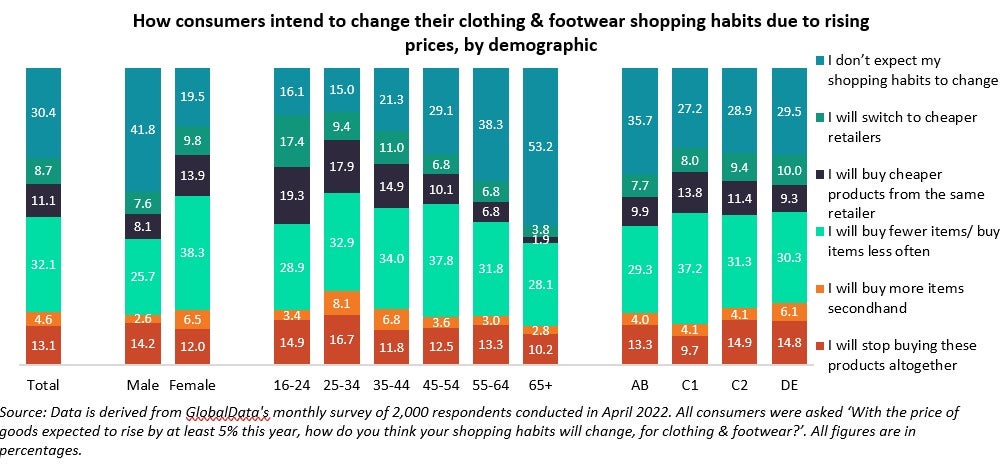

Most UK consumers (69.6%) plan to change their clothing and footwear shopping habits as a result of the ongoing surge in inflation rates and living costs, explains GlobalData’s apparel analyst Pippa Stephens, however clothing brands targeting young females could be hardest hit as discretionary incomes will force them to cut back on non-essential purchases.

Stephens explains young consumers are expected to be the most impacted due to their lower incomes and female shoppers will change their spending habits more than male shoppers, as they generally purchase higher volumes driven by trends rather than a genuine need.

As a result, she predicts that growth in the UK apparel market will be muted this year, with spend remaining 4.3% below 2019 levels.

According to GlobalData’s monthly UK consumer survey conducted in April 2022, a third of UK consumers (32.1%) stated they will buy fewer clothing and footwear items as a result of consumer price inflation and 13.1% of respondents said they will stop purchasing these products altogether.

It also revealed that 8.7% of UK shoppers plan to trade down to cheaper retailers as a result of these economic challenges, which will help value players like Primark and the grocers grow market share, whereas mass market retailers will struggle.

Consumers within the AB social grade, which includes higher and intermediate managerial, administrative and professional occupations, are most likely to maintain their existing shopping habits due to having a higher discretionary spend.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn fact Stephens points that over a third (35.7%) stated they do not expect their habits to change, protecting players operating within the luxury and premium segment.

“While younger consumers usually have the highest spend per head for clothing and footwear, consumers aged 16-44 expect their shopping habits to alter the most. Only 17.5% of consumers within this age group stated that they do not expect to make any changes, compared to 41.5% of over 45s, as those under 25 will likely be students or on lower incomes, and many in the 25-44 bracket will have young families to cater for,” she explains.

She also highlights that older shoppers generally have a greater focus on essentials when it comes to clothing, whereas younger consumers shop more often to keep up with the latest trends and frequently refresh their fashion wardrobes, so they have more purchases they can cut back on now that prices have increased.

Stephens adds: “This will also contribute to the strong disparity between genders, with females typically purchasing higher volumes, meaning that only 19.5% do not plan to change their shopping habits, compared to 41.8% of males.”

As a result of these shifting spending habits, GlobalData now forecasts that though the UK apparel market in 2022 will grow 9.5% on the year due to the Covid lockdowns in early 2021, it will remain 4.3% below 2019 levels.

She concludes: “This is significantly worse than our forecast in January 2022, where the market value was expected to recover to just 1.6% below 2019. Most of the year-on-year growth is being driven by inflation, which is forecast to reach 7.3%, while volumes are only expected to grow by a marginal 2.3%, remaining 9.0% below pre-pandemic levels. A resurgence of travel and events this year will also limit disposable income which is left to spend on apparel, though holidaywear and occasionwear should receive a much needed boost.”