Figures from the report, which urge UK brands and retailers to explore the opportunities being offered in the online marketplaces space, indicate that the value of non-food retail exports, including apparel, has fallen by almost 18% since 2019, despite inflation softening the decline.

The report explained that the UK’s non-food export environment, particularly

in the clothing and footwear sector, has faced significant challenges

post-Brexit. Exports in this category have plummeted from £7.4bn in 2019 to

£2.7bn in 2023.

Challenges have arisen from heightened export costs and intensified competition. But amidst these challenges, digital marketplaces have risen as crucial enablers of growth, providing a platform for innovation and access to wider markets. Platforms like Asos Marketplace, About You and Zalando have become essential in this new reality, serving as “growth beacons in a competitive global arena”, reads the report.

Opportunities in online marketplaces

The report highlights that amidst challenges, digital marketplaces have risen as crucial enablers of growth, providing a platform for innovation and access to wider markets.

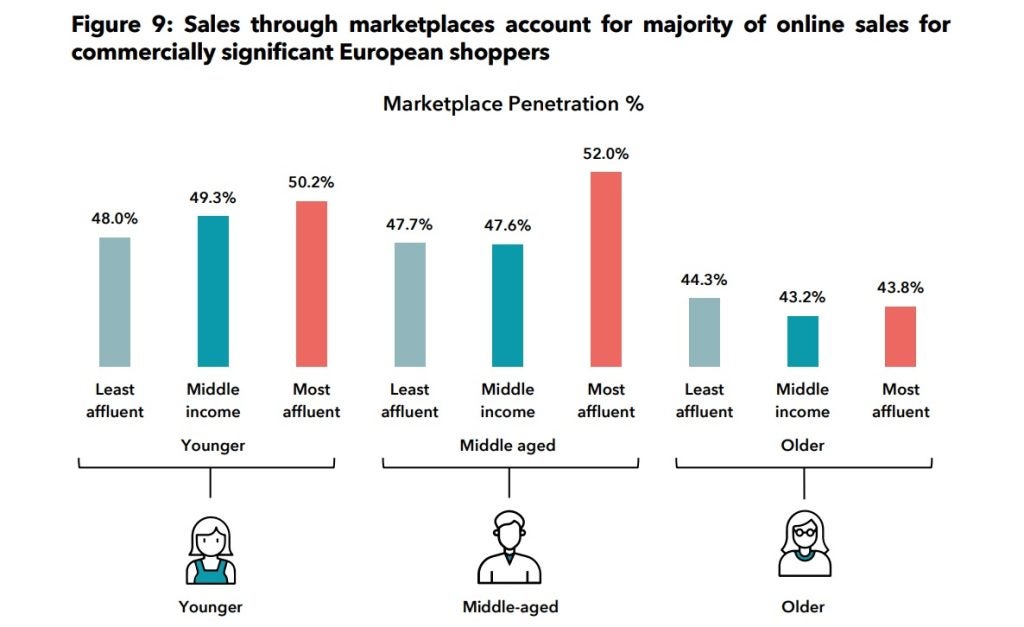

It views online marketplaces, which reportedly account for over two-fifths of the EU’s £322.6bn annual online non-food sales, as a streamlined path to access “affluent and younger consumer demographics.”

The concentration of sales among the largest markets means that the top 10 online markets in the EU account for 85.8% of online sales. From this, marketplaces account for just under half of online sales across the EU, and are considered important platforms for spending among key demographics, typically younger, more affluent consumers who shop online frequently. Currently, marketplaces across the top 10 largest EU markets account for £132.8bn of annual spending.

The report underscores the growing importance of digital marketplaces, driven by key trends such as:

- Accelerated digital transformation within retail

- Integration of AI to enhance customer experience and personalisation

- Adoption of circular economic principles like re-commerce

- Consumer demands for better value amidst financial pressures

Writers of the report argue that these developments have carved out a critical role for online marketplaces ensuring competitiveness, streamlining operations, and fostering consumer engagement in more sophisticated ways.

Moreover, they highlight that today, demand for technology-driven shopping experiences that merge the physical and digital worlds is higher than ever, with personalisation and community engagement at the core of marketplace strategies.

In addition to this, consumer expectations have soared which has been partially attributed to instant access to online information and smartphone use.

“Marketplaces are ideal for younger, affluent spenders who are key drivers of

consumer expenditure. While middle-income groups prioritise the ease of access

reflecting their stage in life, younger consumers are drawn to the diversity and

brand selection available on these platforms.

“Amid economic uncertainties, young and middle-aged spenders with more

disposable income exhibit increased sensitivity to financial fluctuations, with nearly

half expressing concern over inflation and interest rates. Such economic factors are

likely to influence their future marketplace spending behaviours.”

Evolution of online marketplaces and expectation

- Marketplace evolution: Online marketplaces are dynamic digital platforms connecting buyers and sellers. Over the years, they have significantly evolved, enhancing their features, functionality, and formats to better serve users.

- Impact of technology: Advances in digital technology have transformed marketplaces into providers of convenient and personalised experiences across various devices. These platforms are essential in supporting seamless customer journeys across multiple channels.

- Diverse marketplace models: Marketplaces have expanded into various models, including hybrid, retailer-operated, and social commerce platforms, each catering to specific needs and preferences.

- Broadened service offer: Marketplaces have evolved into comprehensive ecosystems that offer extensive opportunities for product discovery, as well as fulfilment and after-sales services. Retailers and brands frequently engage in partnerships to meet increasing customer expectations, enhance their capabilities, and achieve scalable growth.

- Streamlining operations: As online marketplaces evolve, strategic partnerships with marketplace integrators have become essential for sellers to enhance capabilities, navigate new opportunities and centralise the management of multiple platforms.

Richard Lim, CEO of Retail Economics, believes marketplaces have emerged as a lifeline to tap into the EU market which now accounts for over half of online sales among the most affluent young and middle-aged EU consumers.

Lim said: “The profound shift in the UK’s trade relationship with the EU has hit British brands and retailers hard. Successive waves of disruption caused by Brexit and the pandemic have significantly disadvantaged UK exporters who are having to navigate through increased friction and cost. As UK retailers search for expansion into new territories, marketplaces have emerged as an important channel for growth, opening up new scalable market opportunities at low risk.”

Alexander Otto, head of corporate relations at Tradebyte, views access to relevant customer data, an intuitive understanding of the market, relevant experience and knowledge of current trends and an effective fulfilment strategy as crucial for today’s marketplace landscape.

Otto adds: “International retail is a complicated space to be in, particularly for UK brands and retailers looking to sell in Europe post-Brexit. From language barriers to taxation and customs issues through to warehousing and fulfilment, these are not small obstacles to overcome.”