Zara plans to launch live shopping shows on its app and website in the UK, Europe and the US between August and October this year due to its livestreams in China contributing to the brand selling 50% more product sizes in the first quarter of 2024 compared to last year, according to Reuters.

Zara has been live-streaming weekly five-hour shopping shows on Douyin, TikTok's Chinese sister app, since November. The broadcasts feature models showcasing Zara apparel, footwear and accessories in a variety of catwalks, dressing rooms and behind-the-scenes settings.

A Zara spokesperson told Reuters: "We want to take this to the Western countries, where livestream is not as popular...but we think why not – from an entertainment perspective this is like an evolution."

The news publication mentioned that as Zara's physical retail footprint in China has contracted from 570 stores in 2019 to just 192 currently, the livestream platform provides a means to maintain customer engagement and drive sales growth in the market.

How has live shopping grown in China?

Digital initiatives like live shopping and the metaverse, which is more advanced in China than other global markets, have contributed to its growth, according to GlobalData’s 'The Apparel Market in China to 2027' report with the online market forecast to grow 7.8% between 2023 and 2027

However, more Western countries will overtake it in terms of penetration by 2027, due to slow internet take-up in lower-tier cities, added the report.

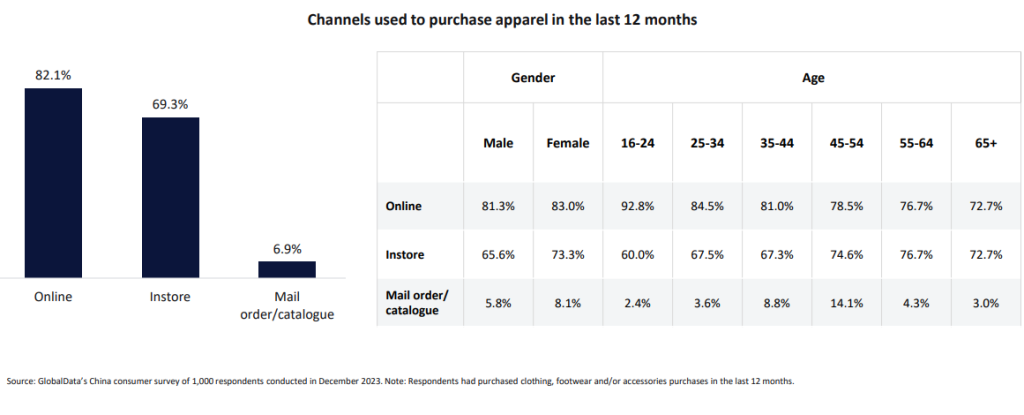

While livestream selling is a popular phenomenon in China another GlobalData report titled: “Apparel Consumer Insights: China” explained this could be down to social media which was found to play a part in influencing consumer purchasing decisions.

Consumers explained online shopping offered more options and greater convenience, with 75.8% of apparel shoppers agreeing that online shopping allows for a much greater choice compared to physical stores. Additionally, 72.8% of consumers preferred online shopping due to its ease of product comparison.

Brands and retailers on social media wielded the most significant influence on Chinese consumers’ apparel purchases after family and friends, emphasising the significance of social media marketing for brands operating in the country.

Online market potential in 2025/26

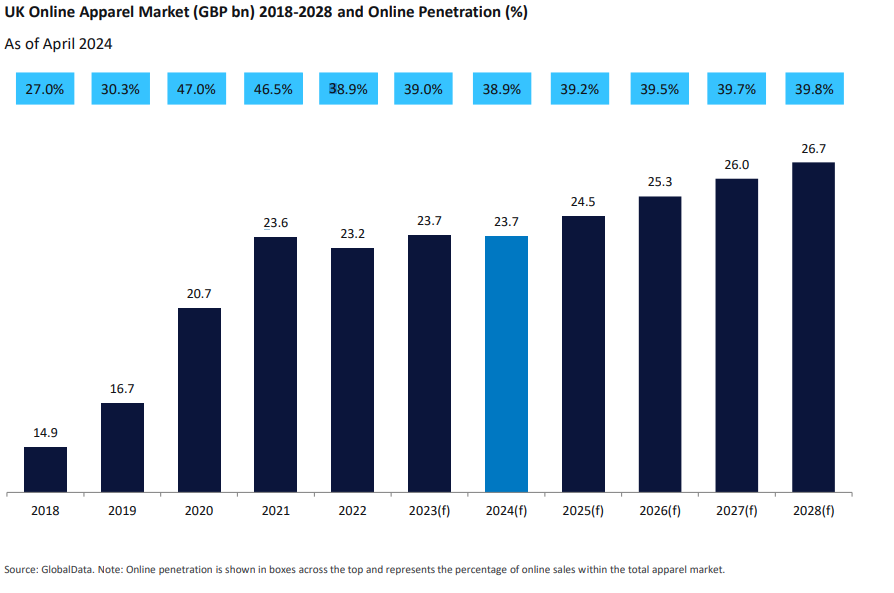

In a report called 'The Apparel Market in the UK' GlobalData said online penetration is expected to rise again from 2025 onwards, as brands keep investing in technology to elevate the online shopping experience.

Growth will be slow rising by just 0.6ppts to reach 39.8% in 2028 as the market is already well established, giving it limited scope for further developments.

While Instagram was previously the prime social media platform for fashion inspiration, the “The Apparel Market in the US & Forecast to 2026” from GlobalData found that TikTok is now rapidly growing in popularity in the US, particularly among Gen Z consumers.

The platform makes it easy for products to go viral and be seen by millions of users, so brands are advised to take advantage of this to increase visibility.

GlobalData senior apparel analyst Pippa Stephens previously commented on the growth of live shopping and explained that often, there are promotions or discounts offered that are exclusive to that particular livestream, creating a sense of urgency and encouraging consumers to purchase straightaway.