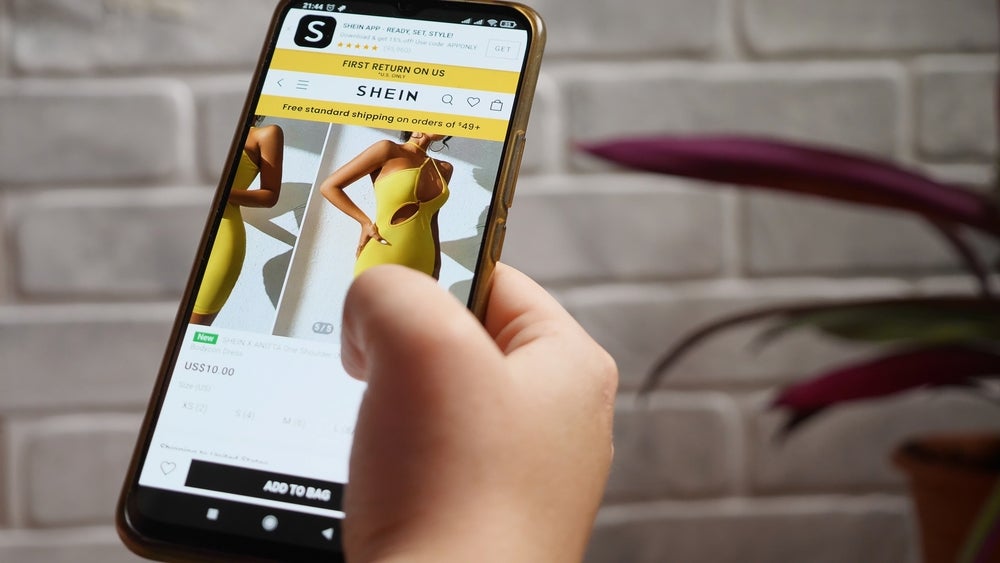

According to the dataset, Shein is expected to continue its "skyrocketing trajectory" to 2027, overtaking fast fashion rivals UK online retailer Asos and Spanish fashion brand Zara, which is owned by Inditex.

The projection would make Shein the "biggest winner" in the expected shake-up of the UK apparel market, with its market share predicted to jump from 2.2% in 2023 to 2.8% in 2027.

In 2023, Shein was the 11th largest apparel retailer in the UK, this prediction will take it up to sixth largest. Asos held the eighth spot in 2023 and is expected to fall into 10th place by 2027.

Last year, Shein acquired UK-based fast fashion brand Missguided from Frasers Group, 18 months after it was saved from administration by the Sports Direct-owned company.

GlobalData's apparel analyst Louse Deglise-Favre said the rise of Shein will see its online rivals struggle.

She explained: "Other online fast fashion players will suffer from Shein’s meteoric rise, with Asos, Boohoo and PrettyLittleThing all forecast to lose market share out to 2027. Therefore, these retailers should focus on agility and price to ensure their product offerings can compete with Shein for the attention of young shoppers, and they must effectively leverage the power of social media and collaborations to regain top of mind appeal."

In recent months, Asos has forecasted a drop in sales ranging from 5% to 15% in FY24, although the company added that it expects to see profitability and a return to growth in FY25.

The Boohoo Group, which owns Boohoo as well as Boohoo Man and PrettyLittleThing, has warned full-year sales could fall by as much at 17% as a result of reduced spending by cash-strapped customers.

Deglise-Favre added: "Next, Primark and M&S are expected to retain their top three respective positions in the UK apparel market out to 2027. Next and M&S will continue to benefit from their value for money perception, wide product offerings including third-party brands, and strong online capabilities."

As consumers continue to cut costs, Deglise-Favre also pointed out that value retailers will continue to succeed. She said: "As the economy remains trying in the short term, Primark’s exciting ranges and stores will allow it to win shoppers looking to trade down, but grocers ASDA, Tesco and Sainsbury’s will not see the same uplift due to less inspiring propositions."

JD Sports and Sports Direct are expected to retain their fourth and fifth places in the UK market respectively, which Deglise-Favre attributed to the continued outperformance of sportswear.