Long considered an essential element of personal style and self-expression, footwear has played a pivotal role in the fashion industry for years.

However, filings analytics data compiled by GlobalData for the month of July 2023 suggests there were only four mentions of “footwear” compared to 194 mentions in the same month last year.

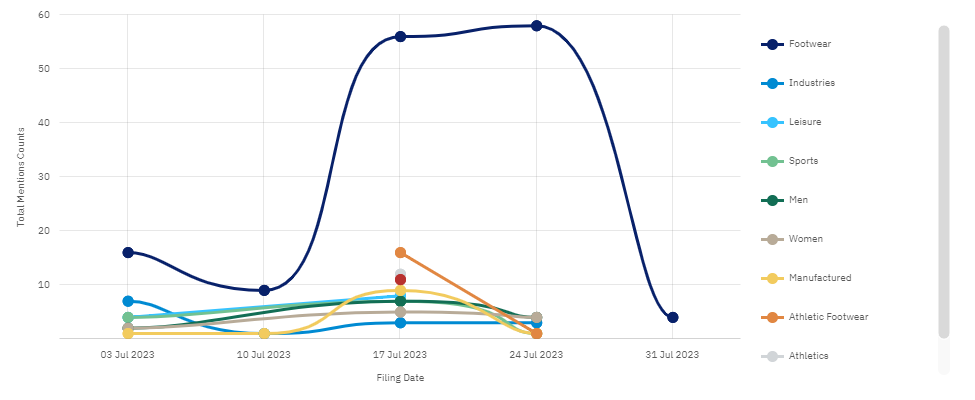

Footwear theme drops in company filings in July 2023

Source: GlobalData

The ongoing cost of living crisis and high inflation have impacted consumer spending across various sectors, including fashion. The increasing costs associated with production, materials, and distribution have driven up retail prices, which could have also deterred consumers from making footwear purchases as frequently as before.

GlobalData’s Sustainability in the Global Apparel Market report, which was published at the end of 2022 (November) suggests almost half of consumers (49%) are buying fewer clothing and footwear items on the back of the cost of living crisis.

GlobalData’s monthly UK consumer survey conducted in April 2022 found less than a third (30.4%) of UK consumers did not expect their clothing and footwear shopping habits to change as a result of price rises, whereas 32.1% stated that they would buy fewer items, and 13.1% would stop purchasing them altogether, emphasising the impact that increasing costs would have on the overall clothing and footwear market.

The uncertain global economy is affecting the US garment and footwear sector, with Gherzi Textil organisation partner Robert P. Antoshak telling Just Style in May that it could take a year for the industry’s outlook to improve, which might explain the reduction in company filings mentioning footwear.

GlobalData's findings also support the recently published results of many footwear companies, such as US footwear and apparel sustainable retailer, Allbirds. The company struggled to even remain flat in Q2 2023 due to what was described as a tougher consumer environment.

German sportswear giant Adidas also reported a flat second-quarter performance due to a volatile market and slow-moving inventory.

In March this year a footwear factory in Vietnam, which cites US sportswear brand Nike and Adidas as suppliers, reportedly axed 6,000 jobs due to weak consumer demand as well as China's Covid measures.

Could the adaptive market give footwear a boost?

From sportswear brands to traditional footwear manufacturers, the industry is being compelled to reimagine its strategies and explore adaptive and more functional designs, as market trends continue to favour inclusivity.

Sorel Footwear and ecommerce company, Zappos Adaptive recently collaborated to release shoes with adjustable straps, and enlarged heel pull loops to fit the needs of people with disabilities.

This release was a follow-up of a previous launch of Nike InfinityRN 4, a trainer that was said to help protect the future of sports by equipping runners with higher energy return and a lower carbon footprint than its Nike React foam.

Plus, German sportswear brand Puma launched a self-lacing training shoe in 2019 made for workouts and light running, as part of its adaptive performance products.

Puma’s innovation came after Nike unveiled its adaptive lacing innovation in March 2016, including what it described as pioneering technology that separates mud from cleats in football boots.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.