According to Zoe Mills, lead retail analyst at GlobalData, the key to success in the 2024 back-to-school market will be retailers’ ability to attract “price-conscious” shoppers.

Mills explained that consumers are increasingly looking for low-cost alternatives as they cut back where possible, aiming to provide all the necessary items without breaking the bank.

In 2023, the proportion of consumers who actively cut back on back-to-school spending to save money rose by 5 percentage points to 73%. Despite inflation slowing in 2024, GlobalData expects this trend of reduced spending to continue.

Mills highlighted Marks & Spencer (M&S) as a likely winner this year, saying: “Marks & Spencer has reiterated its fourth consecutive year of price locks on its school uniform and as shoppers cut back where possible, Marks & Spencer’s clear messaging and reputation for quality should ensure it is a winner this year.”

She believes it will be a battle on price once again this year, noting that “price locks” have proved enticing before and retaining this message will be a way to ensure destination appeal.

However, Mills warns that price should not come at the expense of quality, especially when it comes to school uniforms.

Back-to-school keyword dwindles in popularity

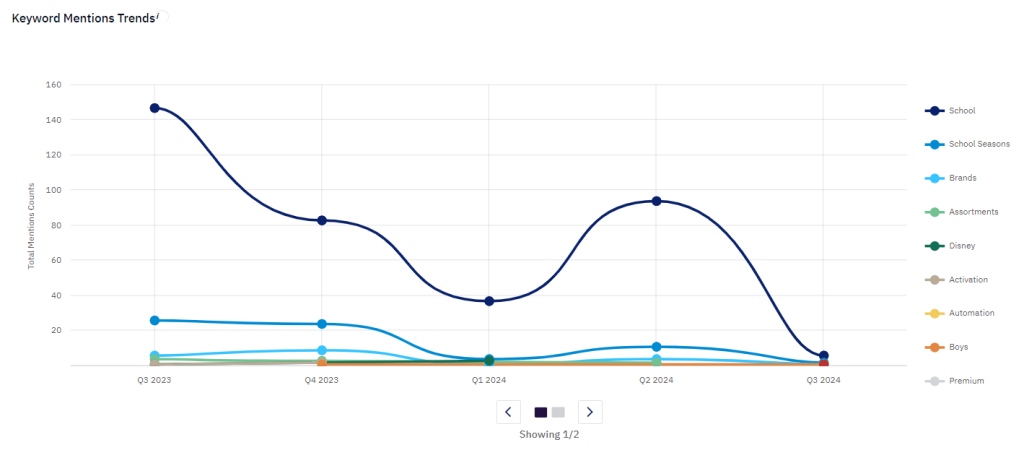

GlobalData’s apparel company filings show a significant drop in mentions of ‘back-to-school’, from peaking at 147 mentions in Q3 2023 to just 6 in Q3 2024.

The data reflects how inflation continues to weigh consumers’ pockets by limiting them to prioritise purchases.

Mills shared: “Parents understand the stresses placed on uniforms, and replacing uniforms frequently at a low price can cost more than spending a little more initially on pieces that last.”

Her advice to retailers is to strike a balance by having entry-level ranges in school uniforms and other back-to-school categories which will ensure retailers can compete with discounters without compromising quality.

Earlier in August, the latest CNBC/NRF Retail Monitor released by the National Retail Federation (NRF) reported that the US experienced retail sales growth in July thanks to back-to-school shopping and retailers’ special promotional events.