This week’s top apparel-related datasets included a decline in sales across the board at Wolverine Worldwide, and job cuts at sportswear giant Nike, which suggests the previously resilient activewear sector could be starting to struggle.

Declining sales across the board at Wolverine Worldwide

US outdoor and activewear conglomerate Wolverine Worldwide shared results for Q4 2023, revealing a decline in sales across its major brands.

The data showed outdoor brand Merrell’s sales declined by 16.6% to $161.8m, Saucony’s sales decreased by 13.4% to $105.1m, Wolverine brand sales fell by 27.9% to $51.8m and sales at activewear brand Sweaty Betty decreased by 7.6% to $67.3m.

Despite this, the company’s CEO is confident about the potential of its running brand Saucony, telling investors he sees it as “a tremendous opportunity”.

Nike confirms plans to cut 2% of workforce

Also in sportswear this week, Nike confirmed plans to restructure its workforce as it looks to “right-size” the business. Approximately 2% of its team will be impacted. Nike plans to use the capital saved to invest in growth areas, such as running, women’s and its Jordan brand.

The news came shortly after Nike reported flat sales growth of $13.3bn in Q2 and announced plans to create savings by simplifying its product assortment and increasing automation.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn its most recent set of Q2 results, Nike revealed flat sales growth of $13.3bn. Net income increased from $1.33bn to $1.58bn, an increase of 19% compared to the same period last year.

Crocs revenue hits $3bn

US footwear brand Crocs shared record results for Q4 2023 and total revenue for FY 2023 of almost $4bn. While the company’s recently acquired HeyDude brand did not perform as well as its main Croc products, the brand did deliver $950m in revenue in Q4.

Credit: Crocs

Looking ahead, Crocs CEO Andrew Rees said: “We are starting off 2024 from a position of strength and taking the opportunity to reinvest into several key strategic areas as we continue to lay the foundation for durable market share gains.”

Gildan Activewear’s new CEO confident on Q4 results

Canadian apparel company Gildan Activewear shared “strong” Q4 results, as net sales increased 8.7% to $783m in 2023, up from $720m in 2022. Sales of activewear increased 8%, while the company’s hosiery and underwear category increased 11%.

Gildan’s new president and CEO Vince Tyra said the company has a “bright future ahead”.

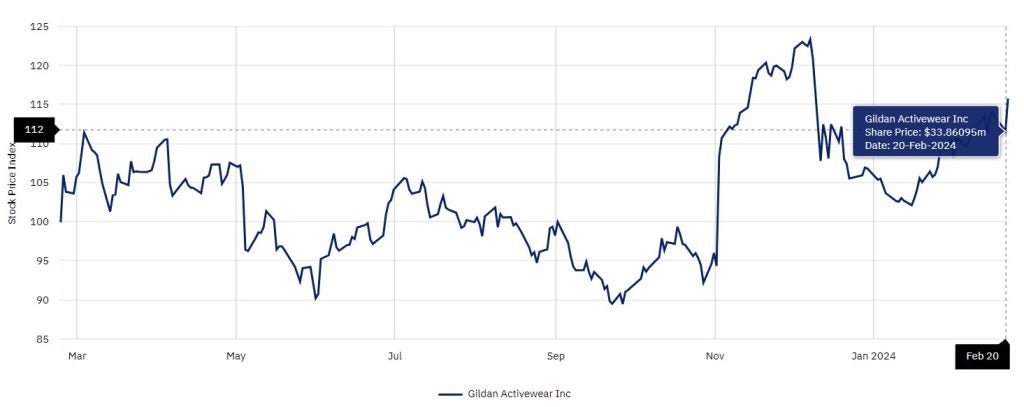

GlobalData’s apparel company filings data shows that as the results were announced, the company’s shares hit $35.16, up from $31.21 on 15 January.

However, this share price was still lower than the $37.21 seen on 7 December 2023, which was before Gildan’s CEO Glenn Chamandy was “replaced” and an ongoing dispute started between Gildan’s company board of directors and some of its shareholders.

Bangladesh garment exports to EU falls

Bangladesh’s ready-made garment (RMG) exports to the EU fell in 2023, as the sector suffered the effects of high inflation and economic turbulence. According to data from Eurostat, as cited by the Dhaka Tribune, apparel exports to the EU from Bangladesh fell 20.65% in value terms to €17.38bn ($18.81bn) in 2023.

In quantity terms, RMG exports to the EU fell 16.53% to 11.14bn kilograms. While the data shows China remains the top apparel exporter to the EU in value terms, the Asian superpower also experienced a shipment decline of 21.54% to €22.73bn in 2023.

The end of 2023 saw Bangladesh’s apparel sector suffer from violent strikes over pay disputes.

In the most recent development, more than 500 workers at Anlima Textile Limited were reportedly protesting the “unfair” termination of co-workers and non-payment of their arrears which had led to “indefinite” closure of the factory.