A new report suggests the global wellness market is estimated at over $1.8tn and is growing 5% to 10% annually. The report by McKinsey & Co explains health and wellness products and services have seen "high demand" in advanced economies over recent years.

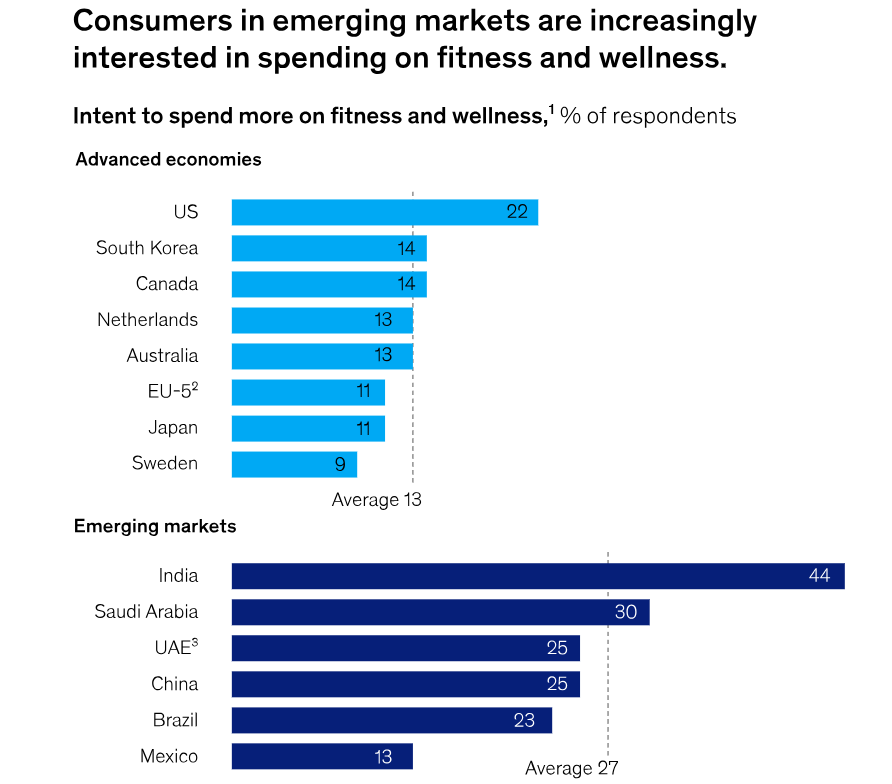

It notes these categories are also snowballing in emerging markets with the intent to spend on health and wellness products often outpacing that in advanced markets.

In emerging markets such as China, India, and the Middle East, the percentage of consumers who intend to increase their spending on wellness products and services is two to three times higher than in advanced markets such as Canada and the US.

McKinsey's research indicates that not only Gen Z and millennials but also Gen X and baby boomers are driving growth in this sector. For example, almost two thirds (63%) of baby boomers in China intend to spend more on fitness, compared to only 4% in India.

Consumers prioritise health, fitness and value for money

GlobalData's Global sportswear market to 2027 report showed that despite a slowed growth in 2023 due to high inflation in Europe and North America, the sportswear market continued to outperform the total apparel market.

This was attributed to the versatility and comfort of athleisure items, which remained highly desirable as consumers prioritised value for money, health and fitness and wanting to try out new sports.

The report identified health and wellness as key drivers of the global sportswear market, noting an increased focus on fitness and physical activity. The continued engagement in exercise and outdoor activities is expected to boost demand for sportswear items.

It also highlighted an opportunity to tap into consumers' desire to try out new types of sports.

This gives sportswear brands the chance to innovate and introduce materials and technologies that meet the evolving needs of consumers who prioritise both performance and style in their pursuit of a more active lifestyle.

Between 2022 and 2027, the global sportswear market is projected to grow at a CAGR of 5.9%, with the Asia-Pacific region leading at a CAGR of 8.6%. GlobalData believes this will lead to an increase in the region's market share from 31.2% in 2022 to 35.4% in 2027, driven by its large emerging middle class embracing global trends like streetwear and athleisure.