US Trade Representative Katherine Tai explained: “After a thorough review of the statutory report on Section 301 tariffs, and having considered my advice, President Biden is directing me to take further action to encourage the elimination of the People’s Republic of China’s unfair technology transfer-related policies and practices that continue to burden US commerce and harm American workers and businesses.”

Modifications were taken on several products while existing tariffs on all others - including finished apparel and textiles - were maintained.

“In light of President Biden’s direction, I will be proposing modifications to the China tariffs under Section 301 to confront the PRC’s unfair policies and practices,” said Tai.

“From the beginning of the Biden-Harris Administration, I have been committed to using every lever of my office to promote American jobs and investments, and these recommendations are no different. Today, we serve our statutory goal to stop the PRC’s harmful technology transfer-related acts, policies, and practices, including its cyber intrusions and cyber theft. I take this charge seriously, and I will continue to work with my partners across sectors to ensure any action complements the Biden-Harris Administration’s efforts to expand opportunities for American workers and manufacturers.”

Why are there tariffs on fashion imports from China?

Back in 2019, the Trump Administration announced an additional 10% tariff would be imposed on 300bn worth of US imports from China – including all textiles, apparel and footwear.

The proposed tariffs would affect $36bn worth of textiles, apparel and home textiles.

The tit-for-tat trade war between the US and China was instigated by a Section 301 investigation into China’s acts, policies, and practices related to technology transfer, intellectual property and innovation. Punitive tariffs were first introduced on US imports from China in July 2018.

Then in December 2019, the US reached a ‘Phase One’ trade agreement with China.

As part of the deal, the Trump administration said the 15% punitive tariffs on Tranche 4A products (which includes textile and apparel) would be reduced to 7.5% around 30 days after the signing of the agreement. It was officially signed on 15 January 2020, meaning the 15% punitive tariffs on Tranche 4A products were reduced to 7.5% from 14 February 2020.

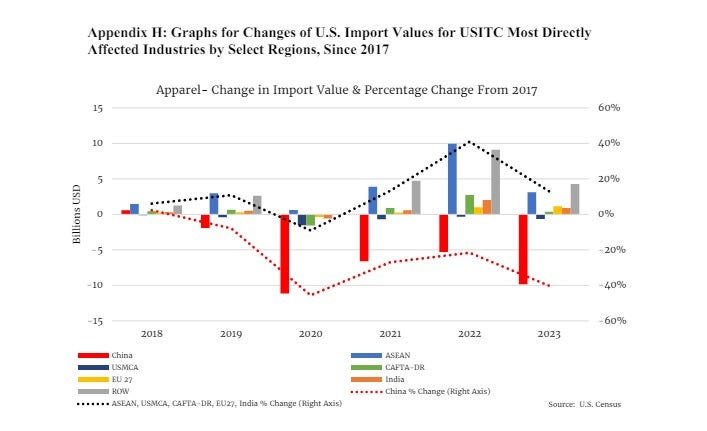

However, according to data published by the USTR citing US Census as a source, the tariffs haven’t done much to deter imports from China. In fact, while apparel imports sank in 2019 from growth between 2017 and 2018, they gradually increased until 2023, when global apparel imports experienced negative growth in 2022.

In 2022 it was announced a review of the tariffs would take place.

Retail and apparel industries react to tariff retention

But the news has been met with outrage from retail, apparel and textile sector trade bodies which say the tariffs cause more harm to American companies and consumers.

“Americans for Free Trade is extremely disappointed by the Biden administration’s decision to maintain the harmful Section 301 China tariffs on many non-strategic products, including consumer goods, to the detriment of American workers, consumers and businesses. The tariffs have been a failed policy attempt to change China’s behaviour. USTR and the administration must find alternative solutions to address the ongoing issues with China but also provide more opportunities for American companies to shift their supply chains," Americans for Free Trade said in a statement.

“Throughout this process, USTR received hundreds of comments from businesses large and small that have been negatively impacted by the tariffs. It is unfortunate that these comments were ignored. Maintaining the tariffs, and even increasing them in some categories, will lead to increased prices and nullify any progress the United States has made to combat inflation.”

Meanwhile, a spokesperson for the US Fashion Industry Association told Just Style it was disappointed the Biden Administration and USTR had chosen to continue to rely on higher tariffs as the only policy to force China to change its trade practices.

“Continuing the 301 tariffs on consumer products such as apparel, footwear, and travel goods raises prices for American families and contributes to inflation. Since the 301 tariffs went into effect, American businesses and consumers have been paid more than $215 billion in higher tariffs – not China.

“We need a new strategy that addresses the core issues and offers real incentives to continue the shift in supply chains away from China. We call on the Biden Administration and Congress to work together to craft a more strategic approach to holding China accountable that does not target US retailers, consumers, and our economy."

The American Apparel and Footwear Association said while the decision to extend the tariffs was not unexpected, it is “a real blow to American consumers and manufacturers alike.”

"Tariffs are regressive taxes that are paid by US importers and US manufacturers and ultimately passed along to US consumers. At a time when hardworking American families are struggling with inflation, continued tariffs on consumer necessities are entirely unwelcome," said AAFA president and CEO Steve Lamar.

"The Biden Administration has had two years to get it right. Unfortunately, they doubled down on a flawed tariff policy, despite the Biden Administration's own acknowledgement that this policy has failed in its goals, and overwhelming public input that supported a different outcome."

While Beth Hughes, vice president of trade argued the Biden Administration has “done nothing to negotiate new trade agreements or improve current trade agreements to make them more competitive.”

Nate Herman, AAFA vice president of policy, added: “It is unclear from the report what the Administration will do with the existing exclusions, which expire in 17-days. Ending this relief rather than making it permanent puts manufacturers and their workers at a significant disadvantage and adds further inflationary pressures.”

When it comes to textiles, however, the National Council of Textiles Organisation (NTCO) observes a different position, believing it is “critical” the administration maintain penalty duties on finished textiles and apparel imports from China and increase tariffs on certain imports of personal protective equipment.

NCTO President and CEO Kim Glas said that was “an appropriate and foundational decision” but adds an opportunity was missed to address China’s continued dominance in the US textile market and to "counter the devastating impact of its predatory and illegal trade practices on domestic textile manufacturers and workers."

In fact, she calls for a hike in tariffs on finished textile and apparel and certain inputs, as the industry is facing severe economic headwinds due to China’s dumping of products on the market that are “flooding the world stage and displacing critical US investments.”

“The flood of under-valued, subsidised and illegal imports from China is undercutting the competitiveness of domestic textile manufacturers, 17 of which have closed in the past several months – including three announcements over the last few days. Furthermore, we need the administration and Congress to immediately close the de minimis loophole that is further undermining all trade enforcement efforts and astonishingly rewarding the Chinese with duty free access to the US market regardless of 301 tariffs.

“While the Section 301 tariffs on finished textile and apparel imports help to partially counter China’s unfair trade advantages, subsidised Chinese textile and apparel inputs, including those made from slave labour in Xinjiang where 20% of global cotton is produced and where man-made fibres like rayon have been tied to forced labour, continue to undermine this vital industry.

“Furthermore, China has been dropping its prices since the tariffs took effect to convince sourcing agents to stay loyal despite the risks. According to US import data, the dollar value per square meter equivalent of textiles and apparel from China fell an astounding 34% over from $1.21 per SME in 2018 to $0.80 for the most recent 12-month period ending March 2024.

“According to the US Department of Commerce, China has increased its textile and apparel shipments to the US by a stunning 20.5% during the first quarter of 2024. Over the same period, our most critical coproduction partners in the United States-Mexico-Canada Agreement (USMCA) and Dominican Republic-Central America- Free Trade Agreement (CAFTA-DR) regions are down 45.2% and 4.6% respectively. The Western Hemisphere is down an incredible 31.9% so far this year. The message is clear: China continues to take Western Hemisphere market share as they flood the world stage directly and indirectly, with subsidised and often illegal exports of textile and apparel products.”