A record 200.4 million consumers shopped over the five-day holiday weekend (from Thanksgiving Day and Black Friday through to Cyber Monday) in the US, surpassing 2022’s record of 196.7 million, according to the National Retail Federation’s annual survey.

Some 36% of surveyed consumers said they shopped at clothing and accessories stores, while 49% of all gifts bought were clothing and accessories.

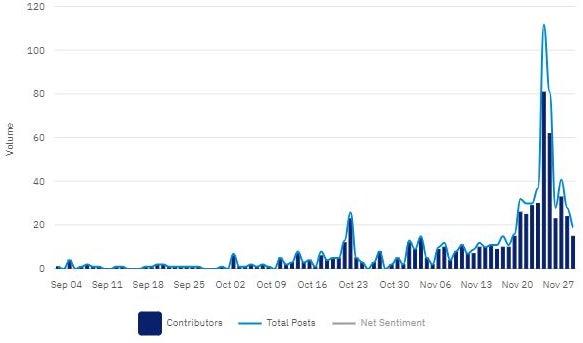

Number of mentions of 'Black Friday' 2023 on social media among tracked industry influencers

Unsurprisingly, GlobalData social media analytics recorded a spike in posts about 'Black Friday' among industry influencers.

However, the holiday was a mixed bag for apparel companies.

Notable online winners included gymwear fashion brand Gymshark, whose Month-over-Month (MoM) traffic rose 83% in November, according to SimilarWeb’s analytics. The company also achieved Year-over-Year (YoY) traffic growth of 12% for the discount holiday of the year.

Other online winners included Inditex’s Zara whose MoM online traffic increased by 13%, while its YoY traffic for Black Friday surged by 32%.

Pretty Little Thing appeared to take a lower profile in this year's Black Friday. Its traffic actually decreased by 2.6% MoM, while YoY traffic for Black Friday decreased by almost half (45%).

Online fast fashion retailer Shein, which has recently filed paperwork to float on the US stock market, also recorded a 9.5% decrease in MoM traffic and a 22% decrease in YoY traffic for Black Friday.

Bloomberg has suggested the brands most reliant on Black Friday suffered the most, with Columbia Sportswear, Levi Strauss & Co and Capri Holdings, recording negative YoY growth for Black Friday sales. The annual retail extravaganza accounts for 3%, 2% and 2.8% of these companies’ observed year-to-date sales, respectively.

By contrast, discount apparel retailer TJX Companies, for whom Black Friday accounts for just 0.7% of year-to-date sales, witnessed 8.8% growth in YoY Black Friday sales.

Nike, for whom Black Friday accounts for just 1.6% of year-to-date sales, also fared very well, seeing a 31.6% growth in YoY Black Friday sales.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.