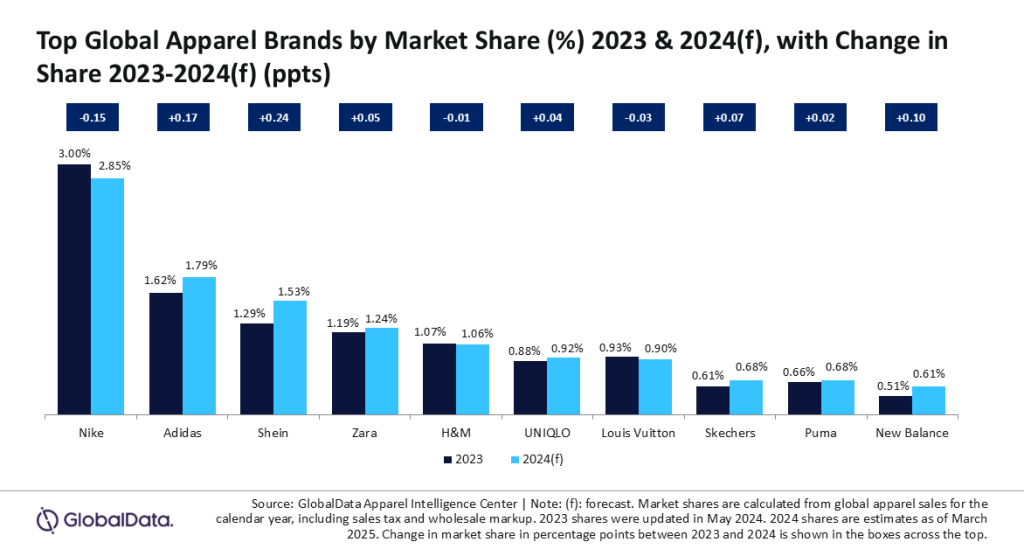

Apparel market share for Singapore-headquartered Shein is projected to have climbed by 0.24 percentage points, reaching 1.53% in 2024, according to insights from data and analytics firm GlobalData.

GlobalData’s senior apparel analyst Pippa Stephens attributes Shein’s continued ascent to its ultra-low price points and nimble response to fashion trends. This growth comes despite the brand facing intense scrutiny over labour and environmental practices.

Last month, the brand reported two instances of child labour within its supply chain in 2024, which mirrors its 2023 figures.

“Shein’s meteoric rise has subsequently taken share away from other fast fashion online pureplays, especially ASOS and boohoo.com, which have seen their sales plummet over the past few years,” Pippa Stephens stated.

Spain’s Zara has also maintained its strong performance in the fast fashion segment, with its apparel market share anticipated to have increased 0.05 percentage points to 1.24%. This was driven by its local supply chain that facilitates quick reaction to new fashion trends as well as the brand’s wide appeal.

On the contrary, H&M’s share of the apparel market is forecast to have dipped marginally to 1.06%, as neutral and lacklustre designs failed to attract consumer interest. The Spanish brand is also losing shoppers to Uniqlo, whose market share is projected to have increased 0.04 percentage points to 0.92%, capitalising on its value proposition and aggressive expansion beyond Japan.

Market share in sportswear

Germany’s Adidas rebounded from a sales slump in 2023, with its market share growth projected to have increased 0.17 percentage points to 1.79% in 2024, driven by its popular Originals lifestyle footwear line.

New Balance and Skechers are also predicted to have captured market share, leveraging their comfortable footwear and successful partnerships.

In contrast, Nike faced a setback with an anticipated market share decrease of 0.15 percentage points to 2.85%, as it lagged behind in innovation and fashion credentials.

Market share in luxury apparel

The luxury segment experienced varying fortunes; Hermès and Chanel thrived among ultra-wealthy consumers, with each brand forecast to have gained market share to 0.55% and 0.59%, respectively.

According to Stephens, this was “due to high-income consumers being less vulnerable to economic hardships.”

Conversely, more accessible luxury brands such as Gucci faced challenges, with its market share expected to have declined 0.10 percentage points to 0.38%, as its departing creative director Sabato De Sarno’s more muted style did not resonate as hoped with consumers.

“Aspirational shoppers, who tend to rely on their savings to afford status symbols, were much harder hit, causing more accessible luxury brands to suffer,” Stephens added.