Reinhart stated in the ThredUp 2023 Impact Report: "By making it easy to buy and sell second-hand, we've extended the life cycle of millions of garments—200 million to be exact."

This achievement has resulted in significant environmental savings, including the reduction of 791.1 million pounds of Carbon Dioxide Equivalents, 8.4 billion gallons of water, and 1.6 billion kilowatt hours (kWh) of energy from the fashion supply chain as of December 2023.

A key highlight of the report is ThredUp's Resale-as-a-Service (RaaS) business, which recirculated 2.2 million second-hand items through partnerships with 47 major brands, including Zara, Old Navy, J CREW and American Eagle. The RaaS programme increased 42% from the previous year, with 680,000 Clean Out Kits received in 2023.

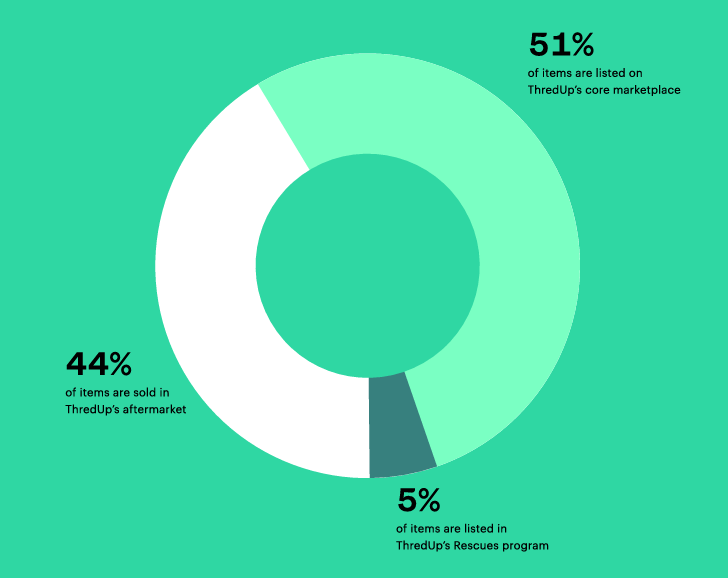

ThredUp diverts 100% of items not resold to Rescues and Aftermarket programmes

Through its Rescues programme, customers can purchase heavily discounted bundles of second-hand items.

“This is our way of saving items we receive that don’t qualify for listing on our marketplace but still have a lot of life left in them,” explained the report.

The Rescues Programme alone saved 1.1 million items from landfills in 2023, contributing to a total of 5.5 million "rescued" items to date.

Source: ThredUp 2023 Impact Report

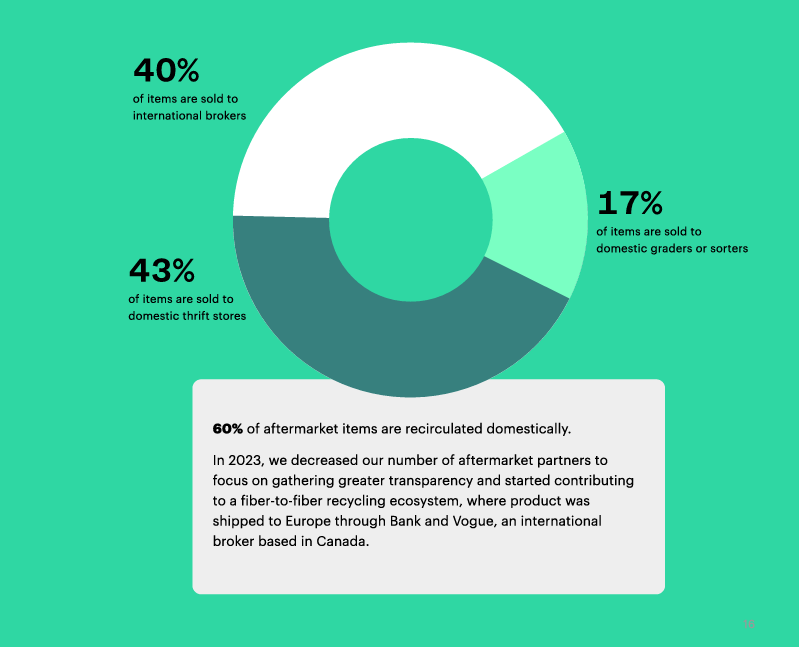

When the items ThredUp receive do not meet its quality standards for resale or inclusion in the Rescue programme, the company work with a vetted network of partners to keep as many items as possible in use and out of the landfill.

All of the aftermarket partners must adhere to ThredUp’s Aftermarket Partner Code of Conduct—requiring transparency, integrity, awareness of environmental impact, and respect for developing nations.

ThredUp says 40% of items were sold to international brokers and 17% of items were sold to domestic graders or sorters in 2023. 60% of aftermarket items were recirculated domestically after the company decided to decrease the number of aftermarket partners that year to focus on gathering greater transparency and contributing to fibre-fibre recycling ecosystems.

Source: ThredUp 2023 Impact Report

Scope 3 emissions make up 91% of ThredUp’s overall impact and the biggest contributing factors are purchased goods and services (30%), upstream transport (25%) and capital goods (21%).

“We know that this is our biggest area of carbon impact and are eager to find more ways to make our Scope 3 activities more efficient in order to reduce our emissions,” the company explained.

ThredUp saw progress in its owned operations as 2023 marked the first full year that its recently established distribution centre in Lancaster, Tex. was operational, employing some of the firm’s “most advanced technological advancements” and building upon years of learnings about how to create a “best-in-class infrastructure for single-SKU apparel,” the group wrote.

A multi-level garment storage system provides 25% higher storage density at the facility while consuming 40% less energy.

The group highlighted its shift into an advocacy role for the textile and apparel industry. Last year, ThredUp became a founding member of American Circular Textiles (ACT), a coalition spearheaded by the Circular Services Group that includes brands, innovators, recyclers, and marketplaces advocating for circular policies. The coalition released a white paper titled The United States’ Opportunity for Circular Fashion, which discussed ways to expand reuse and recycling efforts.