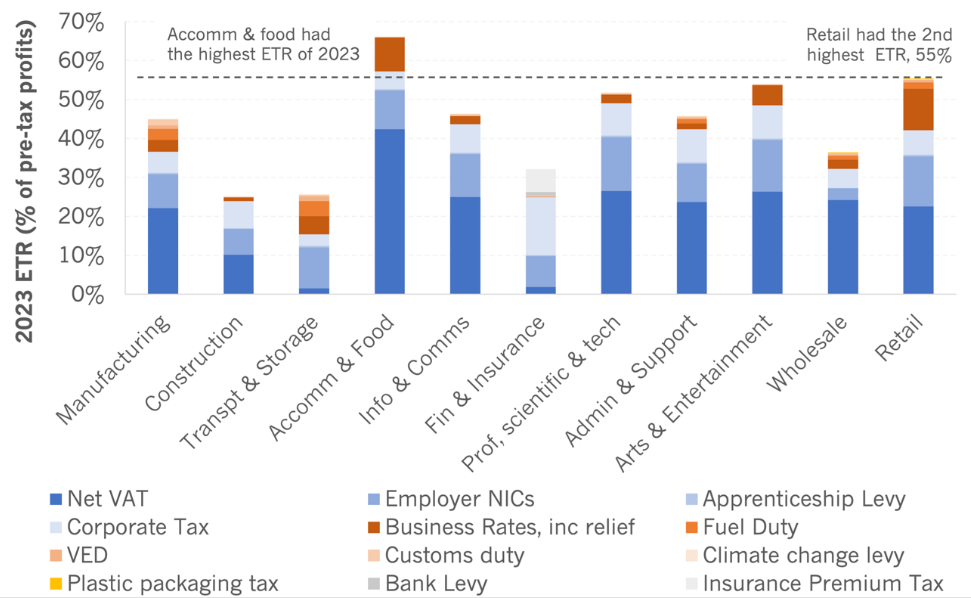

The findings released in the BRC’s Budget submission show UK retail contributes 7.4% of all business taxes, despite making up just 5% of GDP — a rate 1.5 times higher than other sectors. This £33bn tax bill represents 55% of pre-tax profits with 11% of profits absorbed by business rates alone – the highest proportion across all sectors.

The research underscores the heavy toll that this tax burden has taken on the retail sector. Over the last five years, the UK has lost 6,000 shops, with business rates playing a significant role in two-thirds of these closures. Looking ahead, the BRC warns that up to 17,300 additional stores could shutter in the next decade without significant action.

Credit: ONS, HMRC and OBR publications

Beyond the closures, the report notes the tax system is stifling investment in critical areas like employee wages, upskilling, and technology, which could otherwise drive productivity and support decarbonisation efforts.

The BRC’s submission calls for the introduction of a 20% Retail Rates Corrector, which would reduce business rates for retail properties by 20%. This adjustment would fulfil the government’s manifesto commitment of a tax “fairer for bricks and mortar businesses” and support the recovery of the UK’s high streets.

According to the BRC such a move would not only level the playing field for brick-and-mortar retailers but also unlock investment opportunities across the industry.

BRC chief executive Helen Dickinson emphasised the urgency of reform and said: “Our research conclusively proves what retailers have known for years: the industry is paying far more than its fair share of tax. The chancellor has a golden opportunity to fix this and use the scale of the industry to help deliver some of the government’s priorities.

As retailers struggle with shuttered stores, job losses, and missed opportunities for long-term growth, the BRC stresses that the Retail Rates Corrector could provide immediate relief, allowing businesses to reinvest in their future and reinvigorate high streets across the country.