Global jobs across the fashion industry have gradually fallen over the three months to September with active jobs at 39,828 for June, 36,066 for July and 32,836 for August according to GlobalData’s jobs database. But by 1 September, active jobs had fallen to their lowest during the period — 27,118.

During the period, all job types within fashion saw a fall in active jobs with the Internet of Things and Robotics experiencing the biggest plunge when it came to job hirings, falling 24 and 23% respectively year on year. Jobs in artificial intelligence and deal-making saw more modest falls of 10% and 5%.

In terms of specific occupation transportation, storage and distribution managers saw an 80% drop in active jobs and sewing machine operators saw a drop of 66%.

Active jobs fall between June and September

Source: GlobalData

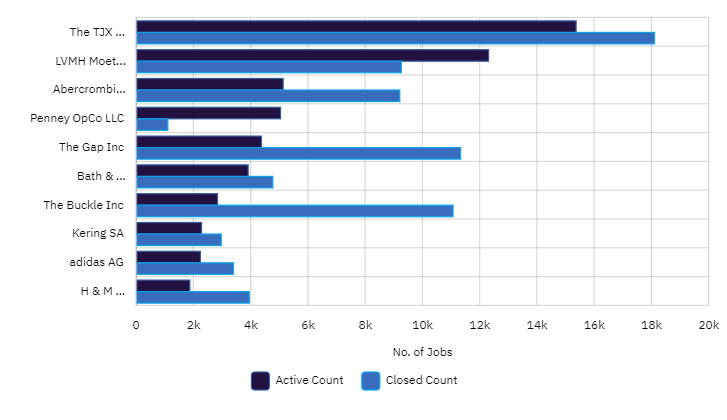

Company-wise, The TJX company had the largest number of active jobs in the sector at 15,350 during the period. But, it also had the highest number of closed jobs at 18,090. This was followed by LVMH Moet Hennessy with 12,291 active jobs and then Abercrombie and Fitch at a more modest 5,114 active jobs.

TJX, LVMH, Abercrombie & Fitch had most jobs between June and September

Source: GlobalData

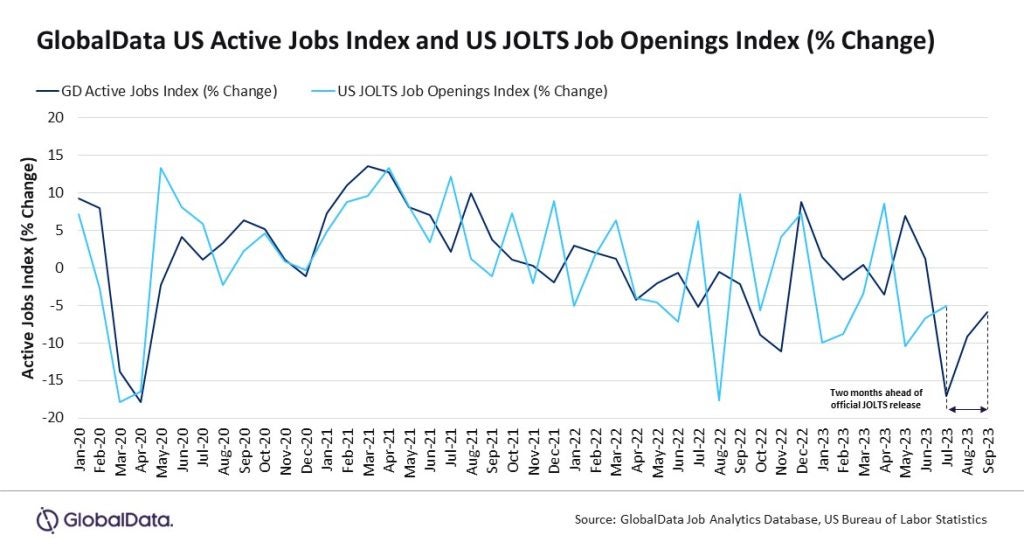

Active US jobs decline in September

GlobalData’s US Active Jobs Index details similar findings for jobs overall during the month of September, which reveals a 12% month-on-month decline.

GlobalData business fundamentals analyst Sherla Sriprada comments: “Post the gradual recovery of the US markets from the impact of Covid in 2021 and 2022, there is a significant fluctuation in hiring during 2023. While there is a deceleration in the recent months, there are exceptions such as the transport and logistics sector with a surge in job postings.”

Earlier this month, the US National Retail Federation’s chief economist, Jack Kleinhenz said the US economy is making a recovery but recent data shows a noticeable slowdown in its momentum.

Meanwhile, in terms of employment, the US economy added 187,000 jobs in August, a slight improvement from the 157,000 recorded in July but significantly below the average monthly gain of 271,000 over the past year.

Consequently, the unemployment rate increased by 0.3 points to reach 3.8% in August, driven by a surge in job seekers. Wages and salaries exhibited a growth rate of 0.4% month-over-month in July, down from the 0.6% reported in June.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.