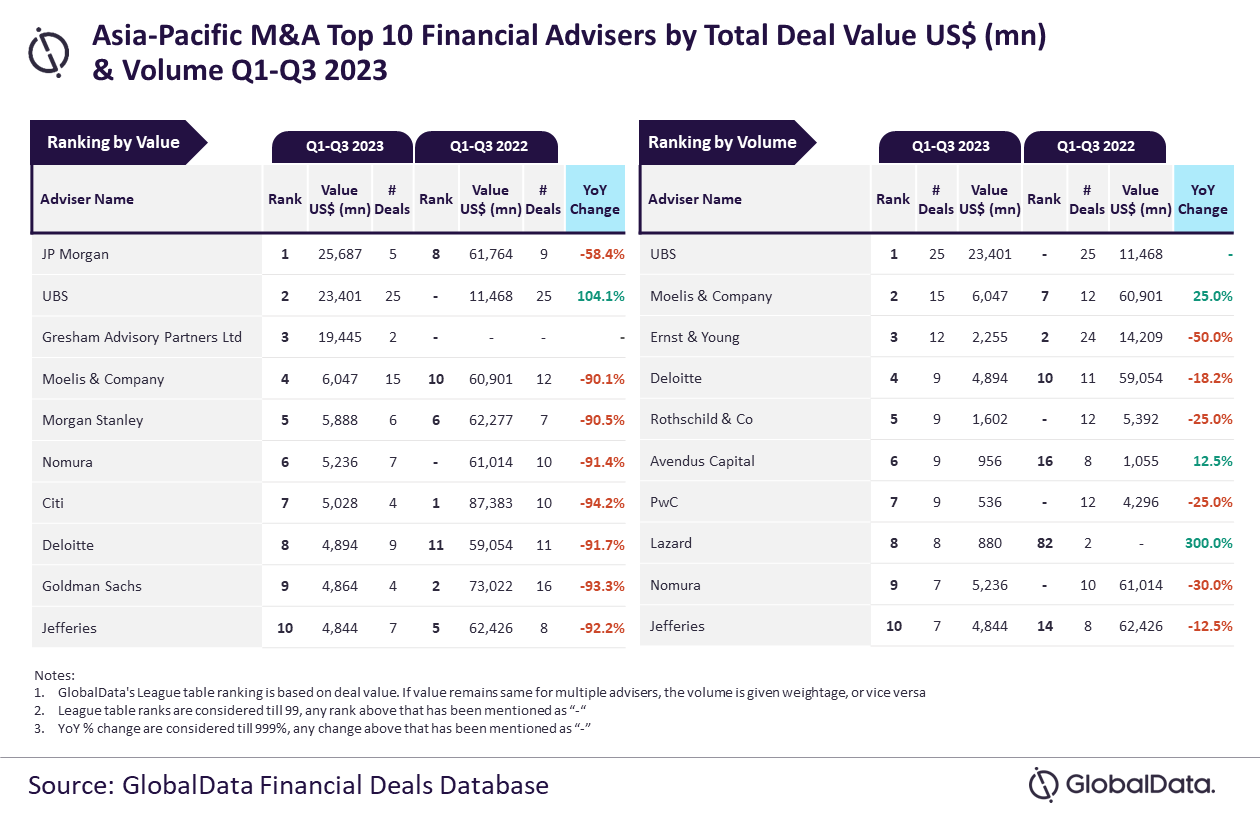

JP Morgan and UBS were the top M&A financial advisers in the APAC region in Q1-Q3 2023, according to GlobalData’s ranking of leading M&A advisers.

JP Morgan topped the charts when measuring the value of deals, advising on $25.7bn worth of deals during the period, while UBS advised on the most transactions with a total of 25 deals.

“While most of the top 10 advisers by total number of deals reported a decline during Q1-Q3 2023 compared to Q1-Q3 2022, deals volume for UBS remained at the same level. In fact, it was the only adviser with more than 20 deals during Q1-Q3 2023,” said GlobalData lead analyst Aurojyoti Bose.

“Meanwhile, JP Morgan was among the only two advisers to surpass $20bn in total deal value during Q1-Q3 2023. Interestingly, UBS was the other firm that occupied the second position with $23.4bn in total deal value.”

An analysis of GlobalData’s Financial Deals Database reveals that Gresham Advisory Partners came second in terms of value by advising on $19.4bn worth of deals, followed by Moelis & Company with $6bn and Morgan Stanley with $5.9bn.

Measured by number of transactions, Moelis & Company occupied the second place with 15 deals, followed by Ernst & Young with 12 deals, and Deloitte and Rothschild & Co with nine deals each.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.