In contrast, consumers in European countries Belgium, Germany, the Netherlands, Sweden and the UK were the least willing in the world to pay for more sustainable and inclusive brands.

The researchers further revealed that consumers from countries including China, South Africa and Thailand had the highest willingness to pay for exclusive, on-trend brands.

The research examined consumer willingness to pay across various demographics, analysing responses from 24,798 individuals across 20 countries and Hong Kong. The study focused on two types of brands: those that aim for sustainability and inclusivity, and those positioned as exclusive and on-trend.

Is sustainability just a buzzword in fashion?

According to GlobalData's Global Apparel Market to 2028 report, while sustainability and ethics are trending in the fashion industry, only 45.4% and 43.5% of consumers within key markets stated that product sustainability and retailer ethics, respectively, always or often impact their apparel purchases. These factors rank far behind value for money, price and quality for consumers.

However, concern around sustainability and ethics rises to almost half among consumers under 35, suggesting these themes will become more important over time.

Investors and legislators are increasingly demanding that fashion brands improve transparency regarding their supply chain impact and increase their sustainability efforts.

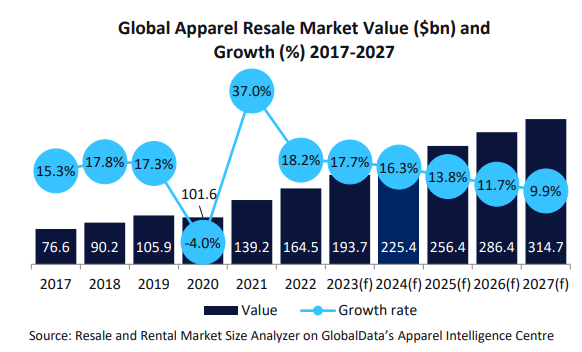

GlobalData's apparel data reveals that the resale market for apparel has grown "tremendously" in recent years, driven primarily by financial and sustainable motivations.

Between 2023 and 2027, the resale market is expected to grow by 56.1% as sustainability concerns rise and more players enter the market, making secondhand apparel more desirable to consumers.

Apparel shoppers concerned about sustainability, ethic but deprioritise to save money

A GlobalData survey conducted in December 2023 across Germany, France, Spain, Italy, China and the US found apparel shoppers prioritise sustainability and ethics far less than factors such as price, quality and value for money, especially during the ongoing economic crisis.

GlobalData apparel analyst Pippa Stephens noted that despite this 60.2% of consumers still worry about the industry’s environmental impact, and 62.8% are avoiding fast fashion as a result.

This highlights the need for apparel brands to focus on the environmental and ethical impact of their practices to maintain strong consumer perceptions.

When asked about sustainable actions taken in the past year, donating items to charity or thrift shops was the most common task, with 41.3% of respondents doing this. It was most popular in the US, with 55.7% participation, due to the large number of thrift shops in the country.

This was followed by selling and buying secondhand items, done by 27.1% and 26.2% of respondents, respectively.

Buying secondhand apparel was most popular among shoppers in the US and France, with 34.1% of respondents in both countries, driven more by financial considerations than sustainability.