According to a new report from McKinsey & Co., weakened brand loyalty, affordability over sustainability, and heightened interest in wellness products and services reflect the preferences and priorities of consumers across ages and geographies.

The global pandemic – which pressured supply chains and led to customers struggling to get hold of products from brands they loved, saw roughly half of consumers switch products or brands.

“That behavioural change has proved quite sticky: consumers continue to be open to exploring alternatives, and brand loyalty is fading across demographic groups,” McKinsey & Co., says in its State of the Consumer 2024: What’s now and what’s next report.

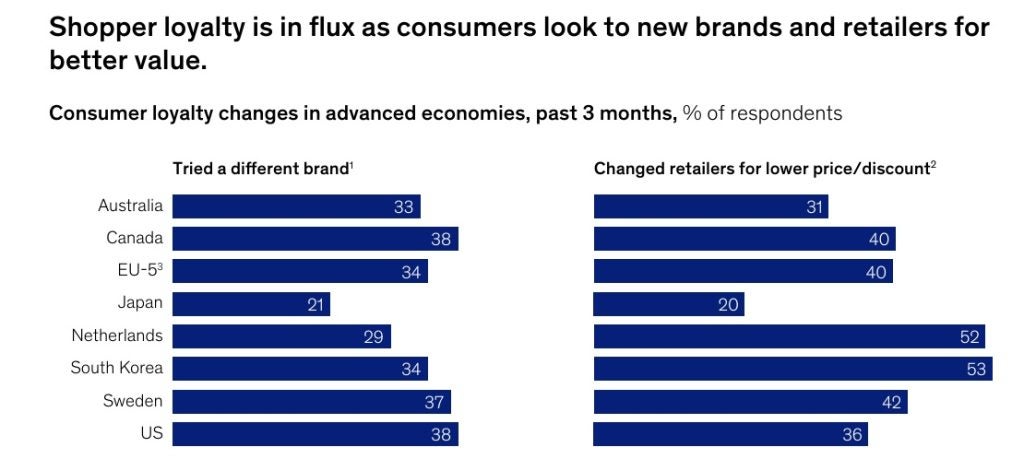

In advanced markets, over a third of consumers have tried different brands, and approximately 40% have switched retailers in search of better prices and discounts. Inflation and economic uncertainty are almost certainly inducing this behavior.

The report further suggests weakening brand loyalty is not specific to an age group and that while older consumers, in the past, were more likely to remain loyal to their favourite brands, they too can be found now embracing new brands and alternative retailers.

To some degree, this comes down to price pressures, with consumers trading down to lower-priced brands and retailers.

Private-label brands have significantly benefitted from this shift with McKinsey finding, 36% of consumers planning to purchase private-label products more frequently, and 60% believe private brands offer equal or better quality.

GlobalData suggests building customer loyalty in apparel is crucial but challenging since the market is saturated with players offering similar products so consumers have lots of options.

“Customer loyalty often extends beyond standard loyalty programmes, with strong brand identities, such as Nike’s, playing an important part in sustaining connections with consumers.

“H&M is an example of a retailer with a successful loyalty scheme. Its membership programme gives consumers benefits for free and gives the retailer access to consumer data, and aids in repeat purchases. The programme is unique in that it rewards purchases as well as environmentally friendly behaviours, which is consistent with the retailer’s dedication to sustainability. It has a tiered system where members receive points for spending money and for taking part in green activities like recycling clothing, as well as discounts, special events, and exclusive deals. Although this programme is good in ensuring consumers sign up, as it provides lower thresholds for free delivery and click & collect, as membership is free, it does not guarantee loyalty. H&M’s approach, taken as a whole, sets the standard in the industry by producing a compelling loyalty plan that blends brand values with customer benefits. Some retailers may have delivery saver schemes instead of specific loyalty schemes, such as ASOS Premier and Next Unlimited, to encourage consumers to make repeat orders throughout the year as they have already paid for the cost of delivery.”

GlobalData also argues that ensuring a streamlined and efficient supply chain is essential in the production and stock of retail goods, and this plays an important role in customer loyalty.

“The network of people, businesses, and activities involved in the supply chain process are essential to ensure the right products reach the right customers at the right time and price. The competitive nature of retail means that if there are any errors or issues in the supply chain that cause a lack of product availability, such as that experienced across different retail sectors due to the impacts of Covid, consumers will purchase the product they wanted from another retailer where possible, or not purchase the item altogether.

“Customer loyalty can be fostered by retailers’ supply chains allowing them to respond to changes in consumer demand in a more agile way. Additionally, ensuring high levels of quality and checks are built into the production process ensures less waste as items last longer and fewer are returned due to faults, translating into greater customer loyalty. In addition to its positive effects on customer loyalty and satisfaction, maintaining an efficient supply chain can also bring down costs as a result of efficiency gains, which can enable greater investments in product development, marketing, and other infrastructure.”