Sportswear brands including Nike, Adidas and New Balance led the way with consumers in China during 2023 while demand for Japanese casualwear brand Uniqlo was also strong.

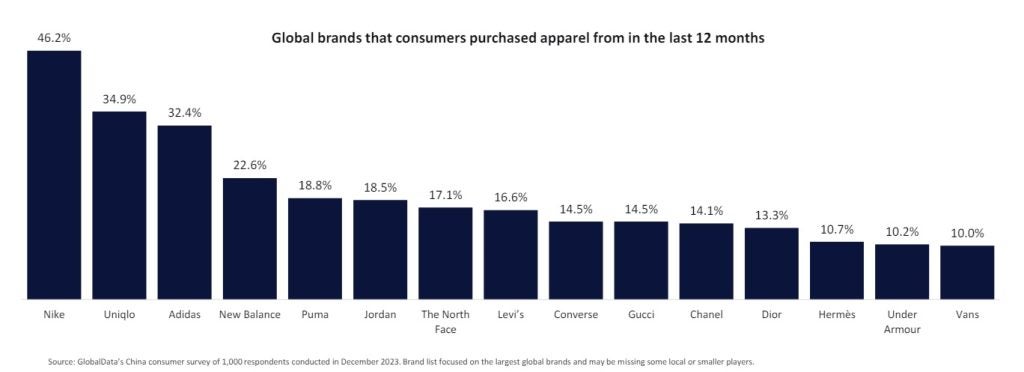

According to the latest figures from GlobalData extracted from a survey of 1,000 respondents, 46.2% of consumers purchased from Nike during 2023.

To some degree, this is down to sustained demand for sportswear in the country, but the report’s authors also said it is “further strengthened by its China-centric ranges, such as the exclusive streetwear collection it launched in the country in March 2024.”

Over a third (34.9%) of consumers bought from Uniqlo which benefits from its “great value for money perception,” while 32.4% of consumers shopped at Adidas which has leveraged its expertise in sportswear.

22.6% of consumers shopped at New Balance while 18.8% did so at Puma “whose comfortable yet trendy product ranges appealed to a wide demographic range.”

Nike’s China comeback

Nike appears to have redeemed itself among Chinese consumers following a controversial boycott by consumers across the country linked to the sportswear giant’s position statement on Xinjiang.

At the time Nike had issued a statement on its website in which it said: “We are concerned about reports of forced labour in, and connected to, the Xinjiang Uyghur Autonomous Region (XUAR). Nike does not source products from the XUAR and we have confirmed with our contract suppliers that they are not using textiles or spun yarn from the region.”

Reports then emerged Nike and H&M were the target of a boycott from angered consumers following the statement.

The move saw a spike in China’s homegrown sneaker brand sales with Anta, operator of the FILA brand in Hong Kong, Macao and China, climbing to a series of record highs, pushing its market value to over $60bn in 2021. Li Ning saw its shares jump more than 84% since the end of March that year. However, at the time, Nike’s management team asserted it would be staying put in the region, where it had a 40-year-long presence, despite the turbulence.

CFO John Donahoe told investors in March 2021:“We are optimistic that we can continue to grow low to mid-teens over the long-term.” He continued: “We remain committed to investing in the local consumer experience and inspiring the next generation of athletes in China… Today, we are the largest sports brand there, and we are a brand of China and for China.”