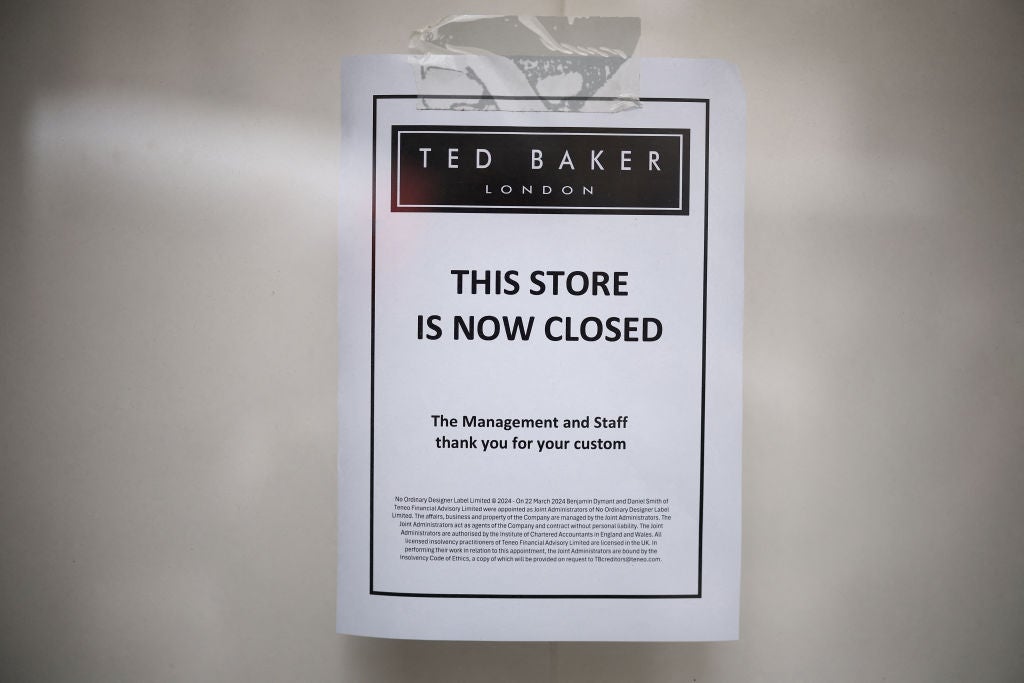

The closure of Ted Baker's final UK stores marks the end of an era for the British high street fashion retailer. Ted Baker's departure leaves a gap in the UK market, but as one door closes, others may open.

Just Style delves into the aftermath of the brand's downfall and explores who might benefit as well as what the future might hold for the brand in the digital realm.

Who stands to gain from Ted Baker's fall?

In the wake of Ted Baker's closure, a select group of retailers are well-positioned to capture its former customer base. GlobalData senior apparel analyst Pippa Stephens identifies premium fashion players like Reiss, Whistles, and Phase Eight as the most likely beneficiaries.

These brands she says offer similar formal collections and cater to a comparable customer demographic, making them natural alternatives for Ted Baker's displaced shoppers.

Clive Black, vice chairman of Shore Capital cites "aspirational, mid-to-high ticket competitors, chain and independent" as likely beneficiaries. Specifically, he mentions brands like Flannels, Fred Perry, and Ralph Lauren Polo as potential winners in this scenario.

Reports were circulating that UK fashion conglomerate Frasers Group was in talks to acquire Ted Baker's UK and Europe retail and online business so it would've been the most likely winner if a deal had taken place.

Reports in news publication The Guardian suggest these talks fell through with Frasers Group, Ted Baker's administrator Teneo Financial Advisory Limited and owner Authentic Brands Group all declining Just Style's request for comment.

The future opportunities extend beyond Ted Baker's direct competitors as retailers who have successfully adapted to the casualwear trend could also see an uptick in customers.

GlobalData retail analyst Neil Saunders sees the Paul Smith brand benefiting from Ted Baker’s fall, but he also hints at more mainstream players like Zara, Crew Clothing and Next-owned Joules as possible contenders to “pick up a little share” in select areas.

While Ted Baker's exit from the UK market is undoubtedly significant, Black notes that its impact may be less dramatic than one might expect. "Ted is now small in the UK as it has been in retreat for some time. Hence, the closure of the last batch of stores will be a relatively modest exercise," he explains.

Black also suggests that much of the gap left by Ted Baker has already been filled during its long decline. Still, he advises retailers to consider what initially attracted shoppers to Ted Baker, as there may be lessons to learn from the brand's earlier success.

Key lessons for the industry from Ted Baker's demise

"Brands are hard built and easily destroyed," says Black.

He emphasises the importance of ethical behaviour and customer-centricity in retail success. His advice for other retailers is clear: "Behave properly all the time, remain humble, and always consider one's customers as the priority." This approach, he suggests, is key to avoiding Ted Baker's fate.

To Saunders, the brand’s decline was not overnight but instead a long downfall due to “a lot of missteps and a failure to breathe new life into the brand.”

He suggests the key lessons for brands is to keep innovating and changing in response to market conditions, whilst ensuring proper business funding and a stable operating environment.

“Ted Baker’s demise was hastened because it didn’t have those things in place,” he adds.

Where did it all go wrong for Ted Baker?

Stephens believes Ted Baker's inability to effectively pivot its business model during the pandemic was a huge contributing factor. She says the closure of its UK stores was “a long time coming” due to its product offering having significantly lost relevance among consumers.

Ted Baker's exit from the UK high street isn't just a story of one brand's misfortune; it reflects broader changes in consumer behaviour and the challenges facing traditional retail.

The brand's heavy focus on formalwear and occasionwear became its liability in an era where casual apparel has reigned supreme. Stephens is keen to add that Ted Baker's signature heavily patterned designs and distinct product handwriting “fell out of favour” with the growing consumer preference for minimalistic styles and versatile capsule wardrobes.

She suggests this misalignment with consumer taste and a perceived mismatch between price points and quality, led to a spiral of discounting that further eroded the brand's premium positioning.

This was coupled by a series of financial challenges for the brand in the last few years, which saw Teneo appointed as the administrator of NODL, licencing the brand from Authentic in the UK and Ireland.

However, Ted Baker's troubles didn't begin with changing fashion trends or economic headwinds. According to Black, the brand's decline can be traced back to a critical misstep in corporate governance.

"Ted shot itself in the foot with a high-profile internal misdemeanour from which, reputationally, especially amongst women, it never recovered," he explains.

Black is referring to the founder and former CEO Ray Kelvin being accused of “forced hugging” in December 2018, as well as other alleged inappropriate comments and behaviour. A petition by employees that demanded an end to so-called harassment at Ted Baker garnered over 2,500 signatures and prompted Kelvin to take a voluntary leave and step down in March 2019.

However, Saunders says despite many missed opportunities to revive its brand image no amount of looking back will help Ted Baker now: “All of these are water under the bridge,” he adds.

The future of Ted Baker as an online pureplay

Primarily being a British brand, Saunders sees the disappearance of Ted Baker’s UK operation as leaving a big question mark over how the rest of its business moves forward and impacts the ability to operate at scale elsewhere.

Black adds: “It is wholly unhelpful to disappear in the homeland, the market that created and conditions the brand, so the international side of Ted needs this week’s news like a hole in the head.”

Attention turns to its future as a potential online-only brand. As Black notes: "It remains to be seen if the brand hangs around as an online play in someone else's wider ecosystem or disappears altogether."

Strategic partnerships, like the existing arrangement with Next for childrenswear and lingerie, could play a role in Ted Baker's digital future.

However, as Stephens cautions the brand must address the issues that led to its downfall particularly in “modernising and elevating the designs of these products to help reverse shopper perceptions” whilst rebuilding its “damaged brand image” in international and licensing divisions.

She points out Ted Baker will need to justify its premium pricing in the online space, ensuring that product quality and design warrant higher price points without resorting to the aggressive discounting that plagued its recent history.

While some brands stand to benefit from Ted Baker's exit, the broader message for the fashion industry is clear: staying relevant, adapting to consumer trends and maintaining a strong brand identity are not just advantageous – they are the very essence of survival in an already overcrowded marketplace.