Moss Bros could be taken private after the parent company of Crew Clothing offered to acquire the UK menswear retailer in a GBP22.6m (US$28.5m) deal.

In an announcement today (12 March), Moss Bros said its board has agreed to the terms of a cash offer of 22 pence per share by Brigadier Acquisition Company (Bidco), which is majority-owned by Regiment Acquisition Company, which is, in turn, majority-owned and controlled by Menoshi ‘Michael’ Shina, the owner of Crew Clothing.

The deal represents a 60.6% premium on yesterday’s closing price of 13.7 pence per Moss Bros share. It could see the company taken private, with the acquisition expected to be completed in the second quarter of 2020.

Menoshi Shina, director of Bidco, says Moss Bros can have a “bright future” in the private arena.

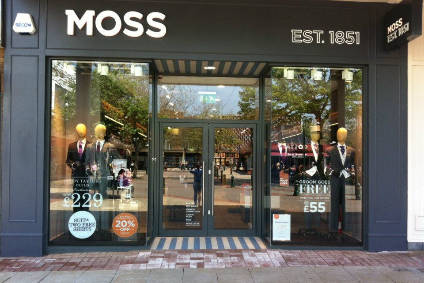

“We see the acquisition as an opportunity to partner with an excellent management team to improve Moss Bros’ financial performance and protect its heritage, brand and presence on the UK high street.”

In January, Moss Bros warned on a full-year pre-tax loss of GBP1m (US$1.3m) as it booked a drop in sales in the first half of the year.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTotal sales were 3% below last year and down 3.2% on a like-for-like basis. Total retail sales, including e-commerce and wholesale, comprising over 92% of group revenue, were 1.6% lower than last year and 1.8% lower on a like-for like-basis.

Colin Porter, chairman of Moss Bros, said of the deal: “In September, the board of Moss Bros set out its strategy to drive Moss Bros’ long-term performance and we have seen some early positive results which support the board’s confidence in Moss Bros as a standalone entity. However, the board is also aware of the risks attached to executing this strategy in the current retail operating environment and as a publicly-listed company.

“Having considered a range of strategic options, the board believes that the terms of the acquisition, which offers a premium cash exit to Moss Bros’ Shareholders, fairly reflect the value of Moss Bros and its prospects, taking account of these risks.”