According to GlobalData’s Global Children’s Market to 2028 report, childrenswear proved more resilient than adult clothing during the pandemic, due to its "essential nature and more frequent need for replacement."

In response to this trend, many clothing brands traditionally targeted toward adults have diversified into childrenswear, including premium, luxury and streetwear players. According to the report, this expansion enables parents to purchase from brands they already trust, seeking to emulate their style preferences for their children.

Premium and luxury brands usually face challenges within the childrenswear market as parents are typically reluctant to invest heavily in items with "relatively short lifecycles."

However, an increasing number of upmarket brands have recently begun launching childrenswear for the first time. For instance, In January 2024, premium British womenswear brand Phase Eight launched its first 18-piece occasionwear collection for children. The brand intends to broaden its offerings with summer and partywear lines throughout the year, alongside introducing children’s shoes and accessories.

In line with this trend, streetwear brands have also started to delve into the childrenswear market to appeal to young parents who want to dress their children trendy. For example, in May 2023, British streetwear label Represent introduced its Mini Owners’ Club, tailored for children up to 4 years, featuring hoodies, joggers, sweatshirts and t-shirts.

Moreover, the report found that brands have also begun launching collections specifically targeted towards tweens and teens to fill the gap in this market which results in a lot of older children buying from adult ranges to access more mature, fashionable styles.

In April 2023, John Lewis & Partners announced its inaugural in-house tween collection, aimed at 7 to 12-year-olds, drawing inspiration from 90s styles like cargo trousers and tie-dye prints. Similarly, in December 2021, Indian online retailer Myntra unveiled Justice, a brand designed to resonate with tween girls aged between 8- 15, offering a diverse selection of daily casualwear and athleisure.

Strategies for success in childrenswear market

- Affordability: While budgets remain squeezed as a result of inflationary pressures, affordability will be key for childrenswear purchases. However, quality should not be compromised so that items offer greater value for money and last as long as possible, reducing overall cost per wear.

- Focusing on longevity: Childrenswear brands should focus on designing clothing that lasts longer to extend the issue of short product lifecycles in the market due to frequent washing, growth spurts, and active lifestyles. Brands should introduce features such as adjustable waistbands and hemlines so they cater better to growth, and also include gender-neutral styles that can be more easily passed down throughout the family.

- Improving sustainable credentials: Environmental awareness will continue to grow among consumers, so brands should adopt practices that promote circularity and focus on reducing landfill. As secondhand is a particular threat to the childrenswear market, brands should look to introduce their resale propositions, with rental subscription services also gaining traction. Childrenswear ranges should also be developed from more sustainable materials, to show responsible sourcing.

- Having age-appropriate ranges: Creating age-appropriate ranges, especially for tweens and teens, can be a strategic move for apparel brands to cater to the specific needs of this demographic. As children get older, they become more opinionated about fashion and start to develop their own sense of style, so specific ranges for these ages will increase their chances of finding garments they like and prevent them from trading up to smaller sizes of adult collections.

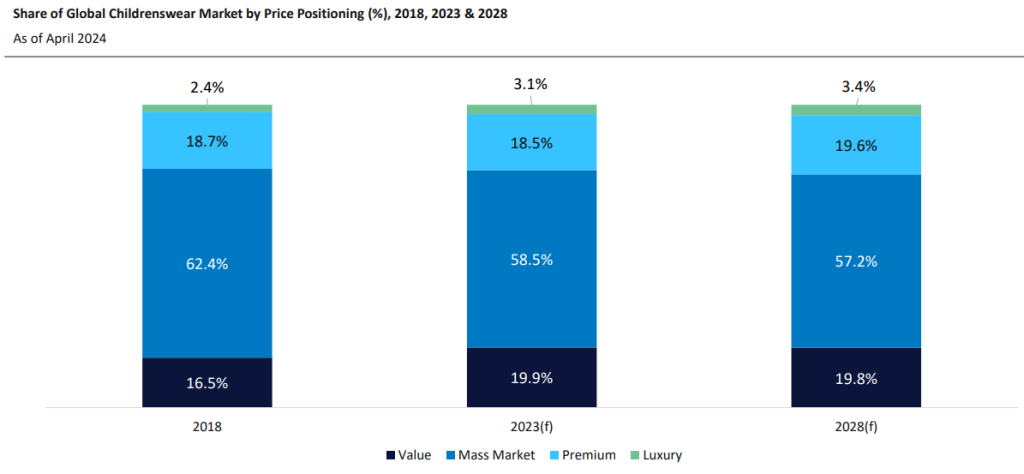

Global childrenswear market by price positioning 2018, 2023 and 2028

The Global Children’s Market to 2028 report by GlobalData observed that following strong growth between 2018 and 2023, the value share of the childrenswear market is expected to stabilise by 2028 as inflation softens and middle-class populations develop in emerging markets.

The report further indicated that although growth is expected to accelerate in the coming years as inflationary pressures ease, the demand for childrenswear will continue to be affected by shrinking family sizes.

Therefore, the childrenswear market is projected to grow at a slower pace with a compound annual growth rate (CAGR) of 2.4% to reach $225.6bn between 2023 and 2028, which is slower than womenswear and menswear, due to declining birth rates.