The report titled ‘Unbound: UK Trade Post Brexit‘ highlights a 33% reduction in the variety of goods exported with sectors like textiles, clothing and materials being the most affected.

Researchers assessed the impact of the UK-EU Trade and Cooperation Agreement by analysing monthly UK-EU trade data from January 2017 to December 2023, comparing pre and post-January 2021 figures when the TCA took effect.

The analysis revealed a 27% decrease in UK exports and a 32% fall in imports from the EU.

Lead author Professor Jun Du of Aston University said: “The Trade and Cooperation Agreement introduced substantial barriers and there are ongoing and marked declines in the value and variety of UK exports and imports. Without urgent policy interventions, the UK’s economic position and place in the global market will continue to weaken.”

UK-EU TCA: a defining partner in UK’s trade

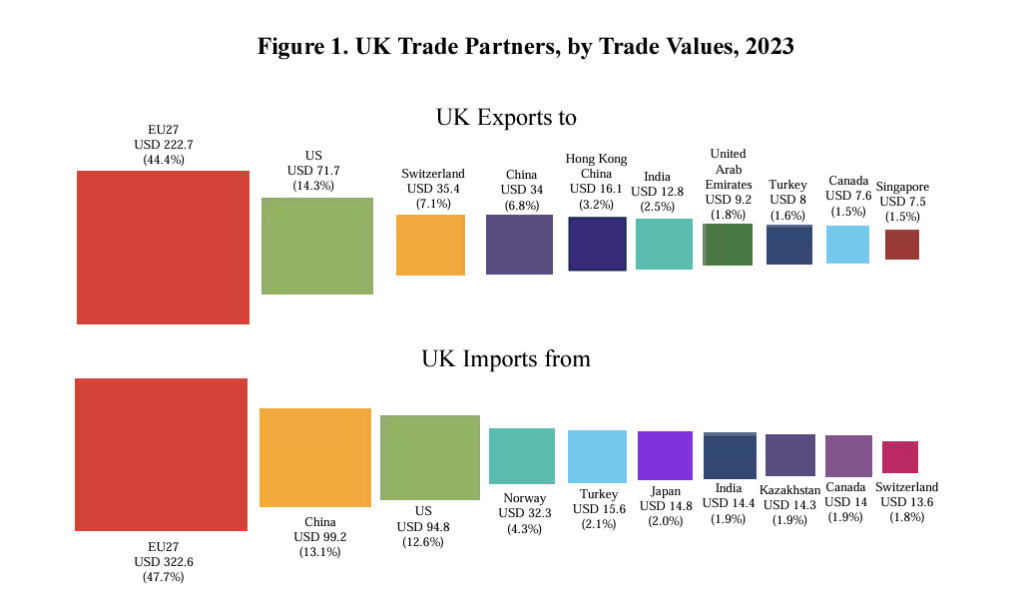

The UK-EU TCA redefined trade and investment rules and market access between the UK and the EU. Since it came into force, the UK government has negotiated several trade agreements, but the EU remains the UK’s largest trade partner.

Moreover, exports across most sectors have declined since January 2021, with agrifood, textiles, clothing, and material-based manufacturing being particularly affected.

Imports have also decreased in value and variety for most sectors, notably agri-food products, optical goods, textiles, and materials. However, some sectors, such as ships and furniture, have seen increased import variety.

The report argued the large variations across different goods categories and EU trade partners underscore the uneven effects of Brexit and the TCA on UK-EU trade dynamics, highlighting the need to “understand the nuances and come up with tailored strategies that address the unique challenges of each sector within the new regulatory environment.”

The researchers make recommendations, outlining how sector-specific negotiations, streamlining customs procedures with digital technologies and reducing regulatory divergence could mitigate some of the impacts.

Co-author Dr Oleksandr Shepotylo noted: “Our findings indicate a decoupling of the UK from key EU final goods markets, accompanied by a shift in UK supply chains toward geographically closer EU trading partners for exports and smaller countries for imports. This shift raises concerns and underscores the urgent need for a strategic reconfiguration of UK supply chains to maintain competitiveness.”

“The TCA has increased non-tariff measures (NTMs) and addressing these through targeted improvements is crucial for maintaining UK business competitiveness in the European market. A comprehensive, multi-faceted approach is essential,” he added.