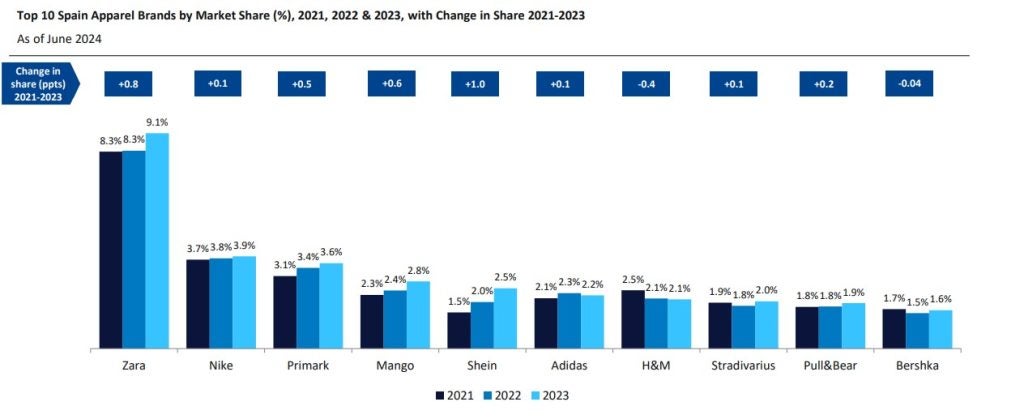

In 2023, Zara had a 9.1% share of Spain’s apparel market – up 0.8ppts from 2021. Spain is home to some of today’s biggest and most popular fashion brands, including the Inditex Group and Mango.

In the year to 31 January 2024, Inditex reported sales growth of 10.4%. In the 12 months to 31 December 2023, Mango reported a 15% growth in sales.

Both companies were seen as outperforming in their native market and are expected to see continued strong growth in Spain going forward, thanks to a growing apparel market in the country and their strong brand identities in the region.

GlobalData’s report – The Apparel Market in Spain to 2028 – attributed Zara’s success to the retailer’s “comprehensive knowledge” of its home market and said a similar trend was seen at Spanish rival Mango.

The report said Zara’s ability to respond quickly to trends and diverse range of styles allows it to cater to a broad range of consumers in its home market.

Mango saw its market share in Spain rise by 0.6ppts between 2021 and 2023, taking a 2.8% share of its home apparel market. Mango’s home market also outperformed its global sales.

GlobalData said its focus on a “more upmarket identity” will help it to gain greater traction in the coming years as consumers put greater focus on value for money.

A recent example of this step toward luxury fashion was its collaboration with designer Victoria Beckham in April 2024.

GlobalData said both Zara and Mango are “stealing share away from H&M” which saw its share of the Spanish market decline 0.4ppts between 2021 and 2023, taking a total of 2.1% of the Spanish market in 2023.

The report attributed H&M’s decline in Spain to its “uninspiring ranges” as H&M Group’s sales declined 1% on a constant currency basis in the six months to May 2024. It said Zara and Mango’s offerings were “overshadowing” H&M.

Zara’s closest rival in Spain is Nike, which took a 3.9% share of the market in 2023, followed by Primark at 3.6% then Mango.

Inditex-owned brands Stradivarius (2%), Pull&Bear (1.9%) and Berksha (1.6%) also took significant shares of their local Spanish apparel market.

Despite the trend for Spanish brands outperforming in their home market, Inditex’s Bershka brand has been struggling in recent years. The retailer faces increased competition from Shein, which offers similar products at a lower price and with greater levels of newness.