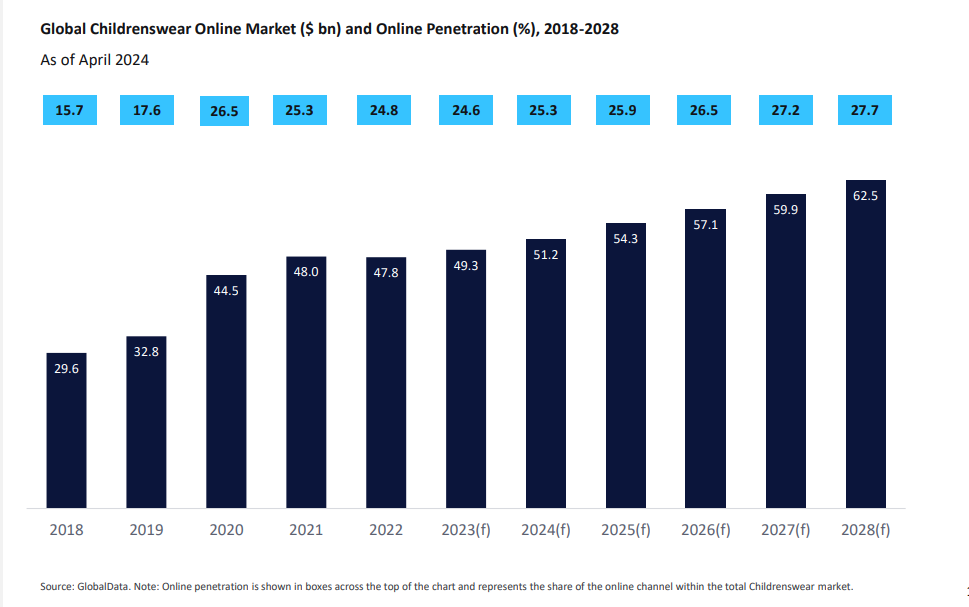

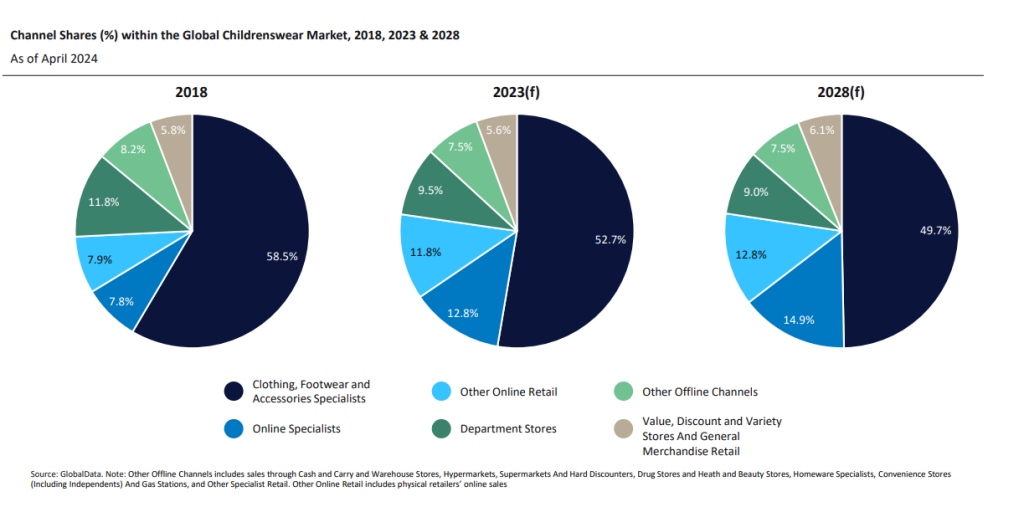

The global childrenswear market is witnessing a shift towards online channels, but the sector's digital transformation still trails behind its counterparts in menswear and womenswear, according to a GlobalData report titled: “Global Childrenswear Market to 2028.”

However, the future looks promising for the online childrenswear market. The report forecasts a 4.0% growth in 2024 and a compound annual growth rate (CAGR) of 4.9% between 2023 and 2028, with the market expected to reach $62.5bn and a penetration of 27.7%.

GlobalData said this growth will be driven by the increasing digitalisation of less developed markets and the entry of more valuable childrenswear brands into the online space.

What is hindering the growth of the online childrenswear market?

While the COVID-19 pandemic provided a significant boost to the online childrenswear market, its overall penetration remains relatively low.

In 2023, the online segment grew by 2.9%, but its penetration stepped back by 0.2 percentage points to 24.6%, as consumers returned to in-store shopping, particularly those who preferred to see items in person before making a purchase.

The report cites several key factors contributing to the slower online adoption in the childrenswear market. Firstly, major value players like Primark and Pepco have a limited online presence, and supermarkets like Tesco and Walmart continue to dominate the offline space. Additionally, the importance of accurate sizing for children's clothing, as they quickly outgrow their garments, presents a challenge for online shopping.

Brands are expected to invest more in advanced technologies to offer a seamless shopping experience, catering to the evolving needs of consumers.

The report also highlights that online specialists will continue to outperform multichannel players in the long term, thanks to their superior digital capabilities.