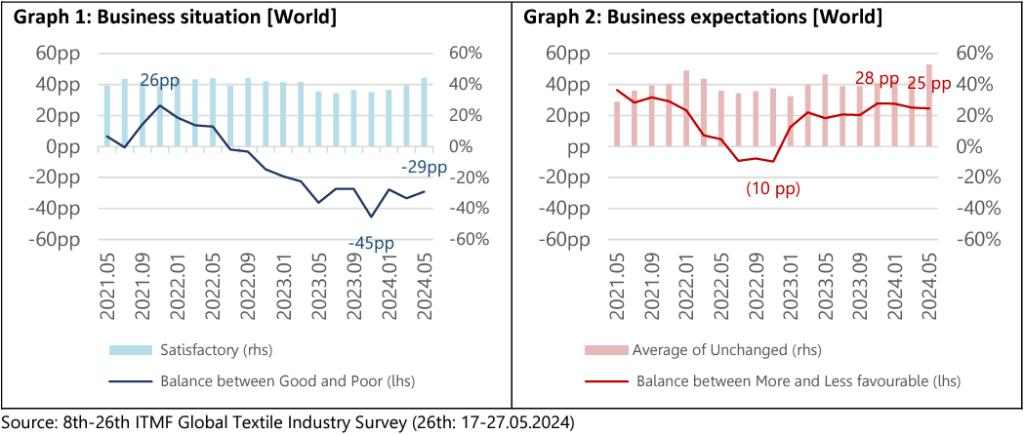

The Global Textile Industry Survey (GTIS) by ITMF showed the textile business climate remains largely unchanged, with only a marginal uptick in companies reporting “satisfactory” business conditions. While business expectations have held steady for the past year, this optimism has yet to translate into tangible improvements across the supply chain.

The balance between “good” and “poor” order intake has improved slightly, and expectations for order intake in six months are trending upwards. However, the order backlog remains relatively stable at around two months, showing a minor increase from 1.9 months in March to 2.1 months in May 2024. ITMF cautions against interpreting this small rise as a definitive positive trend.

Weak demand continues to be the primary concern for global textile manufacturers, although its significance has somewhat diminished over the past six months.

Other challenges facing the textile industry include high raw material and energy prices, geopolitical tensions, and a shortage of skilled workers.

GlobalData’s Geopolitics: Executive Briefing report highlighted the apparel and textile industry is no stranger to disruptions and challenges stemming from geopolitical factors such as conflicts, trade policies, and political instability. These variables significantly affect consumer demand, operating costs, supply chains, and sourcing decisions within the apparel sector.

Christopher Granville from GlobalData TS Lombard said in the report: “Geopolitical risk has historically tended to be remote from day-to-day business concerns. This is no longer the case.”

Another report titled: “Thematic Intelligence: Geopolitics in Retail & Apparel,” showed that geopolitical events can create a “ripple effect” for retailers and consumers.

The ITMF survey also highlighted regional disparities in order cancellations. While Africa and Europe reported relatively low cancellation rates, the Americas experienced higher levels, with spinners and finishers/dyers/printers being the most affected segments.

Inventory levels remain a concern, with 59% of companies reporting average stock levels in May 2024. North America registered the highest inventory levels among regions, while spinners topped the list among industry segments. Although inventories at brands and retailers remain high, there are signs of a gradual decrease.

Capacity utilisation rates have shown a modest increase, reaching 71% in May 2024. This figure represents a slight recovery from the decline that began after the peak of 80% recorded at the end of 2021. Survey participants express hope for improved capacity utilisation in the coming six months.

The prolonged negative business cycle has forced many textile companies to operate at a loss or with reduced capacity utilisation, with no significant change expected in 2024.