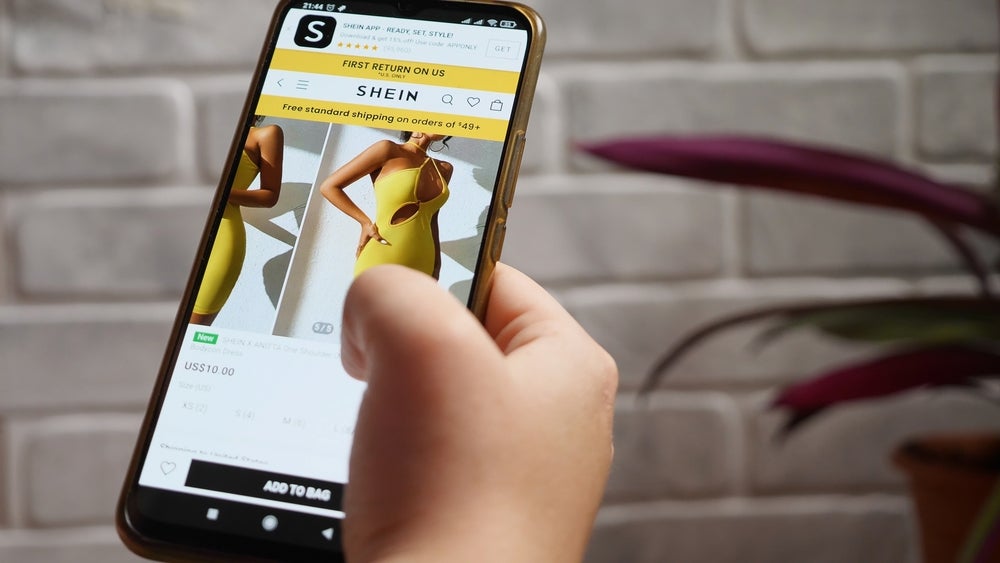

Shein has hired formed EU budget commissioner Günther Oettinger as a consultant amid increased scrutiny of supply chains and pending sustainability legislation.

The news comes shortly after Shein reportedly filed papers for a London IPO in June.

German lawyer and politician Oettinger served as European Commissioner for budget and human resources from 2017 to 2019, European Commissioner for digital economy and society from 2014 to 2016 and European Commissioner for energy from 2010 to 2014.

Shein confirmed to Just Style that it is now working with Oettinger.

The European Commission is currently planning to scrap its €150 ($165.34) import tax exemption, which allows for cheaper goods to avoid custom duties when imported into the block. The plans are widely thought to be targeting Shein and its rival Temu.

At the time, John Stevenson, an analyst at Peel Hunt, told UK newspaper The Guardian: “The whole [Shein] model is based on not paying duty” so “it would have a massive impact”. He argued that some countries impose import duties of up to 30%, so having to pay that would force Shein to either completely change its business model, put up prices or take a hit on profit.

The EU Commission’s president Ursula von der Leyen previously described fast fashion as “poison for our planet” in speech given at Frankfurt Fashion Week in 2021.

In July Shein committed to a €200m circularity fund for the UK and EU over the next five years to advance fashion's sustainability solutions and €50m to boost its ESG efforts.

In a statement shared at the time, Shein’s executive chairman Donald Tang said: “Given Shein’s scale and reach, Shein can become a catalyst for the widespread adoption of these solutions across the industry.

“All across Europe and the UK we have identified a rich and diverse pool of designers, brands, and craftspeople who we know can reach a much wider audience on our platform and who we are confident can successfully scale up their businesses with Shein.”

Last week (8 August), the London Stock Exchange Group rejected suggestions that it is lowering its standards in order to secure a £50bn ($63.6bn) IPO from Shein.