According to GlobalData’s latest report GlobalData’s Global Luxury Apparel Market to 2028, while capturing growth in 2024 will remain challenging due to low consumer confidence, luxury will still outperform the total apparel market.

Industry experts anticipate a stabilisation in inflation rates to re-engage shoppers and drive growth.

Global luxury fashion players like Louis Vuitton Moet Hennessy (LVMH) experienced a surge in demand after the pandemic, with the conglomerate’s Q1 FY23 sales jumping 16.8% to €21.0bn ($22.5bn) as eager shoppers unleashed their pent-up spending.

GlobalData’s apparel analyst Louise Deglise-Favre noted at the time that this was due to strong demand from locals and international tourists, especially from China as the government lifted mandatory quarantines for travellers in December 2022.

She explained: “Europe’s impressive performance is also testament to the wealth of local luxury shoppers that continues to protect them from economic challenges, allowing them to keep spending on luxury goods, despite the region suffering from cripplingly high inflation rates and looming threats of recession.”

However, this momentum waned by the end of 2023 as the luxury market grappled with inflationary pressures, leading to a downturn in spending that has continued through 2024.

As per GlobalData’s apparel analyst Alice Price, the latest figures from LVMH point towards a “bellwether within the luxury sector.”

Price believes this is a result of “aspirational shoppers continuing to reign in spend, as ongoing economic challenges hit their savings and discretionary incomes.” LVMH reported a 1.6% decline in group revenues, reaching €20.7bn in Q1 FY2024 ending on 31 March 2024.

Global luxury market to rebound in 2025

GlobalData’s report reveals that the luxury sector will outperform the total apparel market as demand picks up pace again in 2025.

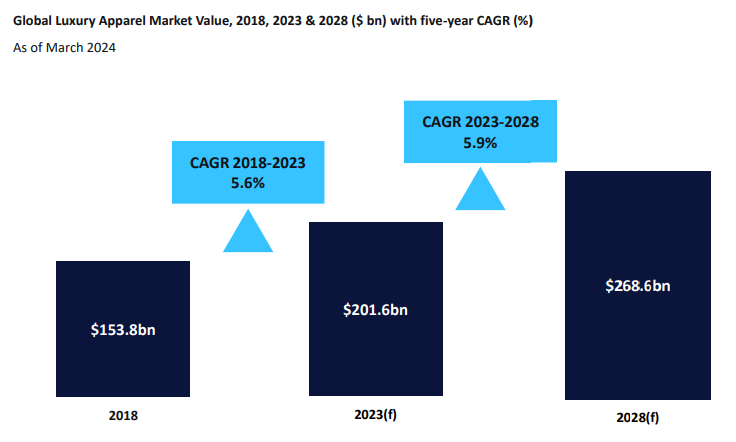

The report’s authors anticipate that this will be achievable as inflation rates begin to stabilise, reigniting interest from “aspirational shoppers.” The luxury market is therefore projected to grow by 27.8% between 2024 and 2028 to reach $268.6bn.

The report highlights that the luxury market will account for 10.9% of total apparel spend. Moreover, the global luxury market is expected to grow at a CAGR of 5.9% between 2023-2028.

What’s driving growth in the global luxury apparel market?

The report’s authors believe that while macroeconomic difficulties in Western Europe and North America will impact luxury demand in the short term, countries in APAC and Eastern Europe will continue to experience burgeoning economies.

“Emerging markets will also continue to see growth in their middle class and urbanised populations out to 2028, driving more luxury spend, as designer items are often seen as status symbols, which newly wealthy consumers are eager to display.”

Another trend emerging is the role played by Gen Z shoppers who are seen as “increasingly aspirational” towards luxury brands through social media and influencer culture.

This demographic is said to be more committed to following fashion trends and is seen as less willing to cut back on their apparel spending during tough times. The report emphasises that luxury brands are adapting their product offerings and market to appeal to Gen Z and their desire for “exclusivity and social validation” which will continue to drive growth in the luxury apparel market.