According to NRF President and CEO Matthew Shay, the US economy remains fundamentally healthy and continues to maintain its momentum heading into the final months of the year.

Shay emphasised that winter holidays are an "important tradition" to American families, and their capacity to spend will continue to be supported by a strong job market and wage growth.

NRF noted that the holiday forecast is consistent with its forecast that annual sales for 2024 will be between 2.5% and 3.5% over 2023 levels.

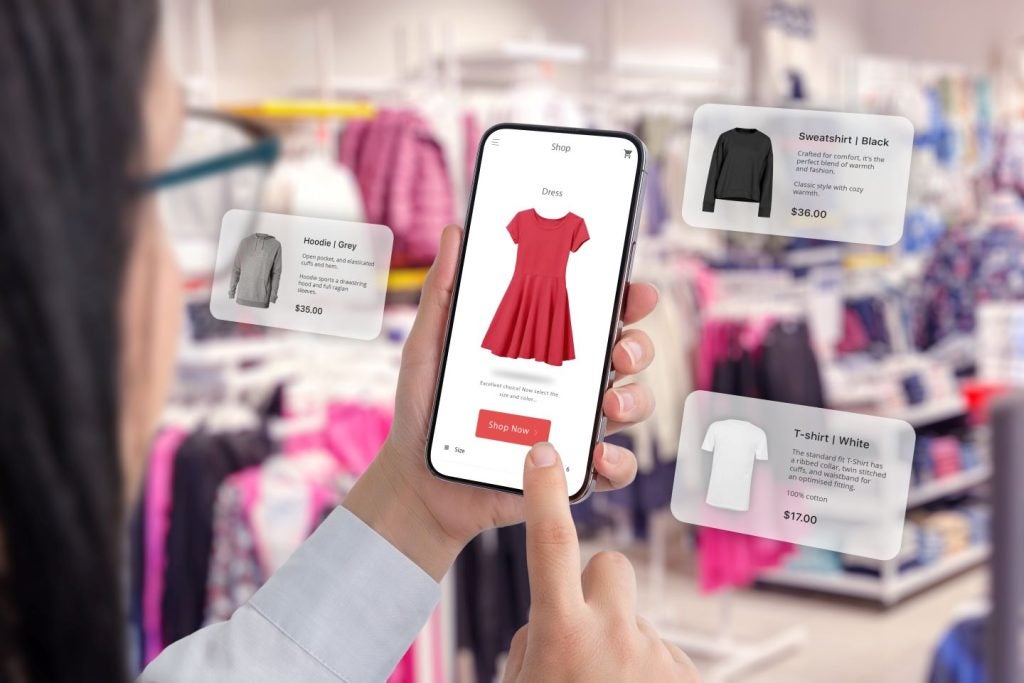

A key driver of this overall retail sales growth is expected to come from online shopping, with non-store and online sales expected to rise between 8% and 9%, reaching a total of $295.1bn to $297.9bn, up from $273.3bn last year. NRF said this figure reflects a more moderate increase compared to last year’s 10.7% growth in non-store sales.

NRF chief economist Jack Kleinhenz also expressed optimism about the financial health of American households, stating it is in "good shape and an impetus" for strong spending heading into the holiday season.

However, he cautioned that consumers are likely to be more deliberate in their purchases: "We remain optimistic about the pace of economic activity and growth projected in the second half of the year."

Key trends

Retailers are preparing for increased consumer demand during the holiday season, with the NRF predicting that between 400,000 and 500,000 seasonal workers will be hired this year, down slightly from the 509,000 hires in 2023. Some hiring may have already occurred in October to support early holiday shopping events.

NRF said that one differentiating characteristic from last year’s holiday shopping season is that the shopping period between Thanksgiving and Christmas will be six days shorter, totalling 26 days.

Additionally, NRF noted that contributing factors this year could include the economic impact of Hurricanes Helene and Milton; even though the 2024 US presidential election will take place during the winter holiday season, it is nearly impossible to measure its impact on current or future spending.

NRF said, its holiday forecast is based on economic modelling using various key economic indicators including consumer spending, disposable personal income, employment, wages, inflation and previous monthly retail sales releases.

In April, Kleinhenz projected that the US economy would remain steady through 2024, despite a slowdown in both gross domestic product (GDP) and retail sales growth.