Ted Baker has been struggling for some time, officially falling into administration on 22 March. Since then, 25 head office roles have been cut and 11 UK stores have closed, resulting in the loss of around 120 store jobs.

The company's website touts its "very clear, unswerving, focus on quality, attention to detail and quirky sense of humour".

However, a catalogue of things have gone wrong for the Ted Baker brand, including a CEO controversy, reneged financial commitments, and a shift in consumer purchasing preferences. So far, it would seem that its dedication to quality, detail and humour haven't been enough.

Things start to go wrong

The company’s difficulties began in December 2018, when founder and former CEO Ray Kelvin was accused of “forced hugging”, as well as other inappropriate comments and behaviour. A resulting petition that was launched by an employee on campaign site Organise to “scrap the forced 'hugs' and end harassment at Ted Baker” garnered over 2,500 public signatures and prompted Kelvin to take a voluntary leave of absence. He officially stepped down in March 2019.

Of this episode, GlobalData retail analyst Neil Saunders tells Just Style: “The brand lost much of its oomph and innovation when founder Ray Kelvin left the business, and it has struggled to regain its position as an interesting fashion brand.”

Since then, Ted Baker has been what Saunders describes as “a brand in decline”. Lindsey Page was appointed in April 2019 to steady the ship but resigned in December 2019 alongside brand chairman David Bernstein after its fourth profit warning was announced in twelve months.

The next CEO, Rachel Osbourne, was appointed in March 2020, but she faced fresh obstacles. Saunders explains that “mini-crises, like the shift to more casual styles, have hit Ted Baker, as has the general slowdown in apparel spending.”

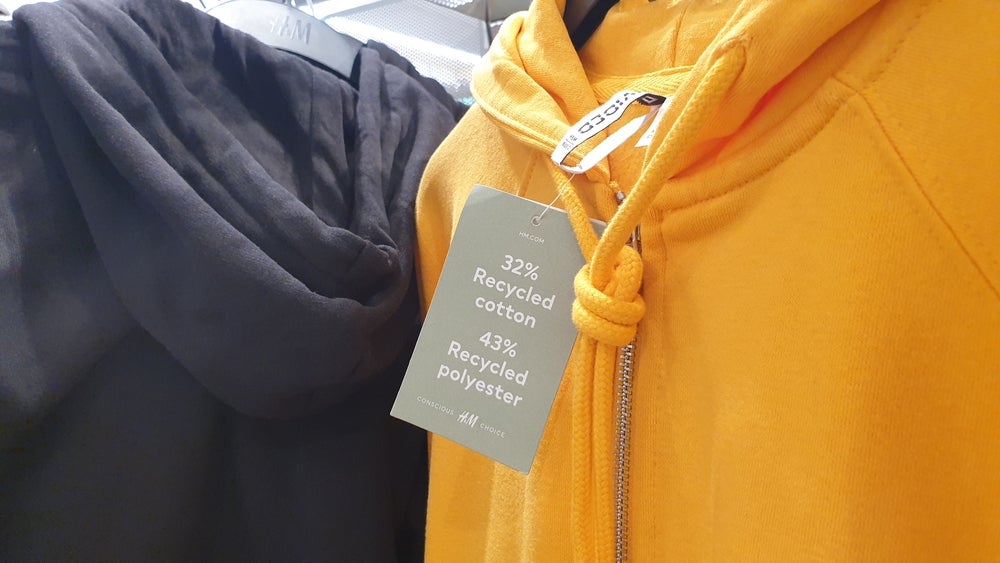

The pandemic caused a rapid shift in purchasing habits, and the pendulum swung the wrong way for Ted Baker, a brand reputed for its sophisticated and professional styles. The normalisation of at-home working catalysed an already-emerging casualisation trend, and inflation saw consumers reduce non-essential spending.

In May 2022, GlobalData’s UK monthly consumer views survey identified that 71.9% of respondents preferred to buy more multifunctional apparel than they did before the pandemic, whilst 65.4% felt that their style had become more casual.

Ted Baker and ABG: acquisition, administration

In October 2022, Ted Baker was acquired by Authentic Brands Group (ABG) for £211m (US$253.5m). The group owns Reebok, Eddie Bauer, Forever21. It also has a majority stake in David Beckham’s brand and has acquired the rights to manage Shaquille O’Neal’s name in merchandise and endorsements. With its extensive portfolio, it was hoped that ABG would steady the company’s shaky course.

ABG is a licensing business, appointing partners to manage parts of the business while retaining ownership and approval rights. In Ted Baker’s case, the group appointed Dutch company AARC in April 2023 to run the brand’s European stores and e-commerce business. However, by February 2024, Authentic had cut ties after AARC reneged on its financial commitments.

Saunders comments: “The latest round of trouble has arisen because, in Europe, the brand has not been properly funded by those licensing it. This has created a host of unfavourable financial issues.”

AARC failed to make the investments agreed upon when it signed the operating contract with ABG, and the promised cash injection never came, leaving Ted Baker struggling in an already difficult retail environment.

In March 2024 (post-AARC), No Ordinary Designer Label (NODL) – which trades under the Ted Baker brand – worked with independent director Russell Downs to place the UK and European retail and e-commerce businesses into administration under Teneo.

While it is hoped that this might mark the end of a rocky road, administration has already brought a series of closures and job losses. UK stores in Birmingham Bullring, Bristol, Bromley, Cambridge, Exeter, Leeds, Liverpool One, London Bridge, Milton Keynes, Nottingham and Oxford have already ceased trading. Further uncertainty about stores in the Netherlands, Belgium and Spain mean 149 European jobs are also at risk of redundancy.

Looking forward, Saunders suggests that, to avoid anything else going wrong, Ted Baker “needs stability and a firm partner who can run the business for Authentic Brands in the UK and in other markets. It then needs an injection of capital to ensure that operations can keep running”.

He adds: “Once those steps have been taken, much comes down to designs and ranges. Here a tired brand needs to be transformed into one that is relevant again. This is arguably the most difficult step as it involves a lot of art and science to make it happen.”

Ted Baker will need to avoid this “tired” image, particularly within the polarisation of apparel where both high-end luxury and value brands are doing well but Ted Baker's mass middle ground is being squeezed.

For example, Louis Vuitton owner LVMH and Hugo Boss grew by 8.8% and 15.0% respectively in FY2023 and at the other end of the spectrum ultra-fast fashion value brand Shein saw unprecedented growth.

GlobalData's Casualwear in Apparel Industry report predicts this trend will consolidate throughout 2024, but warned that “many mass-market brands continue to lose shoppers.”

“The fact Authentic Brands Group and [independent director] Russell Downs will want Ted Baker to be a success lends itself to a solution being found. However, while it is likely Ted Baker will survive in one form or another, it is hard to see it getting back to its glory days,” concludes Saunders.