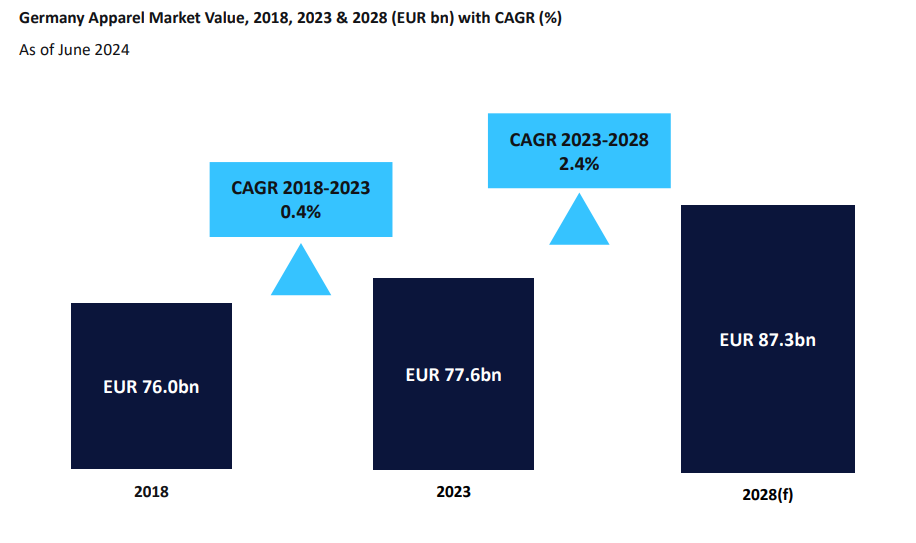

According to ‘The Apparel Market in Germany to 2028‘ report, the German apparel market surpassed past pre-pandemic levels in 2023, growing 4.1% year-on-year to €77.6bn ($85.68bn).

However, persistently high inflation limited potential, as consumers cut back on non-essential spending. Growth was primarily price-driven, with volumes only growing 0.4%, remaining 3.5% below 2019 levels.

The report expects total growth to be slightly softer in 2024 compared to 2023, at 3.2%, though volumes will perform better, growing by 1.1%, as inflation softens.

Moreover, growth in the German market is forecasted to remain subdued until 2028, as consumers continue to move towards secondhand and consider their purchases more carefully, increasingly preferring long-lasting capsule wardrobe pieces.

Between 2023 and 2028, the market is forecast to grow at a CAGR of 2.4%, reaching €87.3bn by 2028. Volumes are expected to return to pre-pandemic levels by 2028.

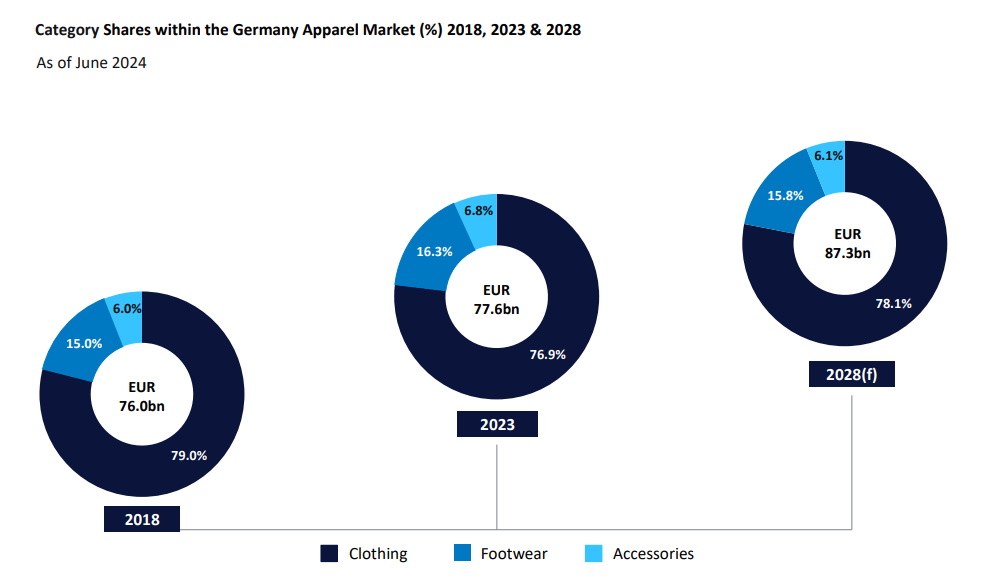

Clothing will record the highest sales by category

The report also highlighteds clothing is set to experience the "strongest" growth out of clothing, footwear and accessories between 2023 and 2028, with sales rising 14.2% to €68.2bn.

However, the report adds this is mainly due to normalisation after a weak few years, with clothing only just returning to 2019 levels in 2023.

Its market share is expected to remain 0.9ppts smaller than in 2018, at 78.1%, because it is easier for consumers to cut back on volumes within this category during the ongoing cost-of-living crisis.

Conversely, footwear's market share is expected to drop by 0.5ppts to 15.8% between 2023 and 2028, as the established trainer market limits new consumer purchases. Despite this, the sector will grow by 9.3% to reach €13.8bn, remaining well above 2018 levels.

Meanwhile, the accessories sector is forecasted to see the weakest growth, at just 1.0%, with its market share nearly returning to 2018 levels due to lower consumer demand and a softening luxury market.

Additionally, Germany’s population is expected to grow slightly until 2026, before declining in 2027 and 2028 due to falling birth rates, according to GlobalData.