M&A activity focused on fortifying supply chains should be a key tool in the arsenal of fashion executives going into 2024, Ed Bradley, founder and CEO of European dropshipping platform Virtualstock told Just Style.

He argued strategic consolidation can help to significantly mitigate supply chain disruption. He suggested technologies such as tracking systems and prediction software could insulate fashion supply chains against a range of issues, such as using data analytics to flag and identify product shortages ahead of time, or tracking vessels moving through high-risk areas like the straits around the Suez Canal.

Bradley added the fashion industry can be particularly vulnerable to supply chain shocks: "The globalised nature of the industry, with production and consumption often taking place in separate nations or continents, means that retailers can really feel the effects of squeezes in long logistical chains."

Unfortunately, he continued: "This is what we're seeing currently, as Houthi attacks in the Red Sea force shipping firms to re-route around Africa, lengthening timeframes and increasing costs".

He pointed out that UK retailer Next has already warned of supply chain delays and UK outerwear brand Barbour has reportedly dealt with significant disruptions, but he continued: "Fashion retailers can't prevent these events, but they can prepare for them".

Bradley believes the recent surge in retail M&A activity will continue into 2024. He said retail consolidation has been largely driven by distressed balance sheets and strategic expansion into ecommerce, but, he argued, senior executives must also use M&A as a means of strengthening their supply chains in 2024 as it allows them to rapidly onboard emerging technologies.

Bradley cited a report by UK law firm Reynolds Porter Chamberlain LLP that said the UK in particular was a hotbed of M&A activity in 2023 with the highest level of deals since the pandemic.

He explained: "The retail M&A activity that has defined the last few years will continue into 2024 as firms with strong foundations seek to strengthen their ecommerce offerings by snapping up retailers in the red. But looking beyond these motivations, I believe that 2024 will be characterised by retailers consolidating, primarily to strengthen their supply chains.

Bradley highlighted the wave of shocks encompassing natural disasters, geopolitical crises, and technological disruption, and suggested many fashion retailers have realised their supply chains are acutely vulnerable.

He said: "It would be negligent to assume that these will just stop in 2024.”

He admitted that retailers can't prevent events such as what's currently happening the Red Sea, but they can prepare for them.

Interest in apparel-specific M&A waned by end of 2023

Credit: GlobalData

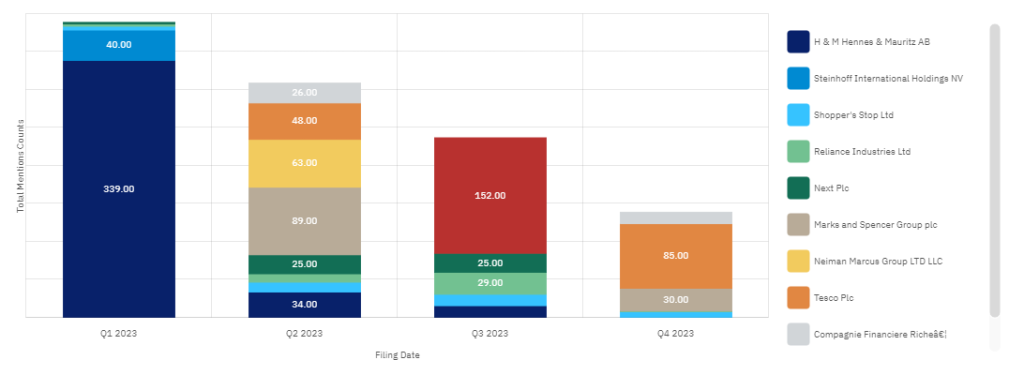

According to GlobalData's company filings database apparel M&A mentions peaked in Q1 of 2023 with 359 mentions and Swedish fashion retailer H&M took the bulk of these with 339 mentions.

By Q4 interest in apparel M&A had declined significantly to 139 mentions with UK supermarket and fashion retailer Tesco taking the bulk of these (85).

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.