Announcing the findings of its ‘2022 Resale Report’, conducted by third-party retail analytics firm GlobalData, ThredUp says the study serves as the most comprehensive measure of the secondhand market and includes global market sizing for the first time.

It also reveals new insights on the key factors driving market growth, why consumers are thinking secondhand first, and the rise of branded recommerce among retailers. In addition, the report includes a one-time special section exploring inflation’s impact on the consumer and a ten-year anniversary lookback on the last decade in resale.

“The last ten years of resale were dominated by marketplaces, but brands and retailers are driving the next wave of secondhand. We’re still in the very beginning of this trend, but the acceleration of resale adoption is a positive signal with enormous benefits for the planet. This year’s report proves that with the collective power of conscious consumers, resale marketplaces, and forward-thinking brands and retailers, we can pioneer a more sustainable future for the fashion industry,” says James Reinhart, Thredup CEO and co-founder.

Key findings from ThredUp’s ‘2022 Resale Report’

Secondhand is becoming a global phenomenon, led by US

- The global secondhand apparel market will grow 127% by 2026 – 3X faster than the global apparel market overall.

- The U.S. secondhand market is expected to more than double by 2026, reaching $82 billion.

- Secondhand saw record growth in 2021 at 32%.

- Resale is expected to grow 16 times faster than the broader retail clothing sector by 2026.

Technology and online marketplaces are driving the growth of the US secondhand market.

- Online resale is the fastest-growing sector of secondhand and is expected to grow nearly 4 times by 2026.

- 50% of total secondhand dollars are expected to come from online resale by 2024.

- 70% of consumers say it’s easier to shop secondhand now than it was 5 years ago.

In an inflationary environment, resale is a bright spot for the consumer.

- 58% of consumers say secondhand has helped them in some way during a time of inflation.

- 80% of consumers are buying the same or more secondhand apparel items, compared to 49% of consumers buying the same or more apparel items overall.

- 25% of consumers say they’ll consider buying more secondhand products if prices in apparel, footwear, and accessories keep rising.

Brands and retailers are embracing resale to satisfy consumer demand, and resale is becoming an inevitable part of retail.

- Brands with resale shops increased 275% in 2021 compared to 2020, according to the Recommerce 100.

- 78% of retail executives say their customers are already participating in resale – up 16 points from 2020.

- 52% of retail executives say offering resale is becoming table stakes for retailers – up 16 points from 2020.

- 88% of retail executives who currently offer resale say it’s helping drive revenue.

Resale is a powerful solution to the fashion industry’s wastefulness.

- Secondhand displaced nearly one billion new clothing purchases in 2021.

- Nearly 2 in 3 consumers believe their individual consumption habits have a significant impact on the planet.

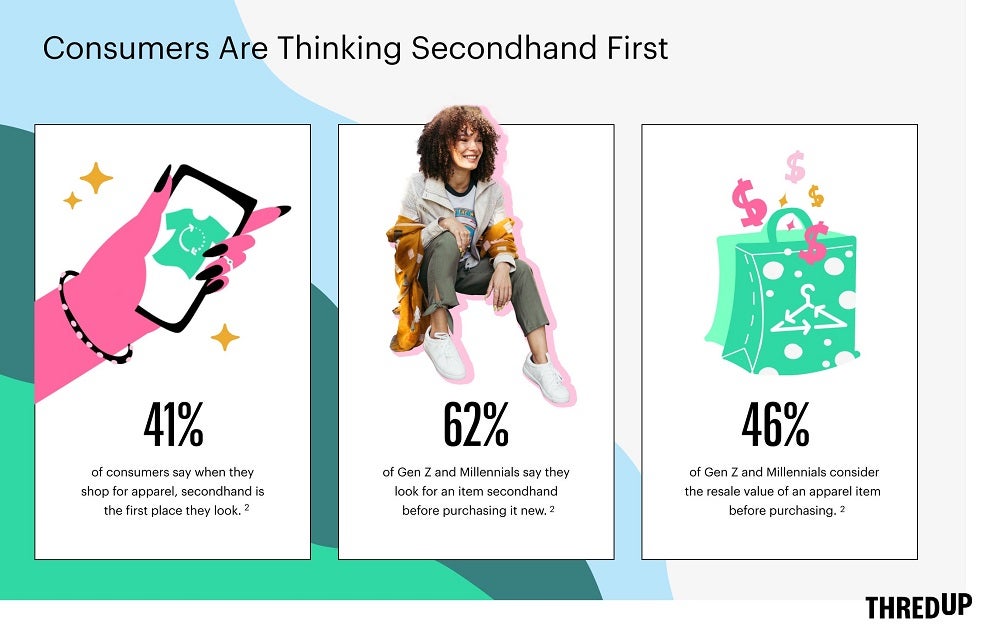

Consumers are thinking secondhand first.

- 41% of consumers say when they shop for apparel, secondhand is the first place they look.

- 62% of Gen Z and Millennials say they look for an item secondhand before purchasing a new item.

- 46% of Gen Z and Millennials consider the resale value of an apparel item before purchasing it.

Social pressure fuels consumers’ addiction to disposable fashion.

- 62% of fast fashion shoppers say fast fashion retailers encourage people to buy things they don’t need.

- 1 in 5 fast fashion shoppers say they feel pressured to have the latest styles due to social media.

- 65% of those who bought their first thrifted item a year ago say they want to quit buying fast fashion.

- 65% of consumers who shop fast fashion say they aspire to buy more secondhand fashion.

Neil Saunders, managing director, GlobalData, says: “Resale has emerged from the pandemic in an extremely strong position. More consumers are shopping secondhand, growth has accelerated, and the interest from traditional retailers has soared. The economic outlook remains uncertain, but with inflation driving apparel prices higher and higher, more shoppers appear to be turning to secondhand to make their budgets stretch further. These things will ensure resale remains a disruptive part of the market and a force for good in helping people shop sustainably.”

Last month, Thredup launched what it describes as a first-of-its-kind monthly index, tracking which brands and retailers have launched resale programs and their potential impact on the planet.

Click here to access the ‘2022 Resale Report’ in full.