributing a further £2m ($2.5m).

Following this, Authentic led the race for Hunter's acquisition with a deal said to have been valued at approximately £100m ($125m). At that time, a source added that BaoZun, which owns Gap's operations in Greater China, also remained interested in a deal if talks with Athentic faltered.

At that time, Salter said: "At the intersection of fashion and outdoor, Hunter introduces another elevated global brand to Authentic’s diverse Lifestyle portfolio.”

It was said that the addition of Hunter to the Authentic portfolio underscored the company’s commitment to diversifying its brand offerings by incorporating non-US-based brands.

Authentic planned to leverage its global network of category experts and operating partners to speed up Hunter’s "worldwide expansion."

The company said then that its growth will encompass key markets across the US and Canada, Latin America, Europe, the Middle East and Africa, as well as significant markets in the Asia-Pacific region.

Based on the agreement, Authentic appointed the Batra Group and Marc Fisher Footwear as the brand’s core partners in key regions.

Therefore, it comes as no surprise that the owner of Reebok and Ted Baker brands has chosen to leverage Baozun's experience and expertise for further expansion of Hunter in Greater China and Southeast Asia regions.

Baozun serves more than 400 brands from various industries and sectors around the world, including East and Southeast Asia, Europe and North America.

Pippa Stephens, senior apparel analyst at GlobalData, is of the opinion that Authentic's partnership with Baozun for its operations of Hunter in Greater China and Southeast Asia will allow the brand to more effectively cater towards consumers in the region, due to Baozun having much greater knowledge of their preferences and needs.

She continues: "The move comes only a couple of months after Authentic Brands Group's acquisition of Hunter's intellectual property, following the brand's collapse into administration in June, blamed on unseasonable weather, inflationary pressures and supply chain challenges."

In fact, Stephens points out that the new owner is well placed to turn the brand around, having acquired several other struggling players in the past, with a diversification of Hunter's offering needed to help it stay relevant.

Vincent Qiu, chairman and chief executive officer of Baozun, notes this marks another milestone in its transformation where all three business lines will cooperate together to deliver an extraordinary suite of services to leading global brand companies in China and other Asian markets.

Key takeaways for the fashion industry

The Key Trends in the Global Apparel Market webinar hosted by GlobalData forecasts that the footwear sector will grow at a CAGR of 5.2% between 2022 and 2027.

The most preferred item in this sector, however, is trainers rather than boots or shoes, which have soared in popularity due to their versatility and comfort. Chole Collins, apparel head at GlobalData, notes shoppers are also more willing to pay higher prices to access the latest styles from their favourite brands.

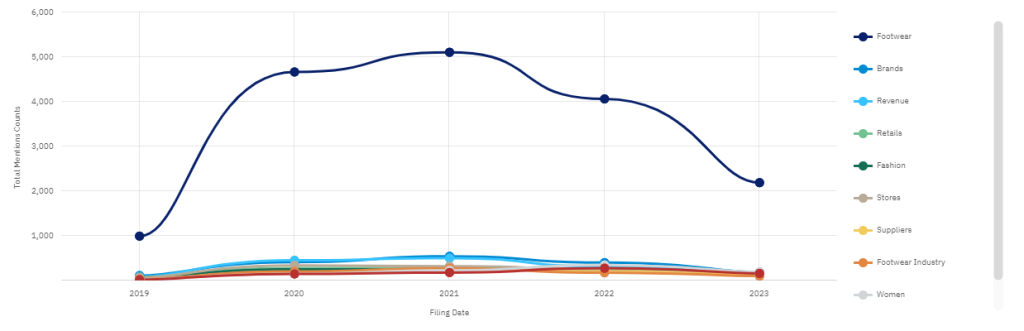

This is also evident from GlobalData's analytics which highlights that 'footwear' filings peaked in 2021, with the keyword being used 5108 times by companies from 1 September 2010 to 1 September 2023.

According to another report titled Apparel M&A Deals Q2 2023 by GlobalData, there were 89 global apparel sector deals recorded in Q2 2023 which is 41% higher than the previous quarter and 39% higher than the previous year.

This is particularly true for the footwear industry, for instance, the US footwear company Sketchers signed an agreement in late April with its Scandinavian distributor, Sports Connection, to set up a wholly-owned subsidiary in a bid to boost its growth within Europe.

David Weinberg, chief operating officer of Skechers USA, said: "We are looking forward to further broadening our reach in Europe by combining the team’s local expertise with our worldwide capabilities and financial resources."

In another example, Reliance Retail's acquisition of V Retail Pvt Ltd, a South Indian footwear retailer, was said to enable the subsidiary of Reliance Industries to tap the growing Indian footwear market that had recovered from the adverse impact of the pandemic.

Authentic Brands Group or Authentic, formerly referred to by the acronym ABG, proved to be exemplary in this regard. It has been on an acquisition spree for over a decade. It bought brands and retailers, left, right and centre expanding its portfolio to more than 50 brands and boasting of an "expansive" retail footprint in 150 countries – something the rest of the industry can probably take away from.

More research:

Apparel Industry Mergers And Acquisitions Deals By Top Themes In Q2 2023

Global Luxury Apparel Market & Forecasts to 2025

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.