According to GlobalData’s ‘The Apparel Market in Germany to 2028‘ report, the country’s clothing is projected to record the strongest growth between 2023 and 2028 with sales expected to rise 14.2% to €68.2bn ($76.04bn).

This growth is primarily driven by a normalisation of shopping patterns after several weak years with clothing sales only returning to 2019 levels in 2023, compared to footwear and accessories, which saw respective growths of 11.5% and 16.2%.

The change in spending patterns has led to a noticeable shift. Despite retaining its market lead in Germany through 2023, Swedish fashion retailer H&M has witnessed its share contract in recent years. GlobalData expects this trend to continue in 2024 due to its “lacklustre” product offerings which continue to undermine its affordability.

In contrast, German consumers are increasingly turning to Inditex’s Zara, whose market share grew to 1.9% in 2023 and is set to climb further this year, thanks to its “superior fashion credentials.”

Meanwhile, ultra-fast fashion giant Shein is rapidly gaining ground, moving up to fourth place in the German market with its vast range of affordable, trend-driven fashion. GlobalData notes that Shein is only marginally behind Nike and is likely to overtake it in 2024 as Nike struggles due to a lack of innovation.

Following a rough few years, German sports brand Adidas is set to regain market share in 2024 thanks to the renewed success of its lifestyle trainers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAdditionally, the report remarks how the second-biggest player in the German market, C&A, lost some market share in 2023 and is focusing on digital progression and store expansion to turn its fortunes around.

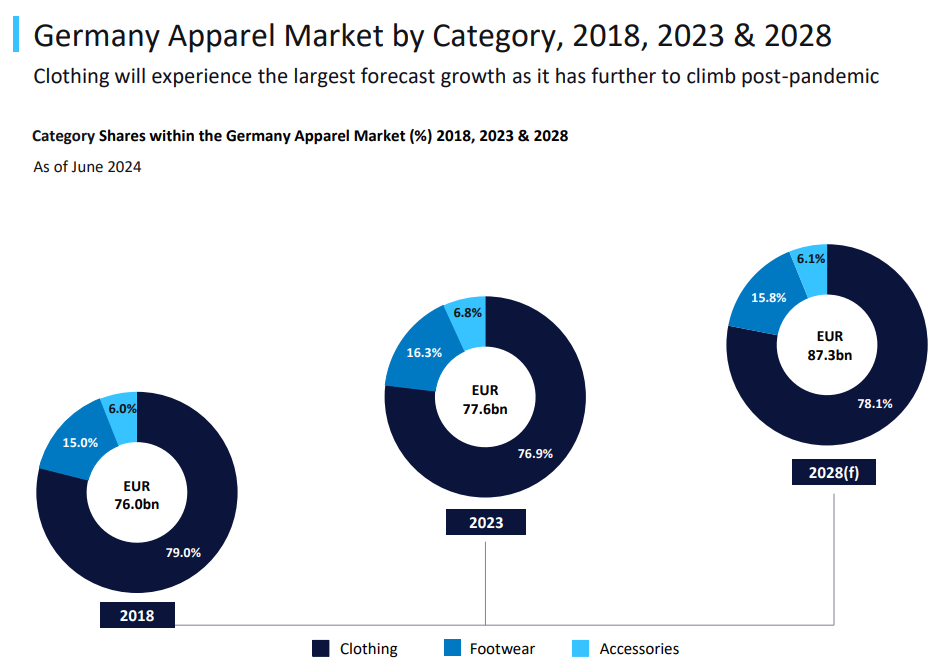

The report further warns that clothing’s share of the overall market will remain 0.9ppts lower than in 2018, at 78.1%, as consumers find it easier to cut back on volumes within this category.