The BRC's chief executive Helen Dickinson explained UK retail sales of weather-sensitive categories such as clothing and footwear were hit particularly hard in June, especially compared to the surge in spend during last year's heatwave.

However, she added retailers remain hopeful that as the summer social season gets into "full swing" and the "weather improves," sales will follow suit.

Key data from 25 May - 29 June 2024

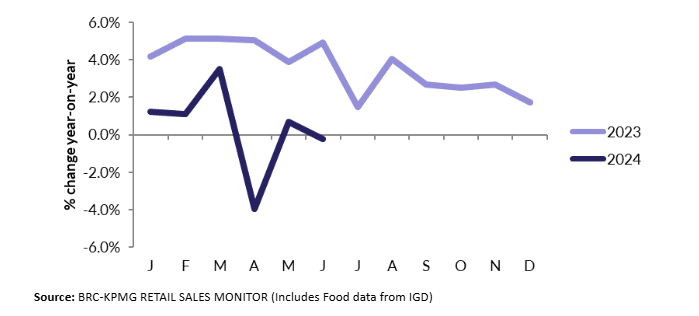

- UK total retail sales decreased by 0.2% year on year in June, against a growth of 4.9% in June 2023. This was above the three-month average decline of 1.1% and below the 12-month average growth of 1.5%

- Non-food sales decreased 2.9% year on year over the three months to June, against a growth of 0.3% in June 2023. This is steeper than the 12-month average decline of 1.9%. For June, non-food was in decline year-on-year.

- In-store non-food sales over the three months to June decreased 3.7% year on year, against a growth of 2.0% in June 2023. This is below the 12-month average decline of 1.5%

- Online non-food sales decreased by 0.7% year on year in June, against an average decline of 1.0% in June 2023. This was above the three-month and 12-month average declines of 1.5% and 2.6% respectively

- Online penetration rate (the proportion of non-food items bought online) increased to 36.2% in June from 35.2% in June 2023. This was the same as the 12-month average of 36.2%.

Retail hopes new government will boost economy, sales

According to Linda Ellett, UK head of consumer, retail & leisure at KPMG, the exhausted retailers who have leveraged all levers to cut costs and drive sales via promotions will be looking to the new UK government to boost the economy and confidence.

Ellet said: "Despite pressure on household finances easing, with petrol and energy costs and shop price inflation all continuing to fall, consumers remain incredibly reluctant to take the brakes off of their spending. The stimulus of good weather, Wimbledon and Euro 24, which was hoped would drive consumer spending, has so far failed to materialise and financial concerns remain with many households.

"The overall economic conditions may slowly be improving, but the health of the sector remains fragile, and action is needed now to help support this vital economic contributor – particularly around neglected areas such as business rate reform."

Sarah Bradbury, CEO of IGD, anticipates a boost in consumer confidence now the election is over.

She noted that the industry experienced an increase in shopper confidence immediately after the last three general elections. As a result, she expects a similar trend to occur as we move through July.

BRC's retail sales data shows year-on-year decline in retail sales between 2023 and 2024

Bradbury highlighted: "It is also worth keeping in mind that although value and volume growth is lower compared to last month’s performance, the market is annualising against significant growth that occurred in June 2023."

Retail expectations for July and August

Research analyst Clive Black from Shore Capital pointed out that a "clement" July and August would be a "notable tailwind" for the UK retail trade against the now favourable comparatives of summer 2023.

He said: "Investment and reform are welcome too in the early days of the new regime, albeit making such comments are easy at this stage, and it will be the actions that determine the economic outcomes.

"The commitment to housebuilding by the new government bodes very well in due course for the bathroom, carpet, furniture, and kitchen trade in the UK. Ahead of that there is much that can be focused upon to make business more productive and rewarding and to turn rising UK real living standards and better consumer confidence into actual expenditure. Maybe by the end of September a base rate cut, or two, will be the spark for the non-food trade to be experiencing better demand against favourite comparatives."