In an industry long defined by its linear take-make-waste model, circularity is a concept that's rapidly gaining traction across the fashion world, promising to change how we approach production, consumption, and waste management.

A report by research firm McKinsey & Company describes circularity as practices that optimise resource use and minimise waste across the entire production and consumption cycle, emphasising sustainability and economic efficiency.

With the government already pushing hard for circularity with regulations like the European Green Deal and extended-producer responsibility, for fashion sourcing managers and supply chain executives, understanding this shift is no longer optional — it's imperative.

How to govern a circular economy

Circularity presents an alternative to a model where every year, McKinsey estimates $2.6tn worth of materials in fast-moving consumer goods (80% of the material value) is thrown away and never recovered.

Unlike the traditional linear model where resources are extracted, used, and discarded, a circular economy keeps resources in use for as long as possible, extracting maximum value before recovering and regenerating products and materials at the end of their service life.

Three key principles govern a circular economy:

- Preserve and enhance natural capital by controlling finite resources and balancing renewable resource flows

- Optimise resource yields by circulating products, components, and materials at their highest utility at all times

- Enhance system effectiveness by eliminating negative externalities like pollution.

As the fashion industry is well-known for its environmental impact, brands have made their own commitments to environmental, social, and governmental (ESG) metrics to create a more sustainable future.

Implementing sustainable circularity in the value-chain

The report explains the main driver of circular fashion and luxury in 2030 will be up to a tenfold increase in recycled, sustainably produced products containing a high share of sustainable fibres.

For fashion brands and their supply chain partners, putting circularity into practice involves rethinking the entire product lifecycle.

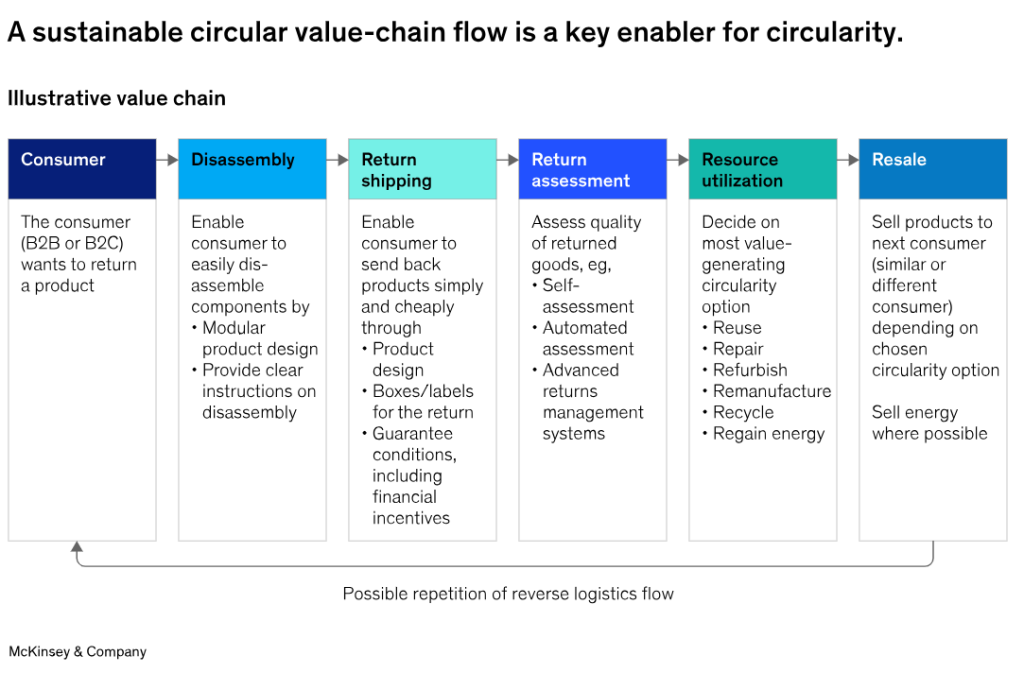

The report highlights the circular value-chain flow which includes disassembly, return shipping, return assessment, resource utilisation, and sale.

Manufacturers can simplify the process by producing modular products with clear instructions. Companies should support consumers by providing clear packaging, financial incentives, and easy return shipping. Companies should then assess the product's condition, choose the most value-generating circularity option, and sell products to the next consumer, depending on their chosen circularity option.

Credit: McKinsey & Company

McKinsey warns that extensive investment and outreach are needed to support each of these steps as getting consumers to change their behaviours is not an easy or inexpensive task.

The research company has devised four steps consumer goods companies should take to pursue a circular business model:

- Portfolio strategy: define where to play. Consumer goods companies should calibrate their portfolios toward segments and categories with the biggest opportunities for circularity

- Green business building: capture new markets. Consumer goods companies have the opportunity to build entirely new businesses around circular products and services. One example is Ireland-based start-up Refurbed, which has built a marketplace for refurbished electronics products

- Green premiums: win in existing markets. Circular products deployed in existing markets can win market share. One big multinational corporation, for example, was able to capture growth on the back of a consumer, performance, and sustainability-driven proposition with a focus on recycling and energy efficiency

- Green operations and supply: enable circular consumer goods. Improving the sustainability of supply chains and operations can make a huge difference in the lifetime value of consumer goods. The Swedish recycling company Renewcell partnered with retailer Beyond Retro to launch a new plant that will recycle 30,000 metric tonnes of textile waste per year.

Technological advancements are a key driver in enabling circular fashion alongside innovations in recycling technologies, particularly for blended fabrics. Developing a robust reverse logistics infrastructure will also be essential for efficiently collecting and processing used garments.

Challenges and opportunities in the circular industry

While the potential benefits of circularity are clear, implementation comes with challenges. These include the need for significant upfront investments, potential short-term productivity drops and the complexity of overhauling established supply chains.

But as McKinsey puts it: “The truth is plain to see: to reduce the massive waste our societies are currently producing, we must drastically slow emissions-heavy productive activity.”

In response, the EU has adopted the Circular Economy Action Plan (CEAP) under the Green Deal, which pledged billions of Euros to net-zero enablers until 2032 alongside the extended producer responsibility, which offers financial incentives to companies looking to transition to circular business models.

Far from being just an environmental imperative, McKinsey estimates that shifting to circular business models could help European consumer goods companies access a value pool worth up to €500bn by 2030.

The macroeconomic environment could however significantly influence regulation and sustainable business models, potentially causing organisations to hesitate to invest in circular business models or drive consumers towards secondary markets.

Fashion brands that successfully transition to circular models stand to gain a significant competitive advantage with one McKinsey study estimating that a circular economy could represent a revenue opportunity of more than $1tn, appealing to increasingly environmentally conscious consumers and potentially accessing new revenue streams through services like repair and resale.