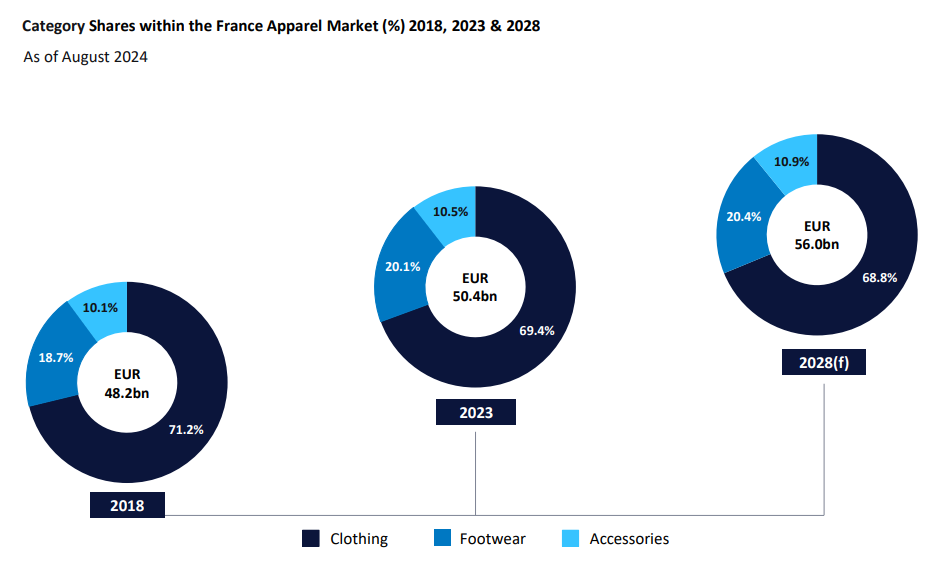

According to GlobalData's 'The Apparel Market in France to 2028' report, clothing is set to be the weakest category among accessories, footwear, and clothing, with a projected CAGR of 1.9% from 2023 to 2028, and its market share falling by 0.6 percentage points to 68.8%.

This decline is attributed to many consumers' reduced interest in keeping up with rapidly changing fashion trends due to financial and environmental concerns.

In contrast, accessories are anticipated to see the strongest growth with a 2.8% CAGR, reaching €6.1bn ($6.73bn) by 2028, driven by the resilience of the luxury market, where ultra-wealthy shoppers are less impacted by inflation.

Similarly, the footwear market is expected to grow at a 2.4% CAGR between 2023 and 2028, with its market share projected to rise by 0.3ppts to 20.4%.

GlobalData explained that this growth is driven by the continued popularity of trainers, which offer superior comfort and versatility, aligning with consumers' prioritisation of value for money.

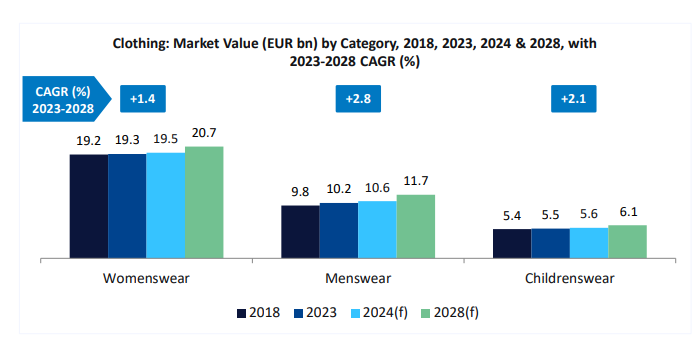

Womenswear category set to grow slowest

The report also highlighted that womenswear will experience much slower growth between now and 2028, with an anticipated CAGR of just 1.4%, as French women increasingly prioritise the quality and versatility of their purchases over buying high volumes.

Menswear is expected to lead within the clothing market with a 2.8% CAGR, fueled by a growing interest in fashion, especially within sportswear and streetwear.

This will be followed by childrenswear, which is forecast to grow at 2.1%, supported by its essential nature, as items need to be frequently replaced due to growth spurts and wear and tear.

Recently, non-food shop prices in the UK saw deeper deflation in September with significant reductions in categories like clothing and furniture driving overall shop prices down to their lowest rate since August 2021.