The Centre for Retail Research explained retailing in most of the Western World has been in crisis since the recession of the mid noughties led to the collapse of many retailers, store closures and job losses as well as the rise of online shopping.

The pandemic accelerated pre-existing trends in shopping behaviour such as online shopping and the cost of living crisis and high rates of inflation have led to shoppers seeking out value.

All of this combined has led to over 100,000 retail job losses each year from 2018 to 2023.

The research and analysis company reported the highest number of retail job losses during the height of the pandemic in 2020 when stores were closed with 182,564 job losses.

However, in 2021 105,727 people lost their retail jobs, 2022 saw 151,474 job losses and most recently 2023 experienced 119,405 lost retail jobs.

The Centre for Retail Research attributes the ongoing problems UK retailers face to the new consumer-focused on value and spending on leisure and tourism undercutting retail sales.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe organisation explained the pandemic and high inflation has led to more ‘shopping around’ and the resurrection of value.

It stated: “People who had never visited a discount store can be heard boasting about ‘Aldi prices’ and how good Primark is. Once this behaviour has been learned, then, even if there is a sustained boost in household incomes over the next two-three years, consumers will continue using the new cheaper stores they have found – though perhaps not as much. And if a new crisis occurs, they have already learned what to do. Customer behaviour will quickly revert to what happened more slowly in 2022.”

Similarly, it added that when money is tight consumers have to choose where they spend it so retailers have lost their share of consumer spending in favour of meals out, city breaks, gym membership, subscriptions to TV Channels, foreign holidays and spa, health and wellbeing treatments.

The company also pointed out that business rates are having an impact on UK retail stores.

It pointed out that business rates are a regular property tax paid by business and it is based on hypothetical rental values.

As much as one-quarter of the entire business rates total comes from the retail sector and business rates could rise in 2024 by as much as £1.95bn ($2.46bn), according to The Guardian.

It highlighted that rents paid by shops have been declining as stores close and new occupants become difficult to find. However, the decline in rents has not led to a fall in business rates.

The Centre for Retail Research explained: “Even those whose sales have risen (especially supermarkets) have faced sharply-increased costs from complying with the new regulations to protect the public and their staff.

“Online retailers of course pay business rates at the reduced levels applicable to warehouses. A satisfactory future for high streets will only occur if online retailers pay the same rates as store-based retailers.”

Fashion retail job opportunities in 2023

Credit: GlobalData

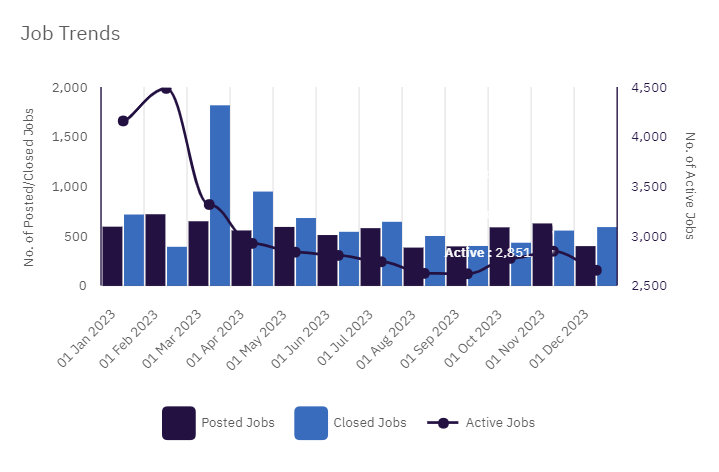

According to GlobalData’s jobs database fashion retail job opportunities remained relatively steady in 2023. Posted jobs started at 585 in January 2023 and ended in December 2023 with 389. The most active fashion retail companies for job postings in 2023, according to GlobalData included Claire’s Stores, J Crew Group, TJX Company and Inditex.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.