The UK apparel market is expected to slow further in 2024, with growth dropping 0.3% to £60.9bn ($76bn) and will ”remain soft” till 2028 as shoppers continue to spend cautiously according to a GlobalData report titled: “The Apparel Market in the UK to 2028.”

UK clothing shares to drop as consumers move to capsule wardrobes, resale

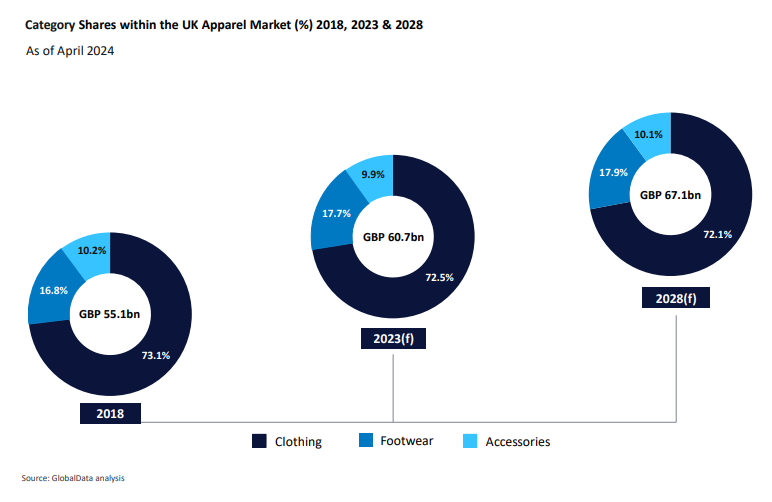

Clothing will see its share of the overall UK apparel market fall by 0.4 percentage points to 72.1% between 2023 and 2028, as consumers invest in footwear, capsule wardrobes and become less receptive to the latest trends, while spending continues to be diverted into the secondhand market.

While inflation is expected to soften to 2.6% in 2024 and slowdown in the second half, from 2025 onwards, inflation is projected to return to around 2.0%, in line with the Bank of England’s recommendation, which should help consumers’ finances recover to healthier levels.

Currently, inflationary pressures are leading UK apparel consumers to prioritise value for money instead of price as shoppers seek apparel that lasts and has a lower cost per wear over time, reinforcing the trend toward capsule wardrobes.

Recognising this trend, other players are adapting their strategies, with Marks & Spencer (M&S) launching capsule wardrobe edits, while value brands including PrettyLittleThing and Asda’s George have introduced premium collections to cater to this growing demand.

Womenswear is the biggest subsector in the clothing market and is expected to achieve a CAGR of 2.1% between 2023 and 2028, reaching £27.8bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMenswear is expected to reach £13.8bn, growing at a CAGR of 1.8%. However, childrenswear is the weakest, with a CAGR of only 1.2% due to declining birth rates in the UK affecting the demand for children’s clothing.

Footwear, on the other hand, is expected to outperform during the same period, with its share rising by 0.2 percentage points to 17.9%, supported by the continued popularity of trainers and consumers’ interest in health and wellness in the post-pandemic era.

More consumers are considering purchasing second-hand apparel in the future

Consumers are reducing apparel spending and prolonging garment life through repairs or sustainable resale and rental models like Vinted which facilitate the buying and selling of second-hand apparel.

Just Style recently examined Vinted’s success layer-by-layer to ascertain what is fuelling the growth of resale platforms and what it means for the wider apparel industry.

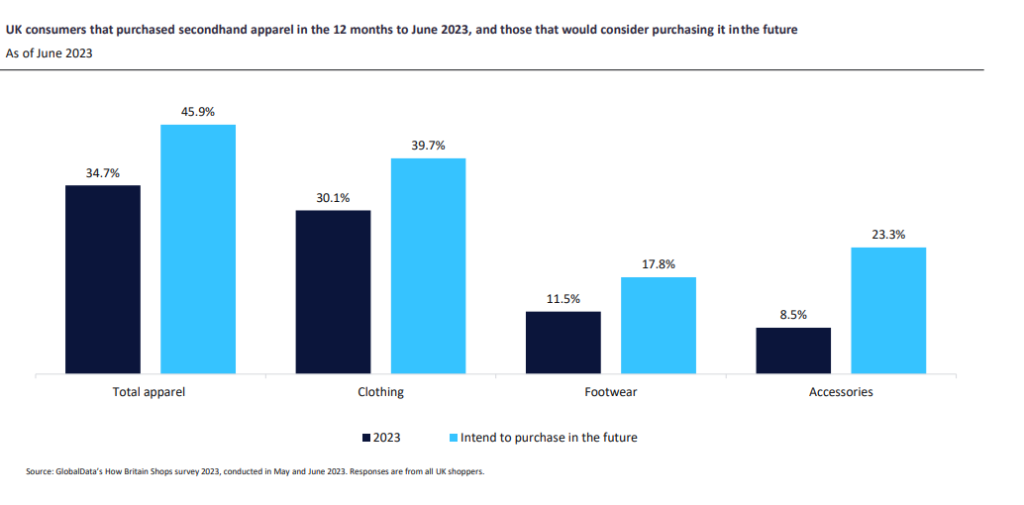

39.7% of UK consumers intend to purchase second-hand clothing in the future along with 17.8% in footwear and 23.3% in accessories.

Because of this, brands such as Asos, John Lewis and PrettyLittleThing, have introduced rental and resale offerings as part of their business strategies.

With rental apparel being a fairly new player in the industry, many customers are unaware or cautious about renting items with only 11.3% renting apparel in the 12 months to June 2023. But 27.6% said they expect to spend more in the following 12 months.

Brands to invest in technology as online UK apparel market to outperform again from 2025 onwards

The online channel is expected to decline marginally to 38.9% in 2024 according to the GlobalData report as players like Asos and Boohoo continue to be hit by shoppers cutting back on trend purchases with tighter budgets.

However, online channels will rise slowly, increasing by 0.6 percentage points to 39.8% by 2028, as inflation stabilises, consumer appetite returns and brands’ investments in new technologies aimed at enhancing the online experience.

For instance, players like John Lewis, H&M and Bershka have begun introducing virtual try-on features to alleviate online returns rates and make it easier for shoppers to choose the correct size.

Nevertheless, the path to recovery won’t be a straight line, as the resale market is likely to continue diverting spend away from traditional channels, thanks to its cost-saving incentives.