In 2023, Primark sustained its market dominance, growing its market share by 0.3 percentage point (ppts) to 6.2%, according to GlobalData’s The Apparel Market in the UK to 2028 report.

Amidst a cost-of-living crisis, the report said Primark’s value proposition and trend-led assortment have resonated strongly with shoppers. Moreover, collaborations with celebrities including Rita Ora have further fueled its popularity as consumers seek to emulate their favourite stars’ styles.

Primark was followed by British omnichannel retailer Marks & Spencer (M&S) which witnessed a share growth of 0.3ppts to 5.3%, after years of “lacklustre” sales. The report said M&S was boosted by its “refreshed” apparel, trend-led offerings appealing to younger shoppers and focus on quality and classic styles that cater to the demand for capsule wardrobes.

British clothing and homewares retailer Next, too, saw its market share rise by 0.1ppts. The report attributed this to Next’s extensive range of third-party brands, which enabled it to draw in shoppers and increase exposure for its own-brand ranges.

In contrast, German sportswear brand Adidas experienced a drop of 0.1ppts in 2023, as its core offerings and the loss of its Yeezy range failed to captivate UK consumers.

Value players such as Tesco’s F&F and Matalan have also seen their shares contract, held back by their weak digital propositions and consumers’ gravitation towards more fashionable value players such as Primark.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataPrimark’s path to success

GlobalData’s apparel analyst Louise Deglise-Favre believes that Primark has made a noticeable and conscious effort to improve both its “style credentials” and “quality” in the past few years.

Deglise-Favre told Just Style: “While the retailer greatly suffered throughout the pandemic due to its lack of online capabilities, it has since introduced some click and collect capabilities and completely revamped its website for it to be an accurate catalogue of its products, complete with live stock information.”

Such features, according to Deglise-Favre, add to its overall proposition which combined with its commitment to offering value prices is highly appealing to consumers.

Primark’s affordability has undeniably been a cornerstone of the brand’s success but that is not all. Through a series of multifaceted strategies aimed at driving demand, the brand implemented initiatives like reducing prices on essential kidswear items, trialing Click+Collect services in UK stores, and expansion plans with new store openings in the pipeline.

The Associated British Food owned brand didn’t stop here. In January, Primark debuted its adaptive lingerie range, further promising to introduce more launches designed to meet the needs of disabled customers.

Primark’s head of diversity and inclusion Charlie Magadah said at the time: “This is more than a new range for us – it’s the start of looking at how we are supporting our disabled customers and colleagues and understanding what more we can do to make Primark a more accessible place to work and shop.”

These actions underscore Primark’s concerted efforts to align its strategies with the needs and preferences of its consumer base.

Another noteworthy step by the brand was to offer discounted prices on selected kidswear ahead of the holiday season in mid-April. Primark explained the move was aimed to “help families make their money go further as they start planning their summer wardrobes.”

Purchase Drivers in the UK apparel market

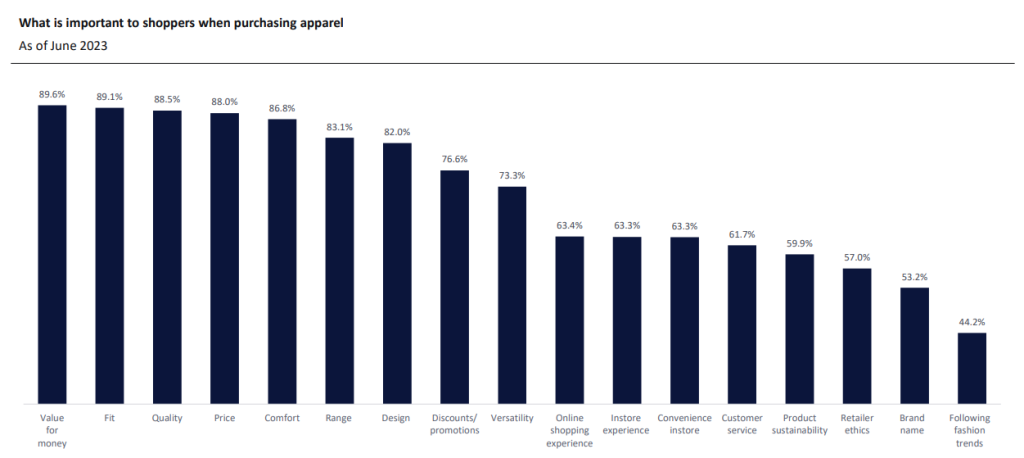

As part of GlobalData’s How Britain Shops survey conducted in May and June 2023, UK shoppers were asked how important each factor is to them out of ten (with ten being the most important) when purchasing apparel.

‘Value for money’ stood out, with 89.6% consumers stating this was important to them. ‘Fit’ followed closely with 89.1% of consumers rating this as important, while, ‘quality’ took the third position with 88.5% of consumers stating this was important to them. ‘Price’ was the fourth most important driving factor for UK consumers when purchasing apparel.

This is not surprising as consumers are being forced to change their shopping habits and seek more affordable options in response to rising inflationary pressures which has tightened their pockets.

Will there be respite from inflation?

According to GlobalData’s The Apparel Market in the UK to 2028 report, the UK apparel market grew just 2.0% in 2023. This was again attributed to the “prioritisation” of spending on essential items and cutting back on discretionary categories such as apparel, amid soaring inflation.

There’s no relief in sight with the market being expected to suffer further in 2024, forecast to grow just 0.3% to reach £60.9bn ($76bn), as inflation will continue to plague the markets and subdue consumer confidence.

Despite a sluggish start to the year, the report anticipates demand to pick up as the year goes on and shoppers begin to feel more optimistic about their finances.

There will be an uplift in demand from 2025 onwards, however, writers of the report warn that consumers will retain a cautious approach to spending, while resale channels and capsule wardrobes will also remain popular.

The report highlighted a modest CAGR of 2.0%, forecasting the market to reach £67.1bn between 2023 and 2028.