Specialist e-commerce platform Centra conducted a survey of 1,000 UK consumers and found consumer loyalty includes engagement through viewing new products, consuming brand content and following brands on social media, with the aim of resuming purchases once their financial situation improves.

Centra’s data found that the prolonged cost-of-living crisis has impacted consumer behaviour, with 64% of respondents reporting a decrease in their fashion and lifestyle product purchases.

In GlobalData’s “The Apparel Market in the UK to 2028,” the market is expected to slow even further in 2024, growing just 0.3% to £60.9bn, as consumers remain cautious with their money, though demand is expected to improve in the latter part of the year, as the economy improves.

To adapt to financial hardships Centra reported how 25% of shoppers have turned to pre-loved or second-hand items, while another 25% are opting for lower-cost items or accessories to update their wardrobes.

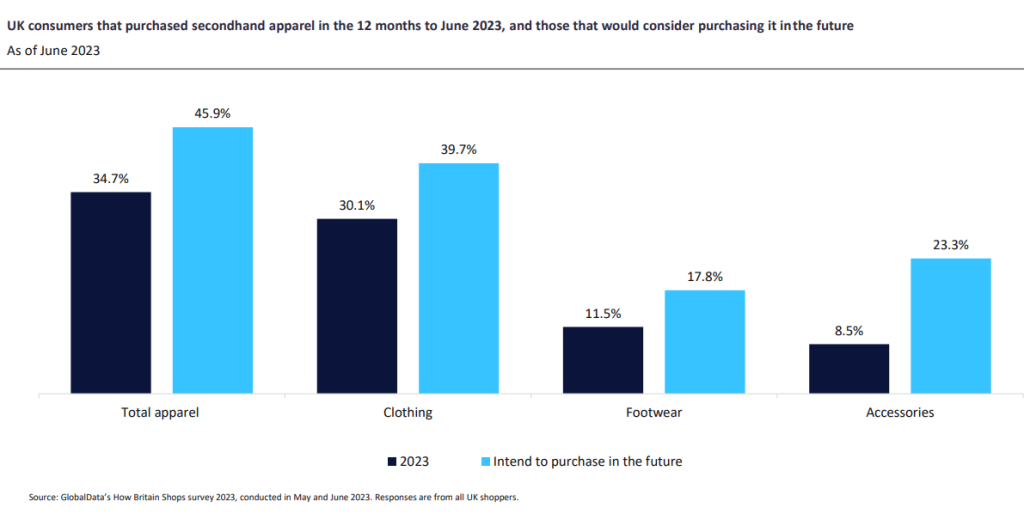

GlobalData found that in the 12 months to June 2023, 45.9% of consumers intend to purchase second-hand apparel in the future. 39.7% would consider purchasing clothing in future and 17.8% would purchase second-hand footwear.

However, the research highlights that reduced spending doesn’t equate to brand abandonment. In fact, 53% of consumers maintain engagement with their favourite brands even when not actively purchasing.

This trend is particularly pronounced among Millennials, with 29% expressing continued brand loyalty despite less frequent spending.

Looking ahead, consumers have clear priorities for future fashion purchases when their finances improve. The top items on their lists include coats or jackets (40%), jeans (37%), formal footwear (25%), gym wear (23%), and watches or jewellery (22%).

Martin Jensen, CEO at Centra, commented: “The data clearly shows the power of brand equity as a sustainer of customer loyalty and UK brands need to remain focused on nurturing existing customers to make sure they return to spend when the economic recovery comes – and that means investing in customer engagement.”

“Fashion and lifestyle brands need to work with a specialist e-commerce platform partner that provides the core features out of the box to build a store that best serves a brand and its customers’ needs, allowing it to remain focused on all elements, from product design to brand content and customer experience, that reinforce the unique brand experience to engender long term loyalty and ultimately sales as economic conditions improve.”

A recent report from advertising platform Cardlytics revealed 64% of UK consumers were increasingly prioritising affordability over brand loyalty when it came to their shopping habits.