Search volume trends show how interest has changed for products, services and content provided within the industry. Marks and Spencer (M&S) has stayed on top with an upward trend of 15%, accumulating 4,090,000 search volumes.

“Marks and Spencer has generated the greatest increase in brand awareness Quarter on Quarter (QOQ),” said the report.

Tk Maxx and Matalan ranked second and third, closely followed by Primark and Zara. The top three receding brands included Asos, New Look and Boohoo.

The report explained that with the cost-of-living crisis bringing huge changes to the consumer landscape, monitoring changes in search volumes for keyword groups is essential to spotting new trends and surging demands.

Ranked as the highest retailer to achieve an organic traffic score of 9% growth year on year, M&S was followed by New Look, PrettyLittleThing, H&M and River Island.

On the opposite side of the spectrum, Next ranked high in the biggest traffic score drops followed by John Lewis and Partners, Asos, Boohoo and House of Frasers. The report said this is likely due to having been punished by a search algorithm update or having let things slide over the year.

When comparing traffic scores to authority scores – the stature and reputation of a brand’s website, measured through a metric called domain rating – M&S came out on top again with Next in second place and John Lewis in third.

Source: Salience

Despite UK consumers tightening their belts as the cost-of-living crisis continues, in FY 2023/24 M&S reported full-price sales in its clothing and home department had increased from 63% to 81% since 2019/20, a category that was formerly labelled as the retailer’s “main handicap” by GlobalData in 2022.

GlobalData senior retail analyst Eleanor Simpson-Gould told Just Style recently that despite traditionally appealing to an older demographic, M&S had managed to attract a younger audience.

GlobalData associate apparel analyst Alice Price also said: “The retailer’s continued focus on classic styles has enabled it to benefit during the cost-of-living crisis as shoppers seek versatility from their wardrobes.”

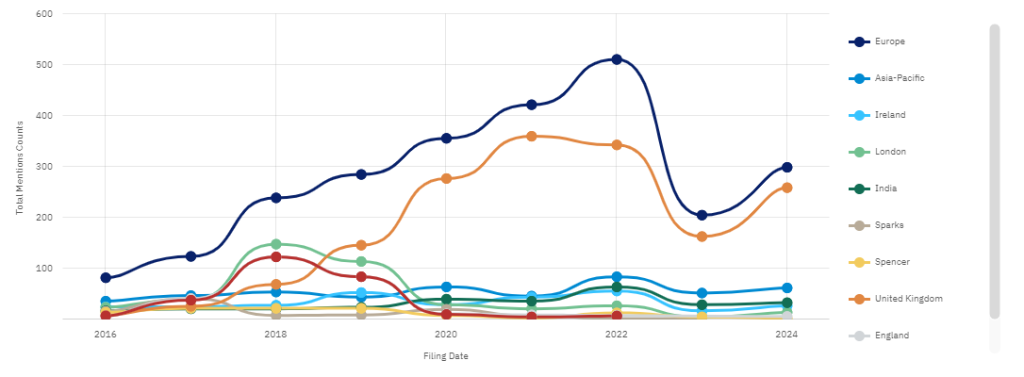

GlobalData apparel company filing mentions of M&S between 2016 and 2024

Source: GlobalData

Apparel company filings data shared by GlobalData suggest that M&S reached its peak in the UK in 2021 with 360 mentions and even though it plunged in 2023 it continues to be one of the top themes in 2024 with 259 mentions to date.

Europe continues to dominate mentions of the retailer with its peak hitting 511 in 2021 and it has now reached a steady 299 in 2024.