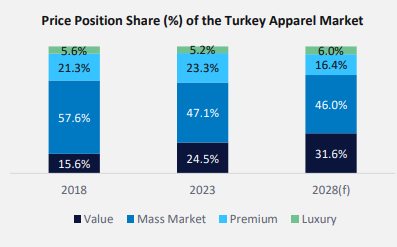

According to GlobalData's ‘Apparel Country Snapshot: Türkiye’ report, the value and luxury segment are both set to outperform the Turkish apparel market from 2023 to 2028.

Value's share is forecast to rise by 7.1ppts to 31.6%, with a CAGR of 34.6%, driven by consumers seeking affordable options from players such as fast fashion giant Shein and sports and athleisure wear brand Decathlon amid economic pressures.

However, the luxury segment is also expected to see its share rise from 5.2% to 6%, at a CAGR of 31.4%, as luxury shoppers remain relatively immune to financial pressures.

The report explained that this market polarisation is projected to cause the premium and mass market segments to lose share. Premium's share is forecast to decline a significant 6.9ppts to 16.4% between 2023 and 2028, with a CAGR of 19.3%, reflecting consumers' shit towards either more affordable or more exclusive offerings.

Meanwhile, the mass market will see its share slightly decline by 1.1ppts to 46% by 2028, with its CAGR standing at 27.3%, however, it will remain the "largest" segment due to the board appeal of these players.

Sportswear, resale poised for growth

The report further revealed that in 2023, the sportswear market rose by 59.6% to reach ₺133.6bn ($3.90bn), marginally underperforming the growth of the wider apparel industry.

It is expected to grow at a CAGR of 30.0% from 2023 to 2028, increasing its share of the total apparel market by 1.4ppts to 17.5%, fueled by a rising interest in fitness and the ongoing popularity of casual, versatile fashion.

GlobalData pointed out that global brands like Nike and Adidas are driving this with their strong market presence and targeted marketing strategies, while local players such as Lescon are also gaining traction.

On the other hand, resale apparel in Türkiye experienced a robust CAGR of 62.1% between 2018 and 2023, driven by consumers' growing interest in sustainability and affordability. Although GlobalData believes the market has slowed as it has become more developed, it continues to show strong growth, with a projected CAGR of 31.2% from 2023 to 2027.

This surge is said to be largely fueled by online platforms, with major players like Dolap, Vestiaire Collective and Letgo gaining share, as consumers increasingly turn to them due to their wide accessibility

Another report by GlobalData published recently, unveiled that footwear is set to drive market growth in Türkiye from 2023 to 2028, fuelled by growing demand for a wider range of styles.