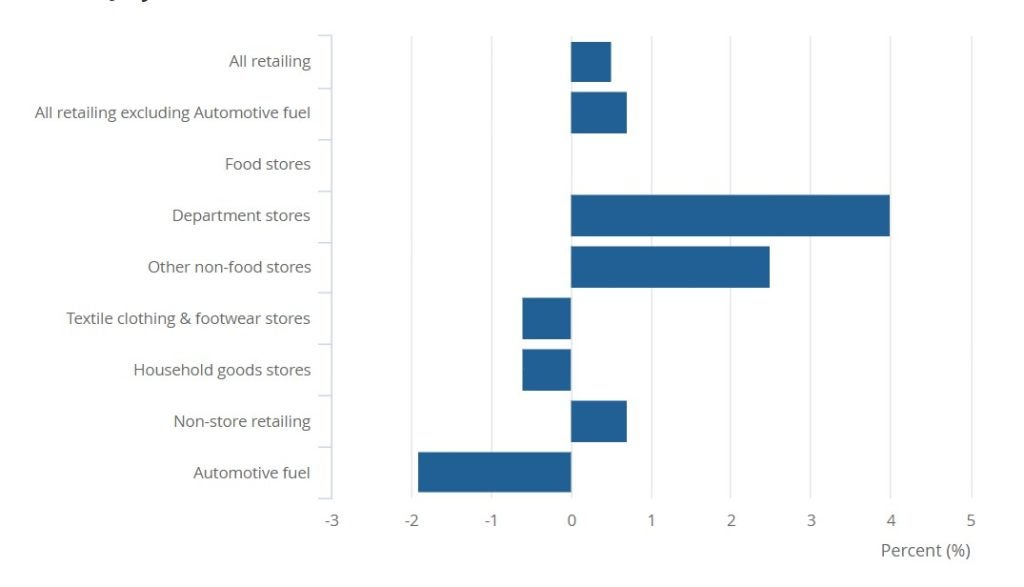

The Office of National Statistics' most recent data on UK retail in July reveals sales were up 0.5%, compared to a fall of 0.9% the previous month. However textile clothing and footwear stores specifically saw a decline of 0.1%.

Total UK sales volumes rose by 1.1% in the three months to July 2024, when compared with the three months to April 2024.

Non-food store sales volumes, which includes department stores, clothing stores, household and other non-food stores, went up 1.4% in July 2024.

UK July retail volume sales by monthly percentage change and seasonally adjusted

The ONS suggests non-food store sales were boosted by summer discounting and sporting events such as the European football Championship.

The amount spent online rose by 2.5% during July 2024, and by 3.6%, compared with July 2023.

British Retail Consortium director of insight Kris Hamer explains that on a year-on-year seasonally adjusted basis sales by value overall increased 2.2% and sales by volume increased 1.4%.

He explains that "following the gloomy start to summer spending, retailers welcomed the warmer July weather which gave sales growth a boost, particularly in areas such as cosmetics, clothing, footwear, and books as consumers prepared for their summer holidays."

Wealth Club manager of the quality shares portfolio, Charlie Huggins agrees, noting: "Retail sales volumes were bang in line with expectations in July, bouncing back from a worse than expected June," before adding: "Online spending was also all strong across the board."

Huggins believes Labour's landslide election victory, the recent interest rate cut and falling mortgage costs have likely all played their part to support UK consumer spending.

Overall, he says the UK economy appears to be chugging along, with little sign that consumers are significantly cutting back. With inflation moderating, paving the way for further interest rate cuts, he suggests retailers can look ahead to the rest of the year with a degree of optimism.

Hamer is quick to add a word of caution, stating: "The high cost of living is still bearing down on consumers, but with interest rates finally easing, retailers are hopeful that this will buoy consumers confidence, and with it greater spending, particularly as we head into August.

He continues: "As retail businesses plan their investment strategies, many will be looking ahead to the Autumn Budget, keen to end 14 years of Conservative business rates rises which has seen the tax rate rise 30%, harming the viability of many retail stores across the country.

“Retailers are working closely with Government to maximise the industry’s contribution to economic growth. But, with headline inflation showing signs of rising further, retailers face the prospect of another large rise in business rates next year."